need helping finishing requirements 2-3

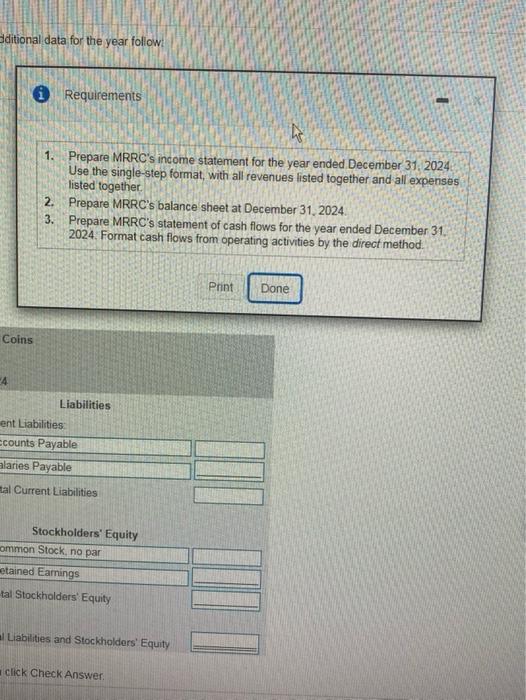

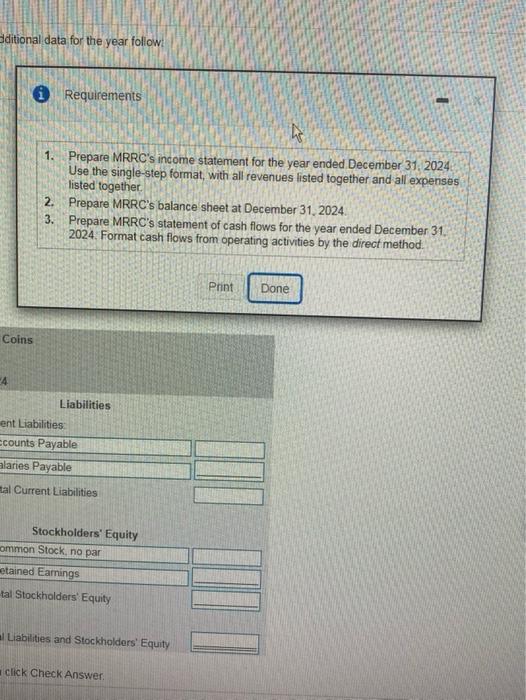

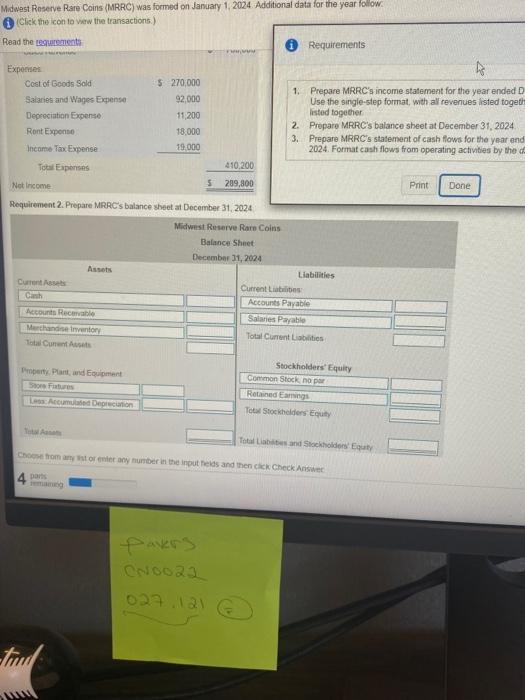

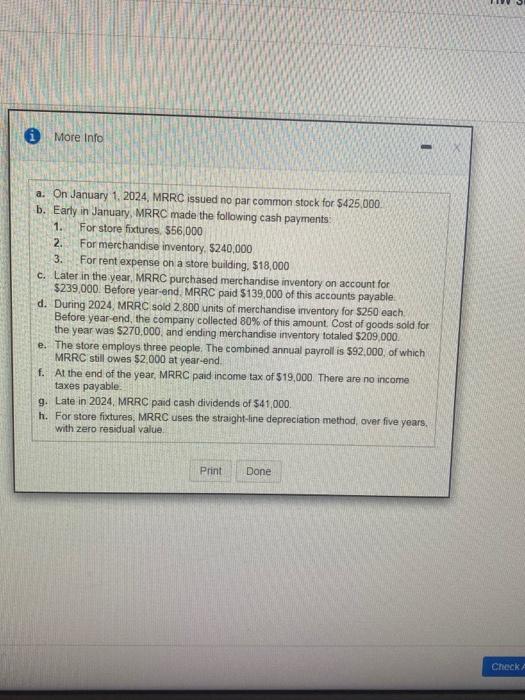

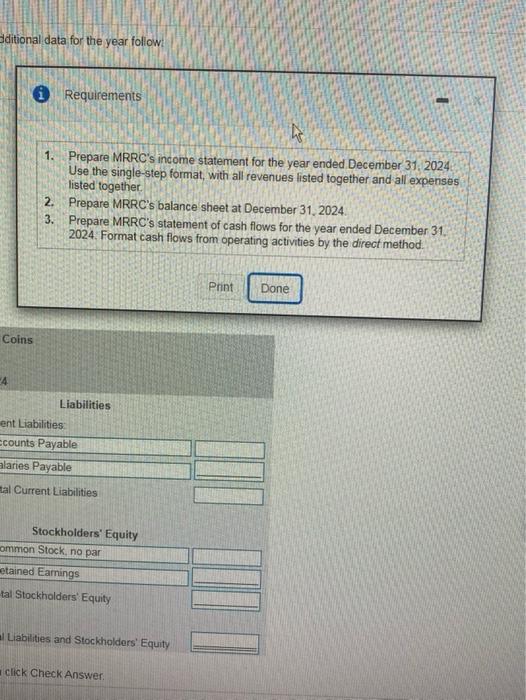

ditional data for the year follow! Requirements - w 1. Prepare MRRC's income statement for the year ended December 31, 2024 Use the single-step format, with all revenues listed together and all expenses listed together 2. Prepare MRRC's balance sheet at December 31, 2024 3. Prepare MRRC's statement of cash flows for the year ended December 31 2024. Format cash flows from operating activities by the direct method, Print Done Coins Liabilities ent Liabilities Ecounts Payable alaries Payable al Current Liabilities Stockholders' Equity ommon Stock, no par etained Earnings tal Stockholders' Equity Liabilities and Stockholders' Equity Click Check Answer Midwest Reserve Rare Coins (MRRC) was formed on January 1, 2024. Additional data for the year follow Click the icon to view the transactions.) Read the requirements Requirements Expenses Cost of Goods Sold $ 270,000 1. Prepare MRRC's income statement for the year ended Salaries and Wages Expense 92.000 Use the single-step format, with all revenues listed togeth Depreciation Expense 11.200 listed together Ront Expense 18,000 2. Preparo MRRC's balance sheet at December 31, 2024 3. Prepare MRRC's statement of cash flows for the year and Income Tax Expense 19.000 2024 Format cash flows from operating activities by the Total Expenses 410,200 Not Income 5 209,800 Print Done Requirement 2. Prepare MRRC's balance sheet at December 31, 2024 Midwest Reserve Rare Coins Balance Sheet December 31, 2024 Assets Liabilities Current Assets Current Liabilities Cash Accounts Payable Account Record Sales Payable Merchandise inventory Total Current Liabilities Total Curent Property Plant, and Equipment Stockholders' Equity Common Stock no per Retained Eags Tool Stockholders Equity Recome Deprecation Toutes and Stockholders' Equity Choose from any story number in the routes and then click Check Ana 4 CN0022 02.12 tund More Info a. On January 1, 2024, MRRC issued no par common stock for $425,000 b. Early in January, MRRC made the following cash payments 1. For store factures. 556,000 2. For merchandise inventory, $240,000 3. For rent expense on a store building. 518,000 C. Later in the year, MRRC purchased merchandise inventory on account for $239,000. Before year-end. MRRC paid $139,000 of this accounts payable d. During 2024, MRRC sold 2.800 units of merchandise inventory for $250 each Before year-end, the company collected 80% of this amount Cost of goods sold for the year was $270,000, and ending merchandise inventory totaled $209,000 e. The store employs three people. The combined annual payroll is 592,000, of which MRRC still owes $2.000 at year-end. f. At the end of the year, MRRC paid income tax of $19,000 There are no income taxes payable. 9. Late in 2024, MRRC paid cash dividends of $41,000. h. For store fixtures, MRRC uses the straight-line depreciation method, over five years, with zero residual value Print Done Check