Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with this problem. not sure how to start. problem 4 need help with. thank you 2. What if the spot rene in 9

need help with this problem. not sure how to start.

problem 4 need help with. thank you

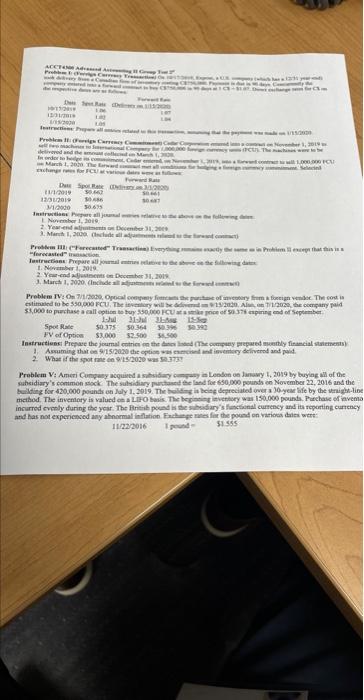

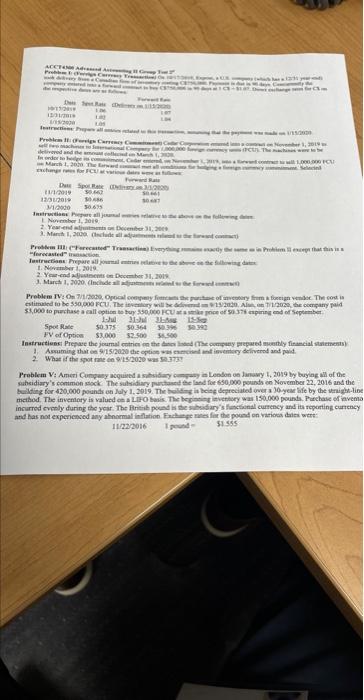

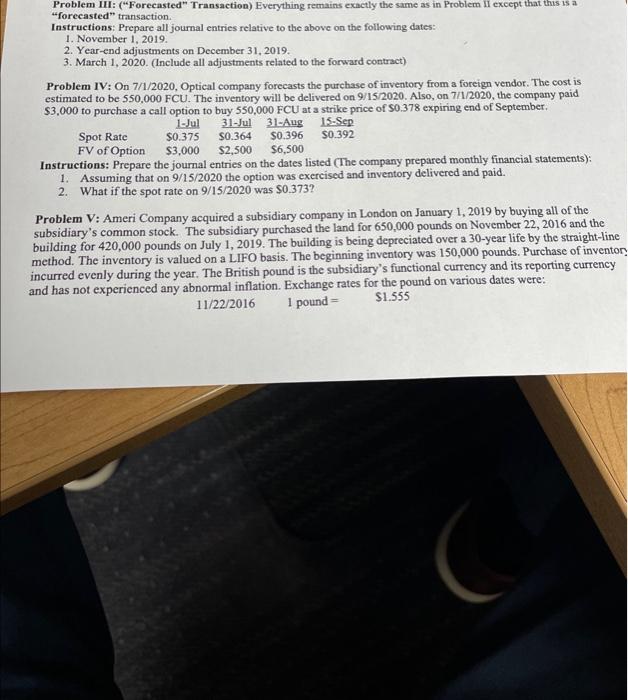

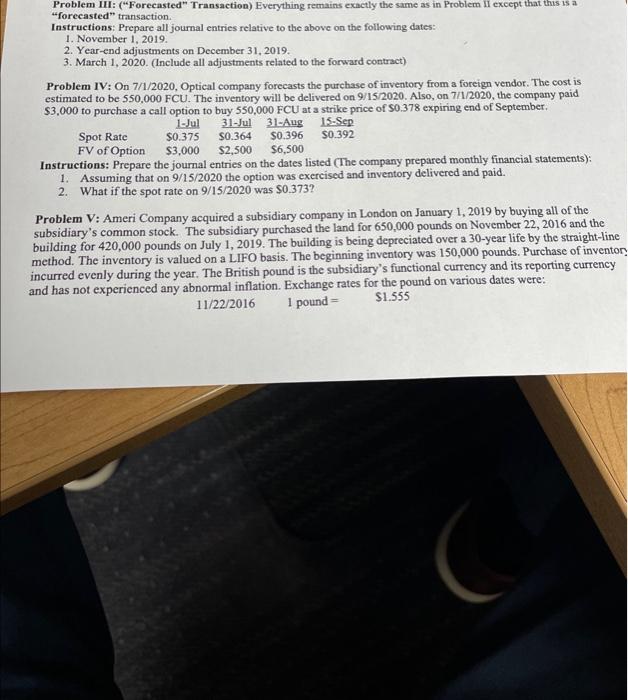

2. What if the spot rene in 9 15/2020 was 37 3721 112220161 peran = 51.555. Problem III: ("Forecasted" Transaction) Everything remains exactly the same as in Problem II except that this is a "forecasted" transaction. Instructions: Prepare all journal entries relative to the above on the following dates: 1. November 1, 2019. 2. Year-end adjustments on December 31,2019. 3. March 1, 2020. (Include all adjustments related to the forward contract) Problem IV: On 7/1/2020, Optical company forceasts the purchase of inventory from a foreign vendor. The cost is estimated to be 550,000FCU. The inventory will be delivered on 9/15/2020. Also, on 7/1/2020, the company paid $3,000 to purchase a call option to buy 550,000 FCU at a strike price of $0.378 expiring end of September, Instructions: Prepare the journal entries on the dates listed (Ine company prepared monthly financial statements): 1. Assuming that on 9/15/2020 the option was exercised and inventory delivered and paid. 2. What if the spot rate on 9/15/2020 was $0.373 ? Problem V: Ameri Company acquired a subsidiary company in London on January 1, 2019 by buying all of the subsidiary's common stock. The subsidiary purchased the land for 650,000 pounds on November 22,2016 and the building for 420,000 pounds on July 1, 2019. The building is being depreciated over a 30-year life by the straight-line method. The inventory is valued on a LIFO basis. The beginning inventory was 150,000 pounds. Purchase of inventos incurred evenly during the year. The British pound is the subsidiary's functional currency and its reporting currency and has not experienced any abnormal inflation. Exchange rates for the pound on various dates were: 2. What if the spot rene in 9 15/2020 was 37 3721 112220161 peran = 51.555. Problem III: ("Forecasted" Transaction) Everything remains exactly the same as in Problem II except that this is a "forecasted" transaction. Instructions: Prepare all journal entries relative to the above on the following dates: 1. November 1, 2019. 2. Year-end adjustments on December 31,2019. 3. March 1, 2020. (Include all adjustments related to the forward contract) Problem IV: On 7/1/2020, Optical company forceasts the purchase of inventory from a foreign vendor. The cost is estimated to be 550,000FCU. The inventory will be delivered on 9/15/2020. Also, on 7/1/2020, the company paid $3,000 to purchase a call option to buy 550,000 FCU at a strike price of $0.378 expiring end of September, Instructions: Prepare the journal entries on the dates listed (Ine company prepared monthly financial statements): 1. Assuming that on 9/15/2020 the option was exercised and inventory delivered and paid. 2. What if the spot rate on 9/15/2020 was $0.373 ? Problem V: Ameri Company acquired a subsidiary company in London on January 1, 2019 by buying all of the subsidiary's common stock. The subsidiary purchased the land for 650,000 pounds on November 22,2016 and the building for 420,000 pounds on July 1, 2019. The building is being depreciated over a 30-year life by the straight-line method. The inventory is valued on a LIFO basis. The beginning inventory was 150,000 pounds. Purchase of inventos incurred evenly during the year. The British pound is the subsidiary's functional currency and its reporting currency and has not experienced any abnormal inflation. Exchange rates for the pound on various dates were

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started