*Need help with whats highlighted in GREEN & QUESTIONS please and thank you*

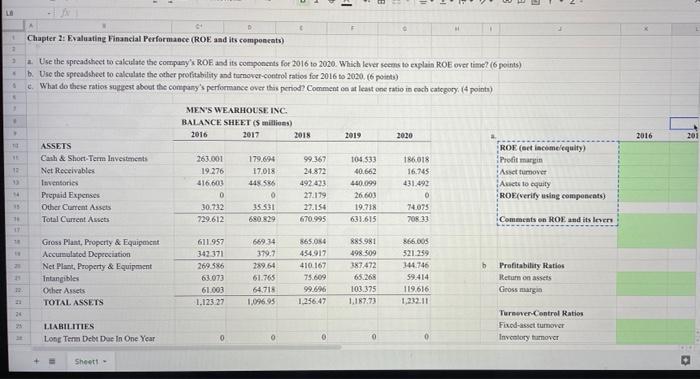

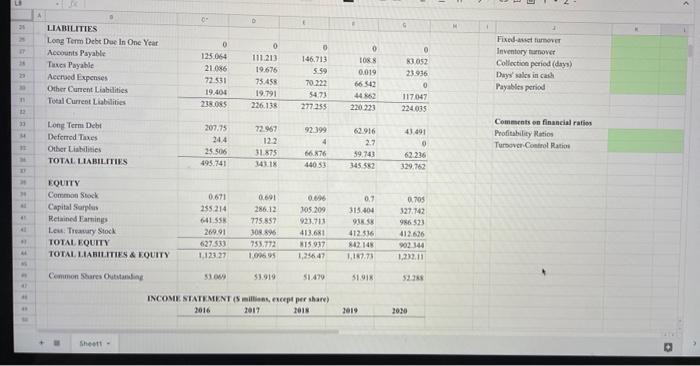

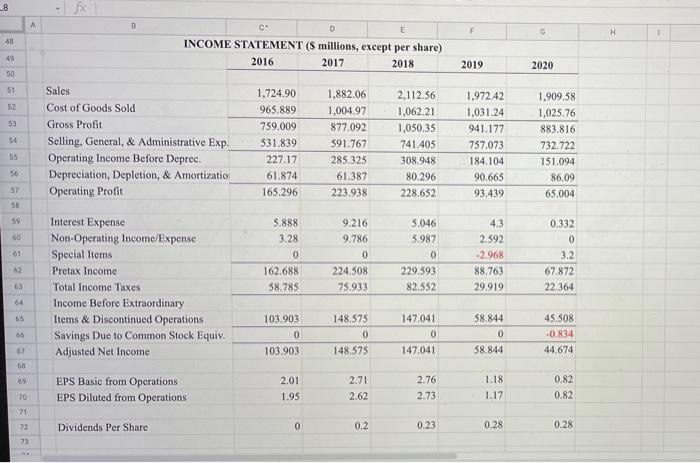

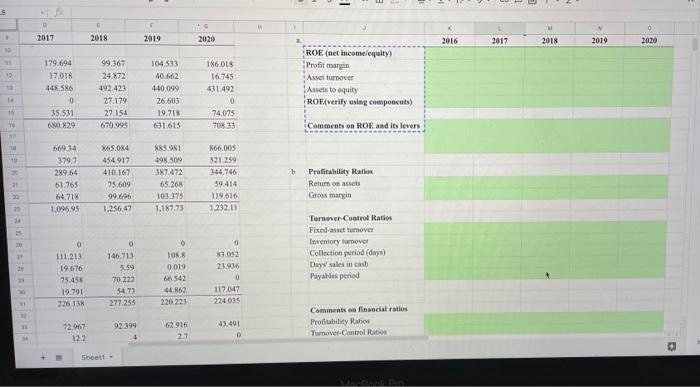

Chapter 2: Evaluating Financial Performance (ROE and its components) 2 3 Use the spreadsheet to calculate the company RE and its components for 2016 to 2020. Which lever seems to explain ROE over time? (6 points) b. Use the spreadsheet to calculate the other profitability and turnover-control ratios for 2016 to 2020.6 points) c. What do these ration suppest about the company's performance over this period Comment on at least one ratio in each category: (4 points) MEN'S WEARHOUSE INC. BALANCE SHEET (5 millions) 2016 2017 2018 2019 2020 2016 201 13 ASSETS Cash & Short-Term Investments Net Receivables Inventories Prepaid Expenses Other Current Assets Total Current Assets 263.001 19.276 416,603 0 179.694 17.018 448586 0 35 531 680 229 99.367 24.872 492.423 27.179 27.154 670.995 104533 40.662 440099 26.603 19.718 631,615 186018 16.745 431.492 0 740075 208 33 ROE ( income equity) Profit margin Asset tumover Aucts to equity ROE/verify using components) 15 30.732 729.612 10 11 Comments on ROE and its lever 2 b Gross Plant, Property & Equipment Accumulated Depreciation Net Plant Property & Equipment Intangibles Other Assets TOTAL ASSETS 611.957 342371 269 586 63.073 61.003 1.123 27 689 34 379.7 289.64 61.765 64.715 1.096.95 865 OK 434917 410.167 75.609 99.696 1.256.47 885981 498 509 187472 65.266 103.375 1.16773 866.003 521.259 344.746 59.414 119.616 1.212.11 19 Profitability Ratios Return on assets Gross margin 24 LIABILITIES Long Term De Due In One Year Turnover Control Ratios Fixed-asset tummover Inventory Humover 0 o 0 + Sheet - a 0 D G 30 IT LIABILITIES Long Term Debt Due In One Year Accounts Payable The Payable Accred Expenses Other Current Liabilities Total Current Liabilities 0 125.054 21.046 72531 19.404 218085 23 0 111.213 19.676 75.458 19.791 226.138 0 146.713 5.59 70.222 5473 277 355 0 1088 0.019 66 542 4422 220 223 Fixed-over Inventory turnover Collection period (days) Days' sales in a Payables period 0 83052 23.936 0 117047 224.035 1 13 13 Long Term Debt Deferred Taxes Other Liabilities TOTAL LIABILITIES 207.75 244 25 506 495.741 72.97 122 31.875 343.1% 92.399 4 66.876 440 53 62.916 2.7 59.743 345 552 43.491 0 62 216 329.762 Comments on financial ratios Profitability Ratio Turnover Control Ratios 0.705 327.42 EQUITY Common Stock Capital Surplus Retained Farming Le Trry Stod TOTAL EQUITY TOTAL LIABILITIES & EQUITY 0.671 255.214 641 558 209.91 627533 1.123.27 0.691 286.12 775 857 308.896 753.772 1.096 0.96 105.209 923713 413.681 N15 037 1,25647 0.7 315.404 916 412516 842148 1.17.73 986 523 412.626 123.11 Common Shares standing 510 53.919 51470 51913 52.355 INCOME STATEMENT (5 millions, nepper share) 2016 2018 2019 2020 Sheet - 8 A B D E F 0 H 4 INCOME STATEMENT (S millions, except per share) 2016 2017 2018 49 2019 2020 50 51 52 53 Sales Cost of Goods Sold Gross Profit Selling, General, & Administrative Exp. Operating Income Before Deprec Depreciation, Depletion, & Amortizatio Operating Profit 1.724.90 965.889 759.009 531.839 227.17 61.874 165.296 1,882.06 1,00497 877.092 591.767 285.325 61.387 223.938 2,112.56 1,062.21 1,050.35 741.405 308.948 80.296 228.652 1.972.42 1,031.24 941.177 757.073 184.104 90.665 93.439 1.909.58 1,025.76 883.816 732.722 151,094 86.09 65.004 55 56 60 01 5.888 3.28 0 162.688 58.785 Interest Expense Non-Operating Income/Expense Special Items Pretax Income Total Income Taxes Income Before Extraordinary Items & Discontinued Operations Savings Due to Common Stock Equiv. Adjusted Net Income 9.216 9.786 0 224.508 75.933 5.046 5.987 0 229.593 82.552 4.3 2.592 -2.968 88.763 29.919 0.332 0 3.2 67.872 22.364 2 63 64 65 16 103.903 0 103.903 148.575 0 148.575 147.041 0 147.041 58.844 0 58.844 45.508 -0.834 44.674 67 68 09 EPS Basic from Operations EPS Diluted from Operations 2.01 1.95 2.71 2.62 2.76 2.73 1.18 1.17 0.82 0.82 71 72 Dividends Per Share 0 0.2 0.23 0.28 0.28 D M 2017 2018 2019 2020 2016 2017 2018 2019 2020 12 179.694 17.018 448,586 0 35531 680.829 12 99.367 24.872 492.423 27.179 27.154 670.095 164.533 40.662 440,099 26.603 19.71% 631.615 ROE (net income equity) Profit margin Asset turnover Assetto equity ROEverily using components) 186.01 16,745 431,492 0 74 075 708 33 11 11 Comments on ROE and its levers 10 b 66914 3797 289.64 61.765 64.718 1.0.95 $65.084 454917 410.167 75,609 99.696 1.256,47 885 981 498.509 387.472 65.268 103.375 1.167.73 866.005 321 259 144.746 59.414 119.616 1,232.01 2 Profitability Ratio Return on assets Gross margin 30 14 TY 0 111213 19676 75.455 19.791 226,13 0 146.713 5.59 70.222 547) 279.255 Turnover Control Ratio Fixed-asset turnover Inventory tumover Collection period (days) Days' sales in cash Payaldes period 0 3.052 23.936 0 117.047 224.035 TORS 0.019 66542 44.862 220 223 72.967 122 92399 1 62.916 2.7 43.491 D Comments on financial ratios Profily Ratio Turnover Control sboett - Chapter 2: Evaluating Financial Performance (ROE and its components) 2 3 Use the spreadsheet to calculate the company RE and its components for 2016 to 2020. Which lever seems to explain ROE over time? (6 points) b. Use the spreadsheet to calculate the other profitability and turnover-control ratios for 2016 to 2020.6 points) c. What do these ration suppest about the company's performance over this period Comment on at least one ratio in each category: (4 points) MEN'S WEARHOUSE INC. BALANCE SHEET (5 millions) 2016 2017 2018 2019 2020 2016 201 13 ASSETS Cash & Short-Term Investments Net Receivables Inventories Prepaid Expenses Other Current Assets Total Current Assets 263.001 19.276 416,603 0 179.694 17.018 448586 0 35 531 680 229 99.367 24.872 492.423 27.179 27.154 670.995 104533 40.662 440099 26.603 19.718 631,615 186018 16.745 431.492 0 740075 208 33 ROE ( income equity) Profit margin Asset tumover Aucts to equity ROE/verify using components) 15 30.732 729.612 10 11 Comments on ROE and its lever 2 b Gross Plant, Property & Equipment Accumulated Depreciation Net Plant Property & Equipment Intangibles Other Assets TOTAL ASSETS 611.957 342371 269 586 63.073 61.003 1.123 27 689 34 379.7 289.64 61.765 64.715 1.096.95 865 OK 434917 410.167 75.609 99.696 1.256.47 885981 498 509 187472 65.266 103.375 1.16773 866.003 521.259 344.746 59.414 119.616 1.212.11 19 Profitability Ratios Return on assets Gross margin 24 LIABILITIES Long Term De Due In One Year Turnover Control Ratios Fixed-asset tummover Inventory Humover 0 o 0 + Sheet - a 0 D G 30 IT LIABILITIES Long Term Debt Due In One Year Accounts Payable The Payable Accred Expenses Other Current Liabilities Total Current Liabilities 0 125.054 21.046 72531 19.404 218085 23 0 111.213 19.676 75.458 19.791 226.138 0 146.713 5.59 70.222 5473 277 355 0 1088 0.019 66 542 4422 220 223 Fixed-over Inventory turnover Collection period (days) Days' sales in a Payables period 0 83052 23.936 0 117047 224.035 1 13 13 Long Term Debt Deferred Taxes Other Liabilities TOTAL LIABILITIES 207.75 244 25 506 495.741 72.97 122 31.875 343.1% 92.399 4 66.876 440 53 62.916 2.7 59.743 345 552 43.491 0 62 216 329.762 Comments on financial ratios Profitability Ratio Turnover Control Ratios 0.705 327.42 EQUITY Common Stock Capital Surplus Retained Farming Le Trry Stod TOTAL EQUITY TOTAL LIABILITIES & EQUITY 0.671 255.214 641 558 209.91 627533 1.123.27 0.691 286.12 775 857 308.896 753.772 1.096 0.96 105.209 923713 413.681 N15 037 1,25647 0.7 315.404 916 412516 842148 1.17.73 986 523 412.626 123.11 Common Shares standing 510 53.919 51470 51913 52.355 INCOME STATEMENT (5 millions, nepper share) 2016 2018 2019 2020 Sheet - 8 A B D E F 0 H 4 INCOME STATEMENT (S millions, except per share) 2016 2017 2018 49 2019 2020 50 51 52 53 Sales Cost of Goods Sold Gross Profit Selling, General, & Administrative Exp. Operating Income Before Deprec Depreciation, Depletion, & Amortizatio Operating Profit 1.724.90 965.889 759.009 531.839 227.17 61.874 165.296 1,882.06 1,00497 877.092 591.767 285.325 61.387 223.938 2,112.56 1,062.21 1,050.35 741.405 308.948 80.296 228.652 1.972.42 1,031.24 941.177 757.073 184.104 90.665 93.439 1.909.58 1,025.76 883.816 732.722 151,094 86.09 65.004 55 56 60 01 5.888 3.28 0 162.688 58.785 Interest Expense Non-Operating Income/Expense Special Items Pretax Income Total Income Taxes Income Before Extraordinary Items & Discontinued Operations Savings Due to Common Stock Equiv. Adjusted Net Income 9.216 9.786 0 224.508 75.933 5.046 5.987 0 229.593 82.552 4.3 2.592 -2.968 88.763 29.919 0.332 0 3.2 67.872 22.364 2 63 64 65 16 103.903 0 103.903 148.575 0 148.575 147.041 0 147.041 58.844 0 58.844 45.508 -0.834 44.674 67 68 09 EPS Basic from Operations EPS Diluted from Operations 2.01 1.95 2.71 2.62 2.76 2.73 1.18 1.17 0.82 0.82 71 72 Dividends Per Share 0 0.2 0.23 0.28 0.28 D M 2017 2018 2019 2020 2016 2017 2018 2019 2020 12 179.694 17.018 448,586 0 35531 680.829 12 99.367 24.872 492.423 27.179 27.154 670.095 164.533 40.662 440,099 26.603 19.71% 631.615 ROE (net income equity) Profit margin Asset turnover Assetto equity ROEverily using components) 186.01 16,745 431,492 0 74 075 708 33 11 11 Comments on ROE and its levers 10 b 66914 3797 289.64 61.765 64.718 1.0.95 $65.084 454917 410.167 75,609 99.696 1.256,47 885 981 498.509 387.472 65.268 103.375 1.167.73 866.005 321 259 144.746 59.414 119.616 1,232.01 2 Profitability Ratio Return on assets Gross margin 30 14 TY 0 111213 19676 75.455 19.791 226,13 0 146.713 5.59 70.222 547) 279.255 Turnover Control Ratio Fixed-asset turnover Inventory tumover Collection period (days) Days' sales in cash Payaldes period 0 3.052 23.936 0 117.047 224.035 TORS 0.019 66542 44.862 220 223 72.967 122 92399 1 62.916 2.7 43.491 D Comments on financial ratios Profily Ratio Turnover Control sboett