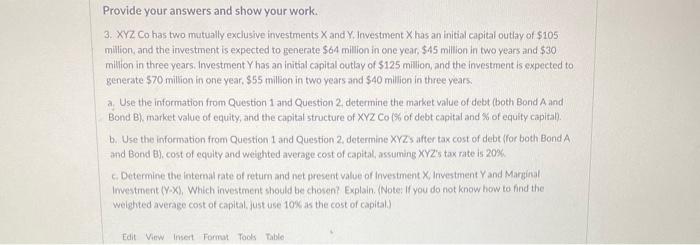

NEED INLY QUESTION NUMBER 3A 3B 3C the orher two pictures are for reference

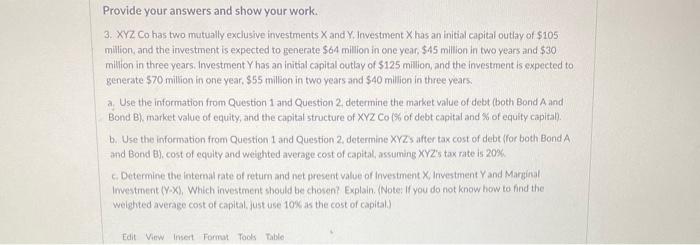

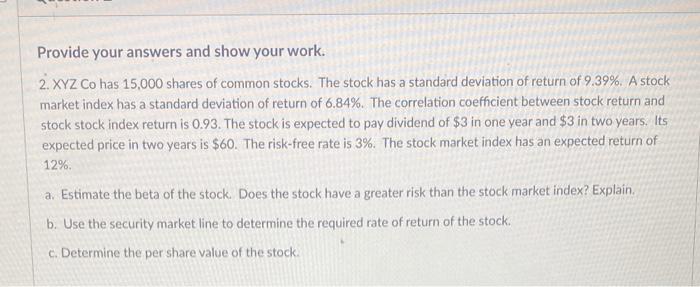

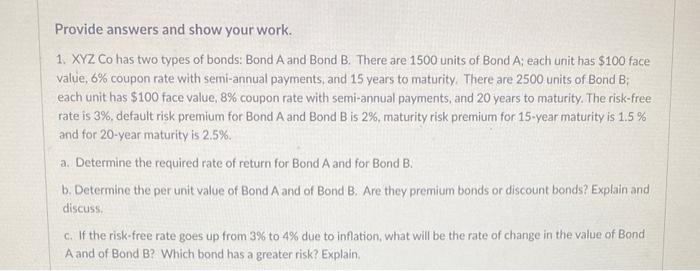

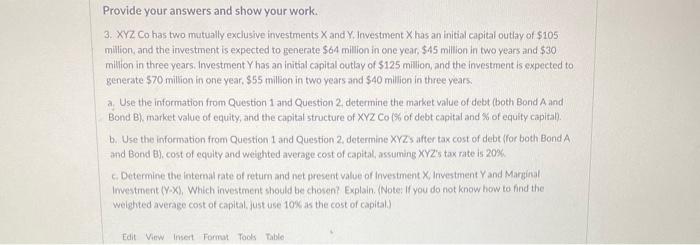

Provide your answers and show your work. 3. XYZ Co has two mutually exclusive investments X and Y. Investment X has an initial capital outlay of $105 million and the irwestment is expected to generate $64 million in one year, $45 million in two years and $30 million in three years, Investment Y has an initial capital outlay of $125 million, and the investment is expected to generate 570 million in one year. $55 million in two years and $40 million in three years, a Use the information from Question 1 and Question 2 determine the market value of debt (both Bond A and Bond B} market value of equity, and the capital structure of XYZ Co t% of debt capital and % of equity capital). b. Use the information from Question and Question 2 determine XYZy after tax cost of debt (for both Bond A and Bond B), cost of equity and weighted average cost of capital, assuming XYZ's tax rate is 20% c.Determine the internal rate of return and not present value of investment X Investment and Marginal Investment (YX), Which investment should be chosen? Explain. (Note: If you do not know how to find the weighted average cost of capital.justuse 10% as the cost of capital) Edit View Insert Tort Tools Table Provide your answers and show your work. 2. XYZ Co has 15,000 shares of common stocks. The stock has a standard deviation of return of 9.39%. A stock market index has a standard deviation of return of 6.84%. The correlation coefficient between stock return and stock stock index return is 0.93. The stock is expected to pay dividend of $3 in one year and $3 in two years. Its expected price in two years is $60. The risk-free rate is 3%. The stock market index has an expected return of 12%. a. Estimate the beta of the stock. Does the stock have a greater risk than the stock market index? Explain. b. Use the security market line to determine the required rate of return of the stock. c. Determine the per share value of the stock Provide answers and show your work. 1. XYZ Co has two types of bonds: Bond A and Bond B. There are 1500 units of Bond A; each unit has $100 face value, 6% coupon rate with semi-annual payments, and 15 years to maturity. There are 2500 units of Bond B; each unit has $100 face value, 8% coupon rate with semi-annual payments, and 20 years to maturity. The risk-free rate is 3%, default risk premium for Bond A and Bond Bis 2%, maturity risk premium for 15-year maturity is 1.5 % and for 20-year maturity is 2.5%. a. Determine the required rate of return for Bond A and for Bond B. b. Determine the per unit value of Bond A and of Bond B. Are they premium bonds or discount bonds? Explain and discuss c. If the risk-free rate goes up from 3 to 4% due to inflation, what will be the rate of change in the value of Bond A and of Bond B? Which bond has a greater risk? Explain