need it asap ill give thumbs up thank you

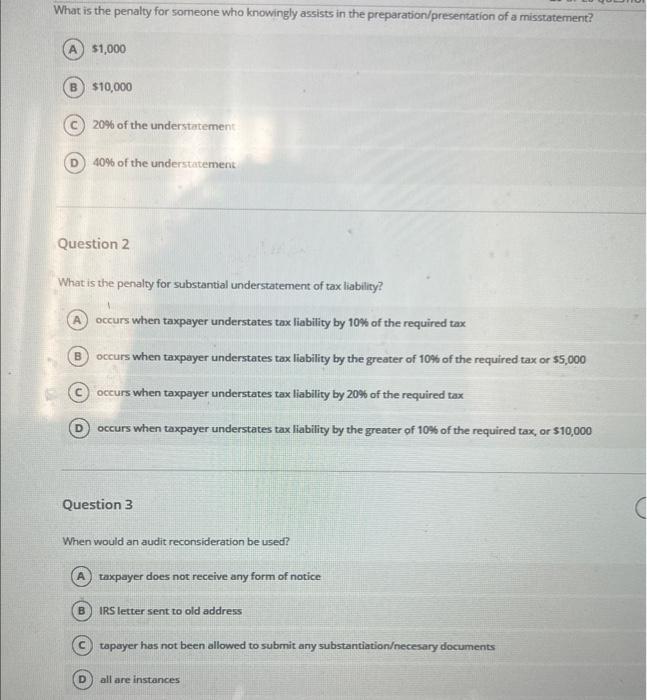

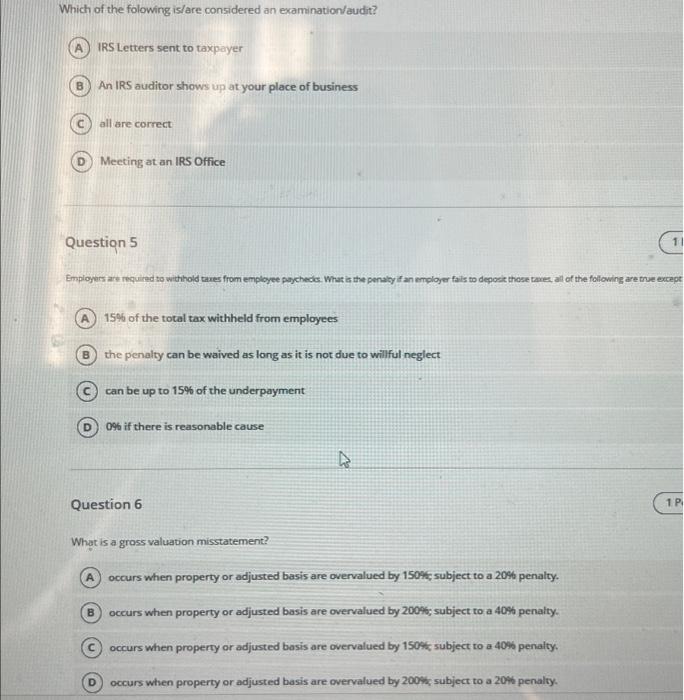

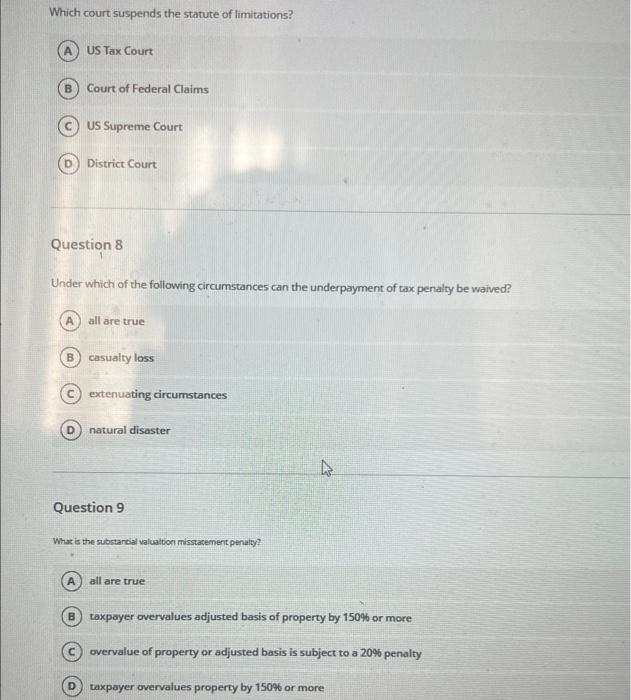

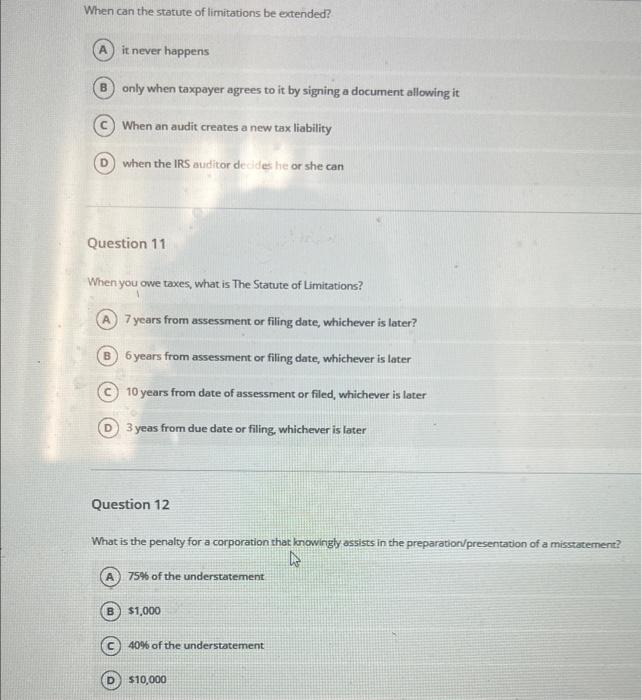

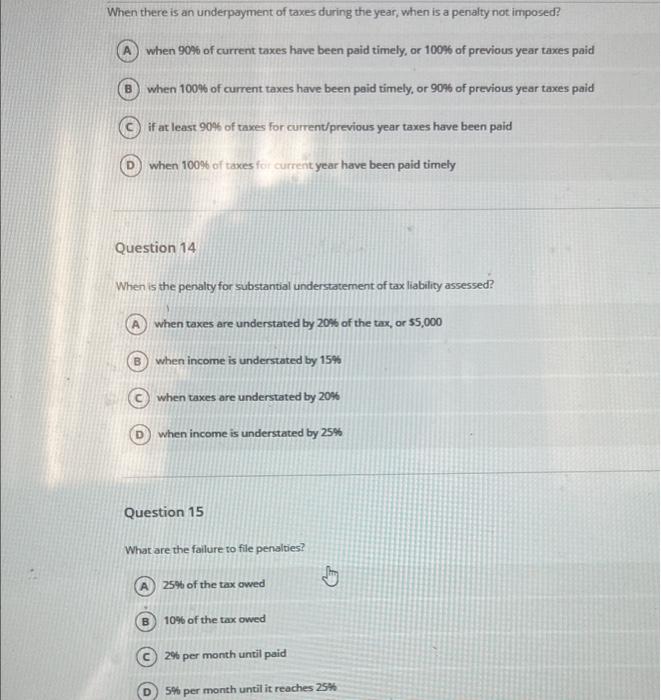

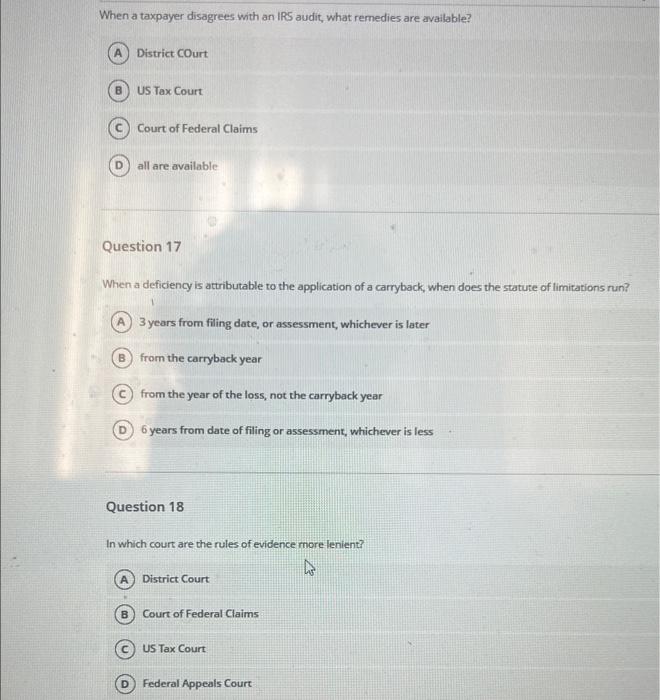

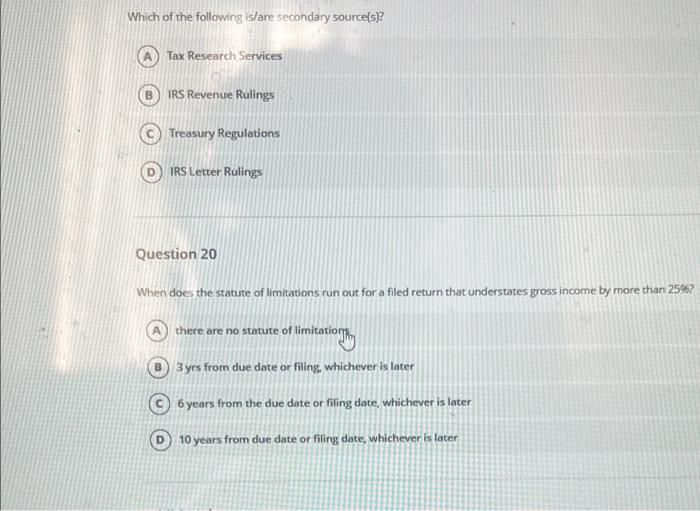

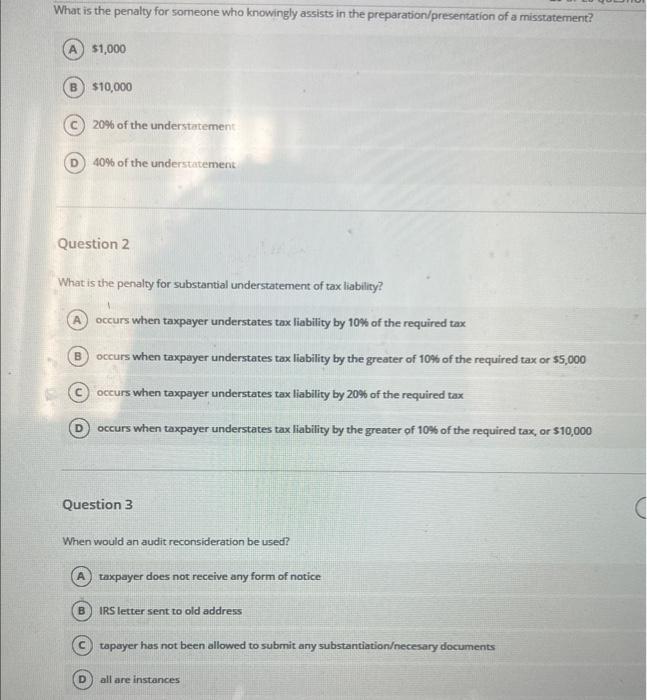

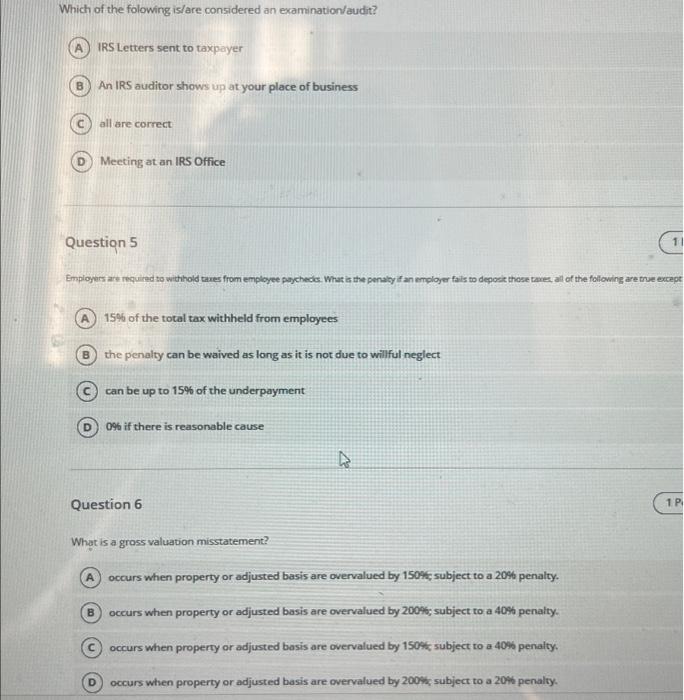

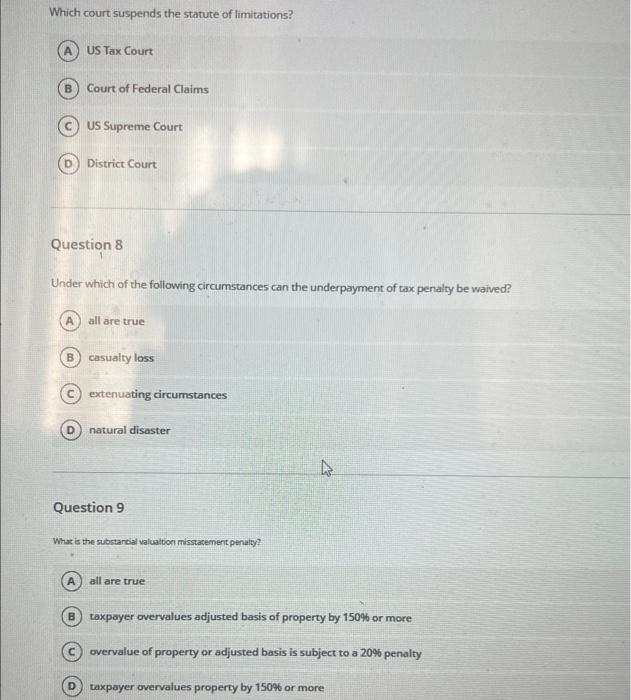

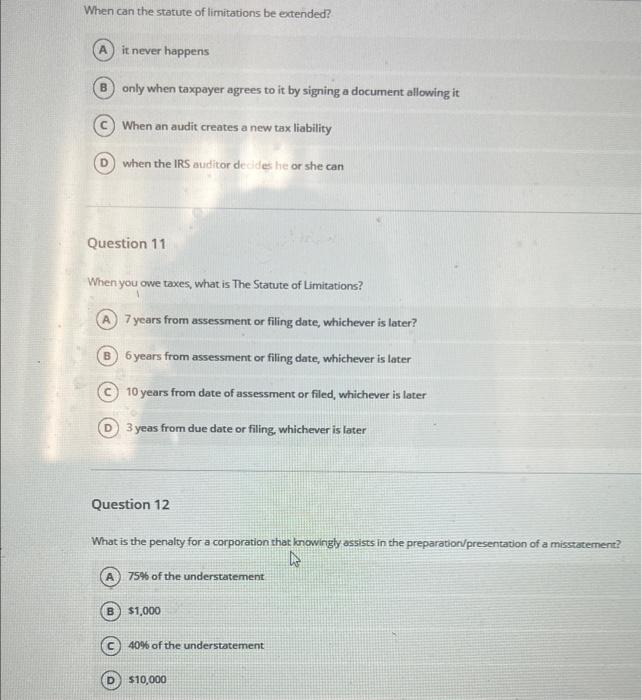

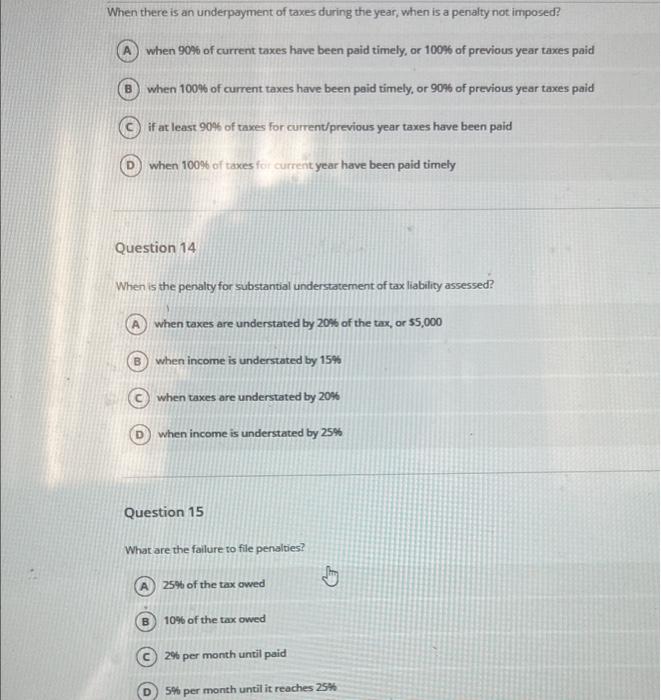

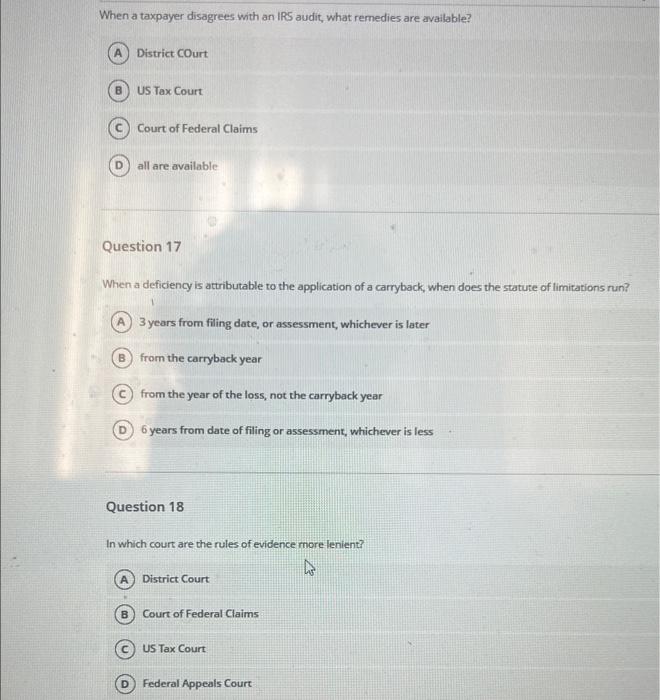

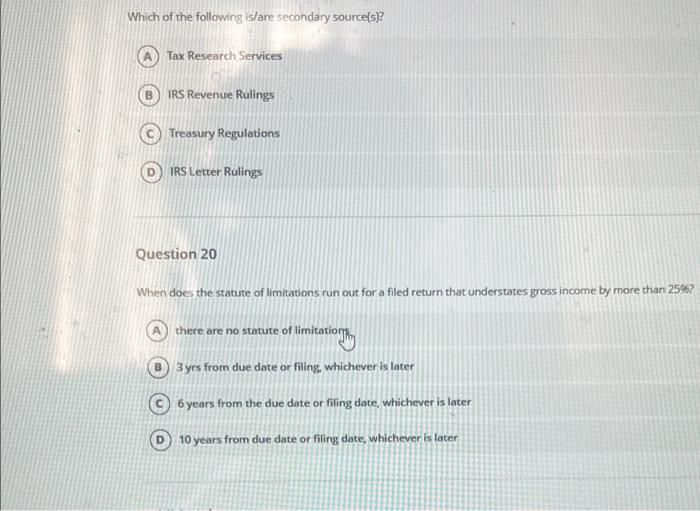

What is the penalty for someone who knowingly assists in the preparation/presentation of a misstatement? 51,000 $10,000 20% of the understatement 40% of the understatement Question 2 What is the penalty for substantial understatement of tax liability? occurs when taxpayer understates tax liability by 10% of the required tax occurs when taxpayer understates tax liability by the greater of 10% of the required tax or $5,000 occurs when taxpayer understates tax liability by 20% of the required tax occurs when taxpayer understates tax liability by the greater of 10$ of the required tax, or $10,000 Question 3 When would an audit reconsideration be used? taxpayer does not receive any form of notice IRS letter sent to old address tapayer has not been allowed to submit any substantiationecesary documents all are instances Which of the folowing is/are considered an examination/audit? IRS Letters sent to taxpayer An IRS auditor shows up at your place of business all are correct Meeting at an IRS Office Question 5 Emplogers are required to withold taies from employee pogchedc. What is the penaty if an emploger fais to deposit those tames, all of the following are true excep 15% of the total tax withheld from employees the penalty can be waived as long as it is not due to willful neglect can be up to 15% of the underpayment 0% if there is reasonable cause Question 6 What is a gross valuation misstatement? occurs when property or adjusted basis are overvalued by 1509 ; subject to a 20% penalty. occurs when property or adjusted basis are overvalued by 200%; subject to a 40% penaity. occurs when property or adjusted bosis are overvalued by 150% subject to a 40% penalty. occurs when property or adjusted bosis are overvalued by 200k subject to a 20s penalty. Which court suspends the statute of limitations? US Tax Court Court of Federal Claims US Supreme Court District Court Question 8 Under which of the following circumstances can the underpayment of tax penalty be waived? all are true casualty loss extenuating circumstances natural disaster Question 9 Whas is the substantial valualion misstacement penaty? all are true taxpayer overvalues adjusted basis of property by 150% or more overvalue of property or adjusted basis is subject to a 20% penalty taxpayer overvalues property by 150% or more When can the statute of limitations be extended? it never happens only when taxpayer agrees to it by signing a document allowing it When an audit creates a new tax liability when the IRS auditor deddes he or she can Question 11 When you owe taxes, what is The Statute of Limitations? 7 years from assessment or filing date, whichever is later? 6 years from assessment or filing date, whichever is later 10 years from date of assessment or filed, whichever is later 3 yeas from due date or filing, whichever is later Question 12 What is the penalty for a corporation that lonowingly assists in the preparaton/presentation of a misstatement? 75% of the understatement $1,000 40% of the understatement 510,000 When there is an underpayment of taxes during the year, when is a penalty not imposed? when 9096 of current taxes have been paid timely, or 100% of previous year taxes paid when 100% of current taxes have been paid timely, or 9096 of previous year taxes paid if at least 90% of taxees for current/previous year taxes have been paid when 100% of taxes for current year have been paid timely Question 14 When is the penalty for substantial understatement of tax liability assessed? when taxes are understated by 20% of the tax, or 55,000 when income is understated by 15% when taxes are understated by 20% when income is understated by 25% Question 15 What are the failure to file penalties? 25% of the tax owed 10% of the tax owed 24 per month until paid 5% per month until it reaches 25% When a taxpayer disagrees with an IRS audit, what remedies are available? District COurt US Tax Court Court of Federal Claims all are available Question 17 When a deficiency is attributable to the application of a carryback, when does the statute of limitations run? 3 years from filing date, or assessment, whichever is later from the carryback year from the year of the loss, not the carryback year 6 years from date of filing or assessment, whichever is less Question 18 In which court are the rules of evidence more lenient? District Court Court of Federal Claims US Tax Court. Federal Appeals Court Which of the following is/are secondary source(s)? Tax Research Services IRS Revenue Rulings Treasury Regulations IRS Letter Rulings Question 20 When does the statute of limitations run out for a filed return that understates gross income by more than 25% ? there are no statute of limitationging 3 yrs from due date or filing, whichever is later 6 years from the due date or filing date, whichever is later 10 years from due date or filing date, whichever is later