Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need it urgently b mo. Case of jsers/Iqra 920Shakeel/OneDrive/Desktop/Comp.%20Case%20(1).pdf PAKISTAN Bookkeeging Out Master Budget Interi.. Glocal Ecademy Writing You work for a small accounting firm

need it urgently

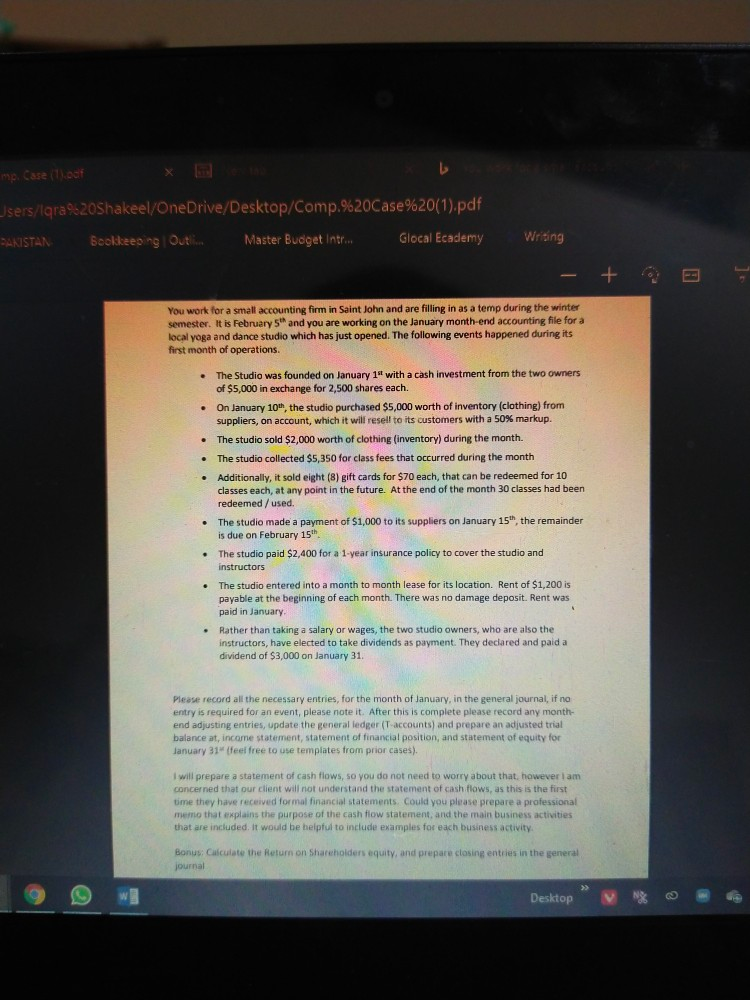

b mo. Case of jsers/Iqra 920Shakeel/OneDrive/Desktop/Comp.%20Case%20(1).pdf PAKISTAN Bookkeeging Out Master Budget Interi.. Glocal Ecademy Writing You work for a small accounting firm in Saint John and are filling in as a temp during the winter semester. It is February 5th and you are working on the January month-end accounting file for a local yoga and dance studio which has just opened. The following events happened during its first month of operations. . . The Studio was founded on January 1" with a cash investment from the two owners of $5,000 in exchange for 2,500 shares each. On January 10th, the studio purchased $5,000 worth of inventory (clothing) from suppliers, on account, which it will resell to its customers with a 50% markup. The studio sold $2,000 worth of clothing (inventory) during the month. The studio collected $5,350 for class fees that occurred during the month Additionally, it sold eight (8) gift cards for $70 each, that can be redeemed for 10 classes each, at any point in the future. At the end of the month 30 classes had been redeemed / used. The studio made a payment of $1,000 to its suppliers on January 15th, the remainder is due on February 15th . . . The studio paid $2,400 for a 1-year insurance policy to cover the studio and instructors The studio entered into a month to month lease for its location. Rent of $1,200 is payable at the beginning of each month. There was no damage deposit. Rent was paid in January Rather than taking a salary or wages, the two studio owners, who are also the instructors, have elected to take dividends as payment. They declared and paid a dividend of $3,000 on January 31, Please record all the necessary entries, for the month of January, in the general journal, if no entry is required for an event, please note it. After this is complete please record any month- end adjusting entries, update the general ledger (Taccounts) and prepare an adjusted trial balance at, income statement, statement of financial position, and statement of equity for January 31" [feel free to use templates from prior cases). I will prepare a statement of cash flows, so you do not need to worry about that, however I am concerned that our client will not understand the statement of cash flows, as this is the first time they have received formal financial statements. Could you please prepare a professional memo that explains the purpose of the cash flow statement, and the main business activities that are included. It would be helpful to include examples for each business activity Bonus Calculate the Return on Shareholders equity, and prepare closing entries in the general journal DesktopStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started