Answered step by step

Verified Expert Solution

Question

1 Approved Answer

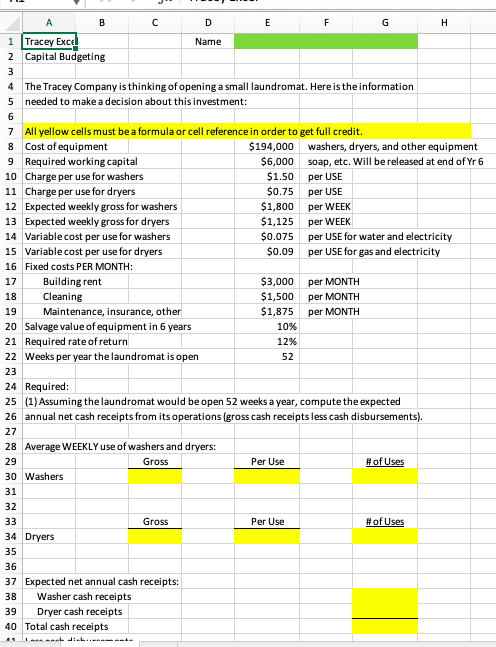

Need in Cell format A C E F G H Tracey Exce Name 2 Capital Budgeting 3 The Tracey Company is thinking of opening a

Need in Cell format

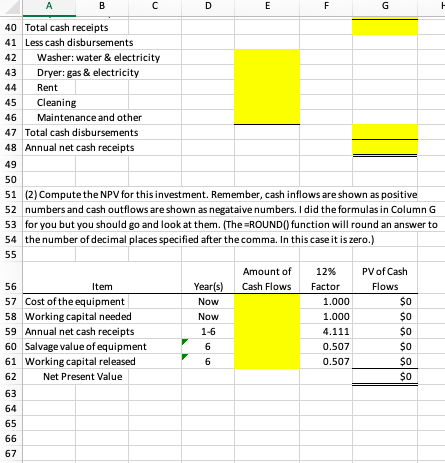

A C E F G H Tracey Exce Name 2 Capital Budgeting 3 The Tracey Company is thinking of opening a small laundromat. Here is the information 4 needed to make a decision about this investment: 5 6 7 All yellow cells must be a formula or cell reference in order to get full credit. Cost of equipment Required working capital 10 Charge per use for washers 11 Charge per use for dryers 12 Expected weekly gross for washers 13 Expected weekly gross for dryers 14 Variable cost per use for washers 15 Variable cost per use for dryers 8 $194,000 washers, dryers, and other equipment $6,000 9 soap, etc. Will be released at end of Yr 6 $1.50 per USE $0.75 per USE $1,800 $1,125 per WEEK per WEEK $0.075 per USE for water and electricity per USE for gas and electricity $0.09 Fixed costs PER MONTH: 16 Building rent Cleaning $3,000 17 per MONTH $1,500 per MONTH 18 $1,875 19 Maintenance, insurance, other per MONTH Salvage value of equipment in 6 years Required rate of return Weeks per year the laundromat is open 20 10% 21 12% 22 52 23 24 Required: (1)Assuming the laundromat would be open 52 weeks a year, compute the expected 25 annual net cash receipts from its operations (gross cash receipts less cash disbursements). 26 27 Average WEEKLY use of washers and dryers: 28 #of Uses 29 Gross Per Use 30 Washers 31 32 #of Uses 33 Gross Per Use 34 Dryers 35 36 37 Expected net annual cash receipts: Washer cash receipts Dryer cash receipts 40 Total cash receipts neeeacb diebieeamm anto 38 39 B A C D E F G 40 Total cash receipts Less cash disbursements 41 Washer: water & electricity 42 Dryer: gas & electricity 43 44 Rent Cleaning 45 Maintenance and other 46 47 Total cash disbursements 48 Annual net cash receipts 49 50 (2) Compute the NPV for this investment. Remember, cash inflows are shown as positive numbers and cash outflows are shown as negataive numbers. I did the formulas in Column G for you but you should go and look at them. (The -ROUND() function will round an answer to the number of decimal places specified after the comma. In this case it is zero.) 51 52 53 54 55 PV of Cash Amount of 12% Year(s) Cash Flows Flows 56 Item Factor Cost of the equipment Working capital needed $0 57 Now 1.000 $0 58 Now 1.000 59 Annual net cash receipts $0 1-6 4.111 Salvage value of equipment Working capital released $0 60 6 0.507 $0 61 6 0.507 Net Present Value $0 62 63 64 65 66 67Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started