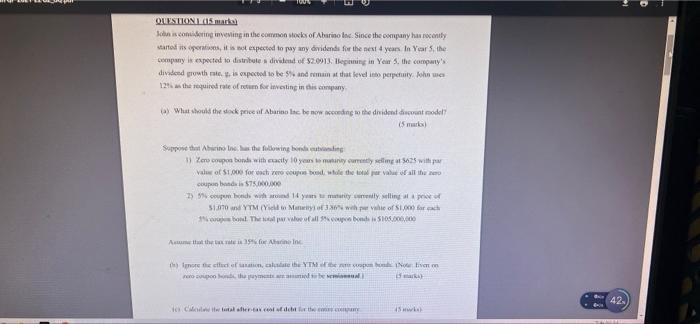

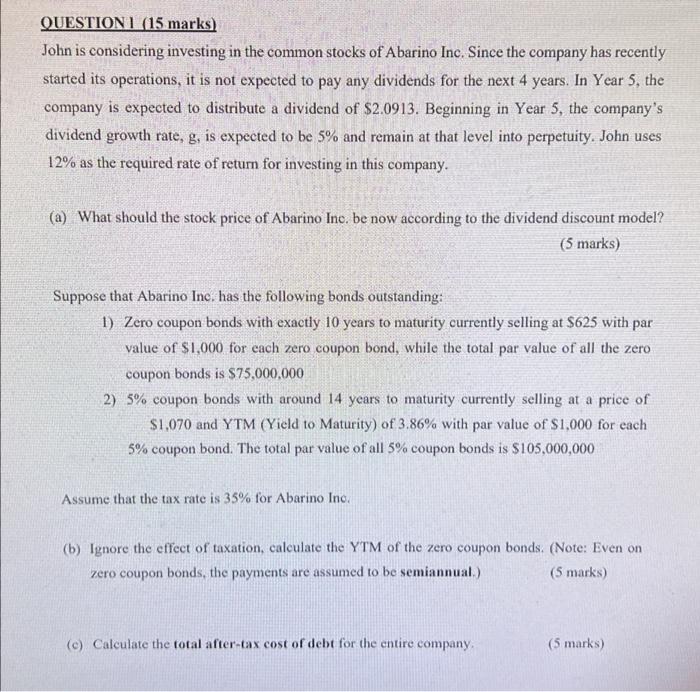

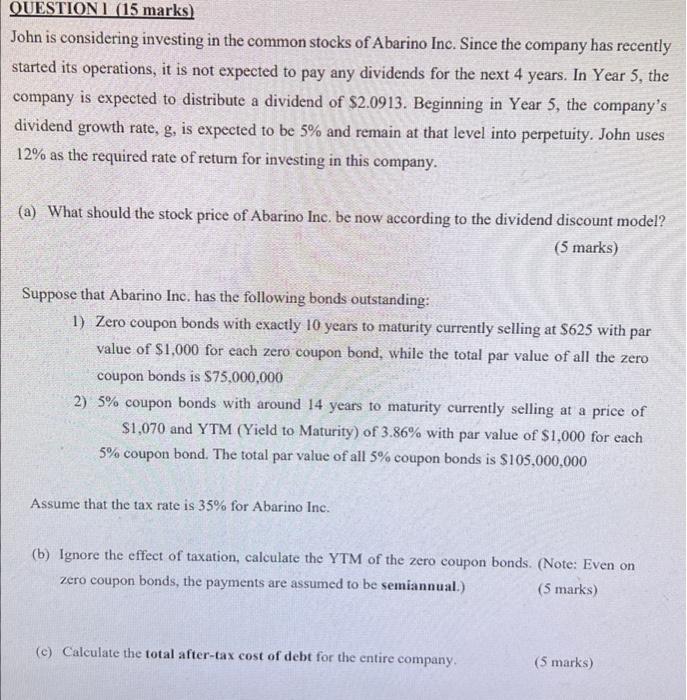

QUESTION (15 marka) Jon is considering in eving in the common ocles of Abarino Inc. Since the company has recently warto sport, it is not expected to pay my dividends for the next 4 years In Year the company is expected to distributo dividend of $2.0913. Beginning in Your 5. the company's dividend growth is opected to be 5 and remains that level in perpetunity John 12 as the required rate of or investing in this company What should the stock price of Abartino lice wwwcondong to the diident duscount model (5 m) Suppose that he has the following bandet 1 La crepes bond with cacity 10 years amotany currently selling 3675 with a Value of $1.000 for each roop bole the value of all the coup dels $75.000 1) coupe bodo od 14 yeni mutunity ceny selling 10 YTM (View Many of uw per te of St. for each bol. The of all coupons 5105.000.000 Acumut there in ne ) for the clock in the YTM protivert y el 42 QUESTIONI (15 marks) John is considering investing in the common stocks of Abarino Inc. Since the company has recently started its operations, it is not expected to pay any dividends for the next 4 years. In Year 5, the company is expected to distribute a dividend of $2.0913. Beginning in Year 5, the company's dividend growth rate, g, is expected to be 5% and remain at that level into perpetuity. John uses 12% as the required rate of return for investing in this company. (a) What should the stock price of Abarino Inc. be now according to the dividend discount model? (5 marks) Suppose that Abarino Inc. has the following bonds outstanding: 1) Zero coupon bonds with exactly 10 years to maturity currently selling at $625 with par value of $1,000 for each zero coupon bond, while the total par value of all the zero coupon bonds is $75,000,000 2) 5% coupon bonds with around 14 years to maturity currently selling at a price of $1.070 and YTM (Yield to Maturity) of 3.86% with par value of $1.000 for each 5% coupon bond. The total par value of all 5% coupon bonds is $105,000,000 Assume that the tax rate is 35% for Abarino Ing. (b) Ignore the effect of taxation, calculate the YTM of the zero coupon bonds. (Note: Even on zero coupon bonds, the payments are assumed to be semiannual) (5 marks) (c) Calculate the total after-tax cost of debt for the entire company (5 marks) QUESTIONI (15 marks) John is considering investing in the common stocks of Abarino Inc. Since the company has recently started its operations, it is not expected to pay any dividends for the next 4 years. In Year 5, the company is expected to distribute a dividend of $2.0913. Beginning in Year 5, the company's dividend growth rate, g, is expected to be 5% and remain at that level into perpetuity. John uses 12% as the required rate of return for investing in this company. (a) What should the stock price of Abarino Inc. be now according to the dividend discount model? (5 marks) Suppose that Abarino Inc. has the following bonds outstanding: 1) Zero coupon bonds with exactly 10 years to maturity currently selling at $625 with par value of $1,000 for each zero coupon bond, while the total par value of all the zero coupon bonds is $75,000,000 2) 5% coupon bonds with around 14 years to maturity currently selling at a price of $1,070 and YTM (Yield to Maturity) of 3.86% with par value of $1,000 for each 5% coupon bond. The total par value of all 5% coupon bonds is $105,000,000 Assume that the tax rate is 35% for Abarino Inc. (b) Ignore the effect of taxation, calculate the YTM of the zero coupon bonds. (Note: Even on zero coupon bonds, the payments are assumed to be semiannual.) (5 marks) (e) Calculate the total after-tax cost of debt for the entire company. (5 marks) 1 / 5 90% + QUESTION 1 (15 marks John is considering investing in the common stocks of Abarino Inc. Since the company has recently started its operations, it is not expected to pay any dividends for the next 4 years. In Year 5, the company is expected to distribute a dividend of $2.0913. Beginning in Year 5, the company's dividend growth rate, g. is expected to be 5% and remain at that level into perpetuity. John uses 12% as the required rate of return for investing in this company. (a) What should the stock price of Abarino Inc. be now according to the dividend discount model? (5 marks) Suppose that Abarino Inc. has the following bonds outstanding: 1) Zero coupon bonds with exactly 10 years to maturity currently selling at $625 with par value of $1,000 for each zero coupon bond, while the total par value of all the zero coupon bonds is $75,000,000 2) 5% coupon bonds with around 14 years to maturity currently selling at a price of $1,070 and YTM (Yield to Maturity) of 3.86% with par value of $1,000 for each 5% coupon bond. The total par value of all 5% coupon bonds is $105,000,000 Assume that the tax rate is 35% for Abarino Inc. (b) Ignore the effect of taxation, calculate the YTM of the zero coupon bonds. (Note: Even on zero coupon bonds, the payments are assumed to be semiannual) (5 marks) (c) Calculate the total after-tax cost of debt for the entire company (5 marks) 1 / 5 90% + QUESTIONI (15 marks) John is considering investing in the common stocks of Abarino Inc. Since the company has recently started its operations, it is not expected to pay any dividends for the next 4 years In Year 5, the company is expected to distribute a dividend of $2.0913. Beginning in Year 5. the company's dividend growth rate, g, is expected to be 5% and remain at that level into perpetuity. John uses 12% as the required rate of return for investing in this company. (a) What should the stock price of Abarino Inc be now according to the dividend discount model? (5 marks) () What should the stock price of Abarino Ino, be now according to the dividend discount model? (5 marks) Suppose that Abarino Inc, has the following bonds outstanding 1) Zero coupon bonds with exactly 10 years to maturity currently selling at $625 with par value of $1,000 for each zero coupon bond, while the total par value of all the zero coupon bonds is $75,000,000 2) 5% coupon bonds with around 14 years to maturity currently selling at a price of $1,070 and YTM (Yield to Maturity) of 3.86% with par value of $1,000 for each 5% coupon bond. The total par value of all 5% coupon bonds is $105.000,000 Assume that the tax rate is 35% for Abarino Inc (b) Ignore the effect of taxation, calculate the YTM of the 2010 coupon bonds. (Note: Even on zero coupon bonds, the payments are assumed to be semiannual) (5 marks) (c) Calculate the total after-tax cost of debt for the entire company