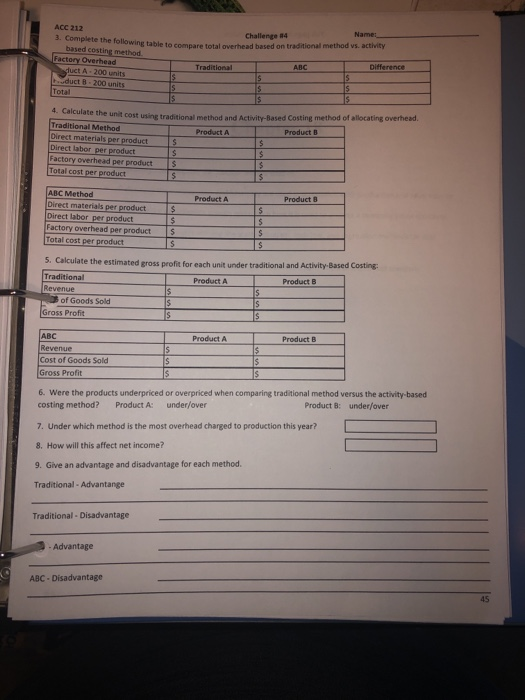

need numbers 5-9 answered

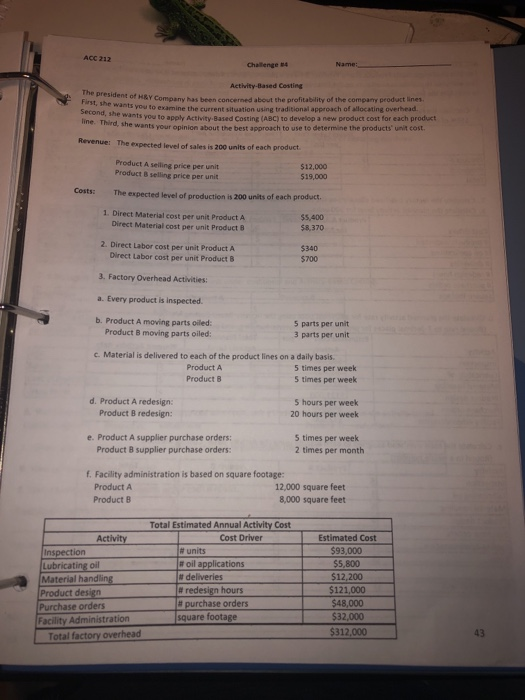

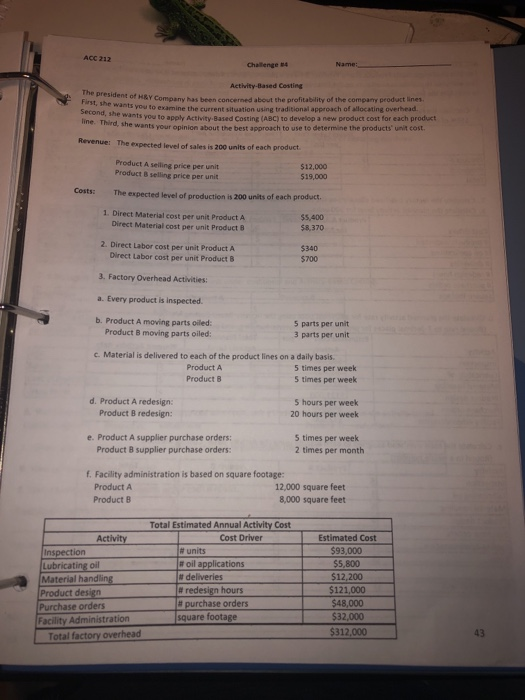

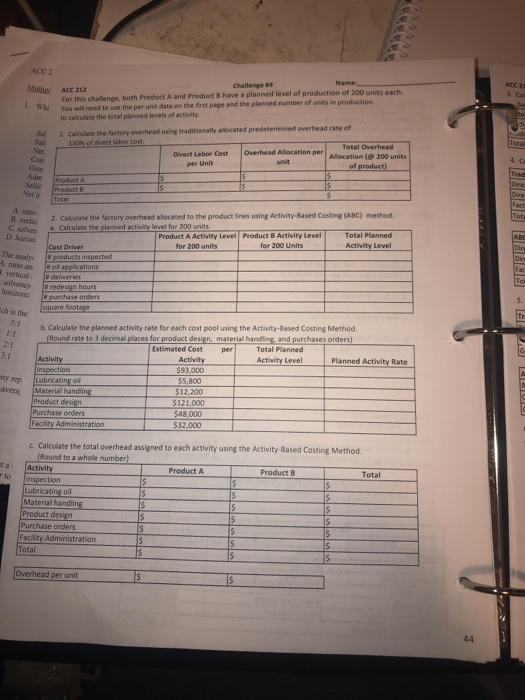

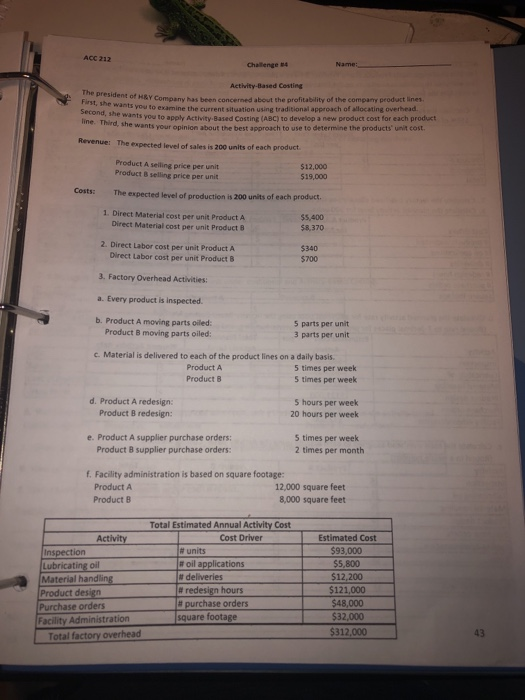

ACC 212 Challenge Activity-Based Costing e president of the profitability of the company product lines wants you to examine the current station in traditional approach of locating overhead wants you to apply Activity Based Casting (ABC) to develop a new product out for each product line. Third, she the wants your own about the best approach to use to determine the producti o n Revenue: The expected level of sales is 200 units of each product Product A Product se priceperit priceper $12.000 $19.000 Costs The expected level of production is 200 nits of each product 1. Direct Material cost per unit Product A Direct Material cost per unit Products $5,400 $8.370 2. Direct Labor cost per unit Product A Direct Labor cost per unit Products 5340 5700 3. Factory Overhead Activities: a. Every product is inspected. b. Product A moving parts oiled: Product moving parts oiled: 5 parts per unit 3 parts per unit c. Material is delivered to each of the product lines on a daily basis. Product A 5 times per week Product B 5 times per week d. Product A redesign: Product Bredesign: 5 hours per week 20 hours per week e. Product A supplier purchase orders: Product B supplier purchase orders: 5 times per week 2 times per month 1. Facility administration is based on square footage: Product A 12,000 square feet Product B 8,000 square feet Activity Inspection Lubricating oil Material handling Product design Purchase orders Facility Administration Total factory overhead Total Estimated Annual Activity Cost Cost Driver units soil applications deliveries redesign hours purchase orders square footage Estimated cost $93.000 $5,800 $12,200 $121,000 $48,000 $32,000 $312.000 ACC2 Whil ACC 212 Challenge 4 Name: For this challenge, both Product A and Product B have a planned level of production of 200 units each You will need to use the per una data on the first page and the planned number of units in production to calculate the total planned levels of activity. 1. Calculate the factory overhead using traditionally allocated predetermined overhead rate of 150% of direct labor cost Total Overhead Direct Labor Cost Overhead Allocation per per Allocation de 200 units per Unit of product) D. horize 2. Calculate the factory overhead allocated to the product lines using Activity Based Costing (ABC) method. Calculate the planned activity level for 200 units Product A Activity level Product Activity level Total Planned Cost Driver for 200 units for 200 Units Activity Level products inspected of applications o deliveries redesign hours purchase orders square footage solvency horizont my rep Ver b. Calculate the planned activity rate for each cost pool using the Activity-Based Costing Method. (Round rate to 3 decimal places for product design, material handling and purchases orders) Estimated Cost per Total Planned Activity Activity Activity Level Planned Activity Rate Inspection $93,000 lubricating $5,800 Material Handling $12.200 Product design $121,000 Purchase orders $48.000 Facility Administration $32,000 c. Calculate the total overhead assigned to each activity using the Activity Based Costing Method (Round to a whole number) Activity 1 Product Product B Total Inspection s Lubricating oil s $ $ Material handling $ $ Product design $ Purchase orders is Facility Administration s SS Total S S S Overhead per unit s Challenge #4 Name: totalmerhead based on traditional method vs. activity ACC 212 . Complete the following table to based costing method Factory Overhead duct A-200 units duct 3 - 200 Total Traditional Activit-Based Costing method of allocating overhead Product Product 4 Calculate the unit cost Traditional Method Direct materials per product s Direct labor per product s Factory Overhead per products Total cost per product S S S Product Products $ ABC Method Direct materials per product s Direct labor per product IS Factory overhead per products Total cost per product $ 5. Calculate the estimated gross profit for each under traditional and Activity Based Costing Traditional Product Products Revenue of Goods Sold S S Gross Profit S S roduct Product B $ Revenue Cost of Goods Sold Gross Profit S S 6. Were the products underpriced or overpriced when comparing traditional method versus the activity-based costing method? Product A: underlover Product : under/over 7. Under which method is the most overhead charged to production this year? 8. How will this affect net income? 9. Give an advantage and disadvantage for each method. Traditional - Advantange Traditional - Disadvantage - Advantage ABC-Disadvantage