Answered step by step

Verified Expert Solution

Question

1 Approved Answer

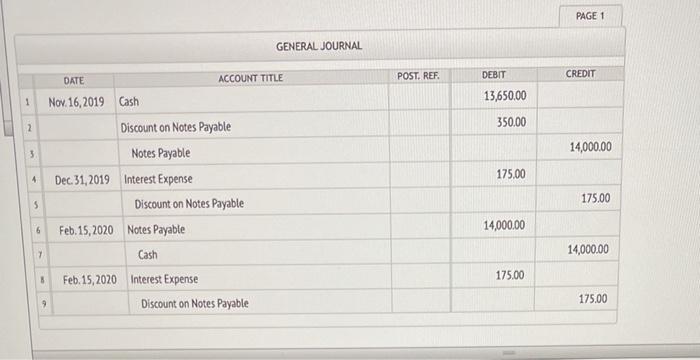

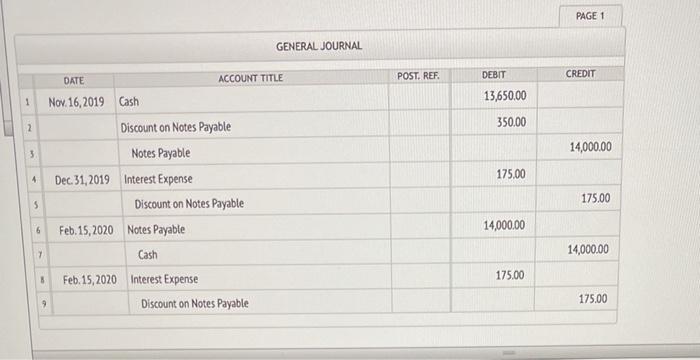

need help with: what is the clear glass company effective interest rate? PAGE 1 GENERAL JOURNAL DATE CREDIT ACCOUNT TITLE POST. REF DEBIT 1 Nov

need help with: what is the clear glass company effective interest rate?

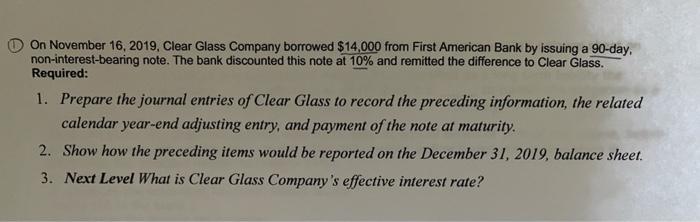

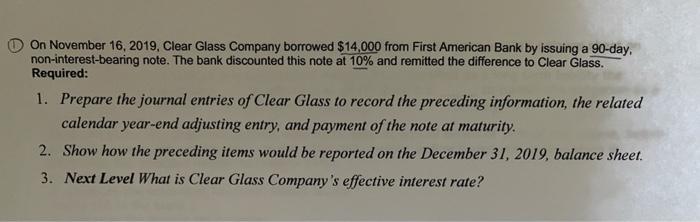

PAGE 1 GENERAL JOURNAL DATE CREDIT ACCOUNT TITLE POST. REF DEBIT 1 Nov 16, 2019 Cash 13,650.00 350.00 2 3 14,000.00 4 175,00 175.00 5 Discount on Notes Payable Notes Payable Dec 31, 2019 Interest Expense Discount on Notes Payable Feb. 15, 2020 Notes Payable Cash Feb 15, 2020 Interest Expense Discount on Notes Payable 14,000.00 6 7 14,000.00 8 175.00 9 175.00 On November 16, 2019, Clear Glass Company borrowed $14,000 from First American Bank by issuing a 90-day, non-interest-bearing note. The bank discounted this note at 10% and remitted the difference to Clear Glass. Required: 1. Prepare the journal entries of Clear Glass to record the preceding information, the related calendar year-end adjusting entry, and payment of the note at maturity. 2. Show how the preceding items would be reported on the December 31, 2019, balance sheet. 3. Next Level What is Clear Glass Company's effective interest rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started