Answered step by step

Verified Expert Solution

Question

1 Approved Answer

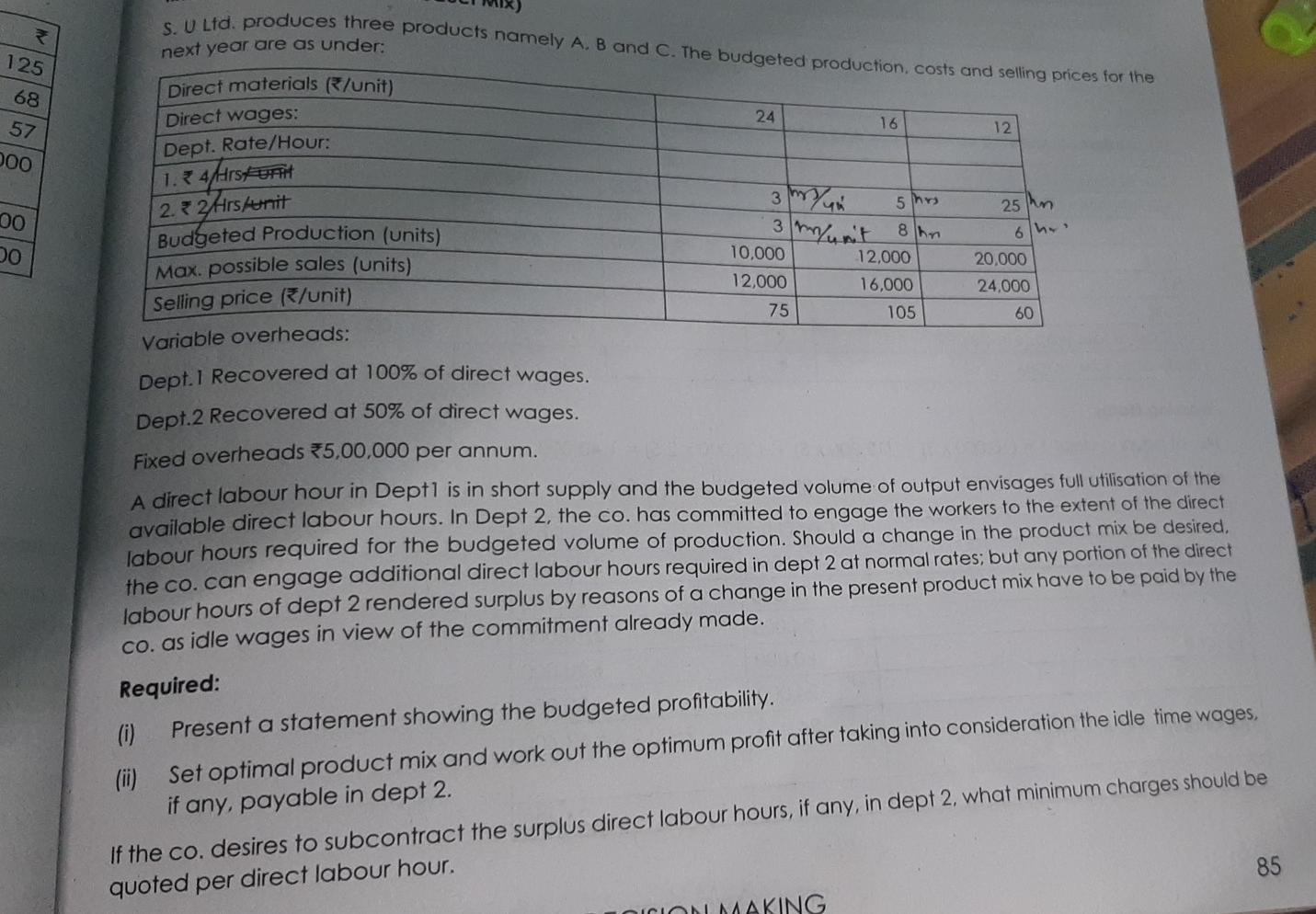

Need only correct no wrong one please SU Lid. produces three products namely A. B and C. The budgeted production, costs and selling prices for

Need only correct no wrong one please

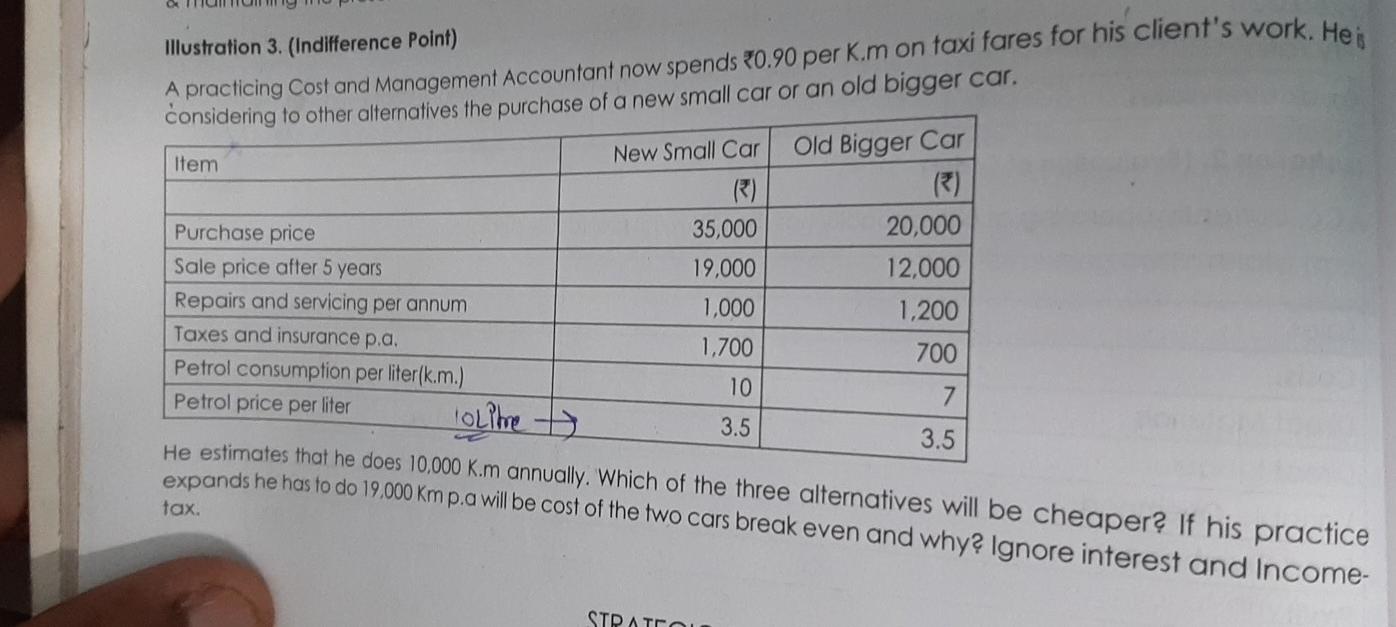

SU Lid. produces three products namely A. B and C. The budgeted production, costs and selling prices for the 125 68 24 57 12. 200 5 hy 00 6 DO 3 m/u 3 m/unit 10,000 12,000 75 105 60 next year are as under: Direct materials /unit) Direct wages: Dept. Rate/Hour: 16 1.4Hrsurit 2.2 Hrs unit 25 Budgeted Production (units) 8 h Max. possible sales (units) 12,000 20,000 Selling price f/unit) 16,000 24,000 Variable overheads: Dept. 1 Recovered at 100% of direct wages. Dept.2 Recovered at 50% of direct wages. Fixed overheads 5,00,000 per annum. A direct labour hour in Depti is in short supply and the budgeted volume of output envisages full utilisation of the available direct labour hours. In Dept 2, the co. has committed to engage the workers to the extent of the direct labour hours required for the budgeted volume of production. Should a change in the product mix be desired. the co. can engage additional direct labour hours required in dept 2 at normal rates; but any portion of the direct labour hours of dept 2 rendered surplus by reasons of a change in the present product mix have to be paid by the co. as idle wages in view of the commitment already made. Required: (i) Present a statement showing the budgeted profitability. Set optimal product mix and work out the optimum profit after taking into consideration the idle time wages, if any, payable in dept 2. If the co. desires to subcontract the surplus direct labour hours, if any, in dept 2, what minimum charges should be quoted per direct labour hour. 85 OCION MAKING Illustration 3. (Indifference Point) A practicing Cost and Management Accountant now spends 20.90 per K.m on taxi fares for his client's work. Hei considering to other alternatives the purchase of a new small car or an old bigger car. New Small Car Old Bigger Car Item (3) 35,000 20,000 Purchase price Sale price after 5 years 19,000 12,000 Repairs and servicing per annum 1,000 1.200 Taxes and insurance p.a. 1.700 700 Petrol consumption per liter(k.m.) 10 7 Petrol price per liter lolitre t 3.5 3.5 He estimates that he does 10,000 K.m annually. Which of the three alternatives will be cheaper? If his practice expands he has to do 19.000 Km p.a will be cost of the two cars break even and why? Ignore interest and Income- tax. STRATO : SU Lid. produces three products namely A. B and C. The budgeted production, costs and selling prices for the 125 68 24 57 12. 200 5 hy 00 6 DO 3 m/u 3 m/unit 10,000 12,000 75 105 60 next year are as under: Direct materials /unit) Direct wages: Dept. Rate/Hour: 16 1.4Hrsurit 2.2 Hrs unit 25 Budgeted Production (units) 8 h Max. possible sales (units) 12,000 20,000 Selling price f/unit) 16,000 24,000 Variable overheads: Dept. 1 Recovered at 100% of direct wages. Dept.2 Recovered at 50% of direct wages. Fixed overheads 5,00,000 per annum. A direct labour hour in Depti is in short supply and the budgeted volume of output envisages full utilisation of the available direct labour hours. In Dept 2, the co. has committed to engage the workers to the extent of the direct labour hours required for the budgeted volume of production. Should a change in the product mix be desired. the co. can engage additional direct labour hours required in dept 2 at normal rates; but any portion of the direct labour hours of dept 2 rendered surplus by reasons of a change in the present product mix have to be paid by the co. as idle wages in view of the commitment already made. Required: (i) Present a statement showing the budgeted profitability. Set optimal product mix and work out the optimum profit after taking into consideration the idle time wages, if any, payable in dept 2. If the co. desires to subcontract the surplus direct labour hours, if any, in dept 2, what minimum charges should be quoted per direct labour hour. 85 OCION MAKING Illustration 3. (Indifference Point) A practicing Cost and Management Accountant now spends 20.90 per K.m on taxi fares for his client's work. Hei considering to other alternatives the purchase of a new small car or an old bigger car. New Small Car Old Bigger Car Item (3) 35,000 20,000 Purchase price Sale price after 5 years 19,000 12,000 Repairs and servicing per annum 1,000 1.200 Taxes and insurance p.a. 1.700 700 Petrol consumption per liter(k.m.) 10 7 Petrol price per liter lolitre t 3.5 3.5 He estimates that he does 10,000 K.m annually. Which of the three alternatives will be cheaper? If his practice expands he has to do 19.000 Km p.a will be cost of the two cars break even and why? Ignore interest and Income- tax. STRATO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started