Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with work out problem!! thanks in advance Mr. Garrett, a single taxpayer, has $15,500 AGI. Assume the taxable year is 2019. Use Standard

need help with work out problem!! thanks in advance

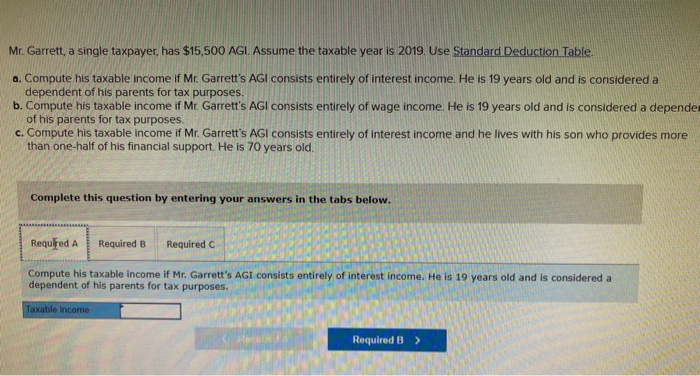

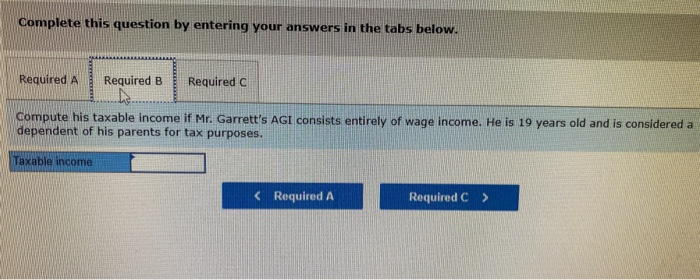

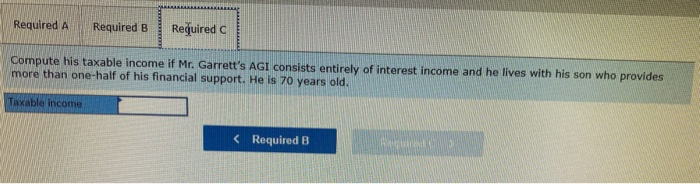

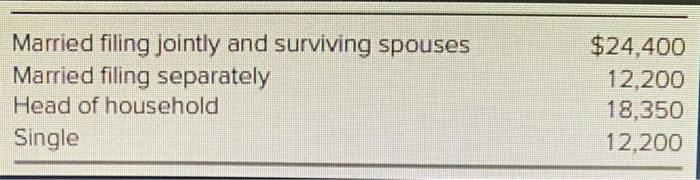

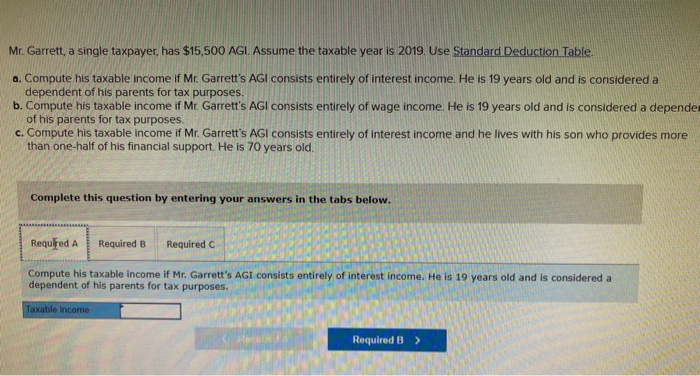

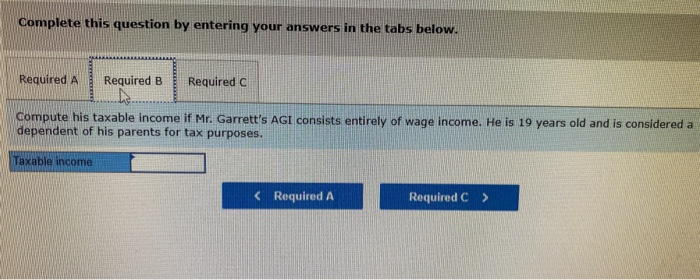

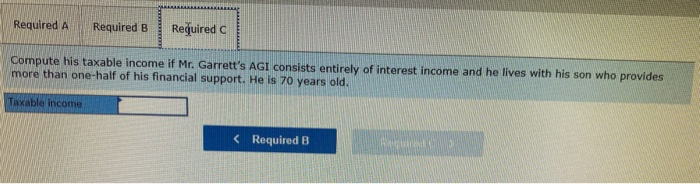

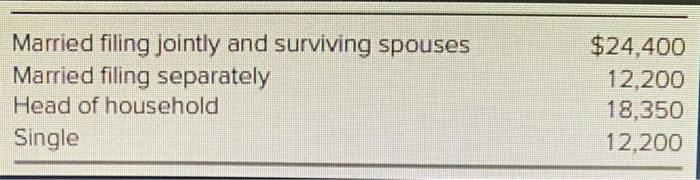

Mr. Garrett, a single taxpayer, has $15,500 AGI. Assume the taxable year is 2019. Use Standard Deduction Table a. Compute his taxable income if Mr. Garrett's AGI consists entirely of interest income. He is 19 years old and is considered a dependent of his parents for tax purposes. b. Compute his taxable income if Mr. Garrett's AGI consists entirely of wage income. He is 19 years old and is considered a depende of his parents for tax purposes. c. Compute his taxable income if Mr. Garrett's AGI consists entirely of interest income and he lives with his son who provides more than one-half of his financial support. He is 70 years old Complete this question by entering your answers in the tabs below. Required A Required B Required c Compute his taxable income if Mr. Garrett's AGI consists entirely of interest income. He is 19 years old and is considered a dependent of his parents for tax purposes. Taxable income Required B > Complete this question by entering your answers in the tabs below. Required A Required B Required Compute his taxable income if Mr. Garrett's AGI consists entirely of wage income. He is 19 years old and is considered a dependent of his parents for tax purposes. Taxable income Required A Required B Required Compute his taxable income if Mr. Garrett's AGI consists entirely of interest income and he lives with his son who provides more than one-half of his financial support. He is 70 years old. Taxable income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started