Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need part C OUT Check my work 1 OOK TI You are considering an option to purchase or rent a single residential property. You can

need part C

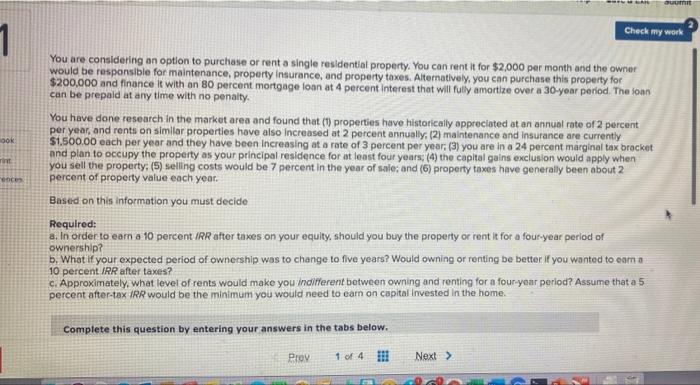

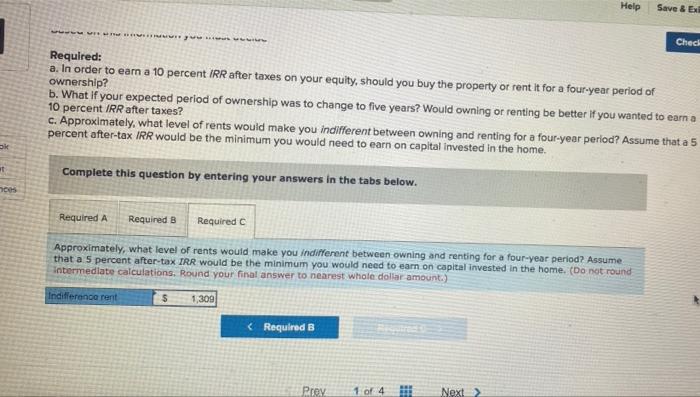

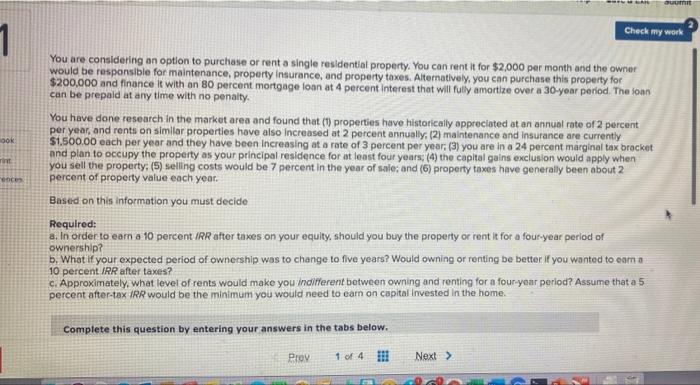

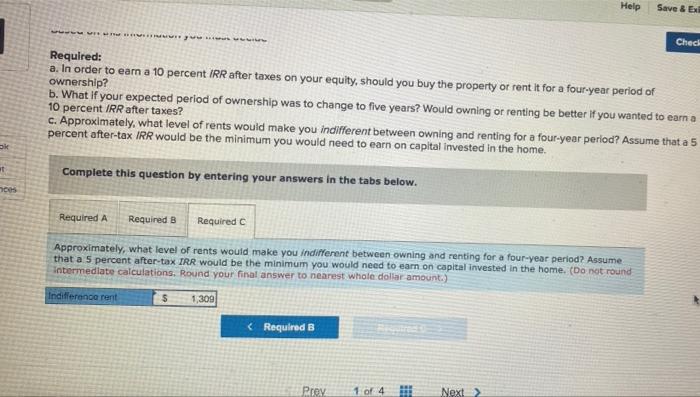

OUT Check my work 1 OOK TI You are considering an option to purchase or rent a single residential property. You can rent it for $2,000 per month and the owner would be responsible for maintenance, property Insurance, and property taxes. Alternatively, you can purchase this property for $200,000 and finance it with on 80 percent mortgage loan at 4 percent interest that will fully amortize over a 30-year period. The loan can be prepald at any time with no penalty. You have done research in the market area and found that (t) properties have historically appreciated at an annual rate of 2 percent per year, and rents on similar properties have also increased at 2 percent annually, (2) maintenance and Insurance are currently $1,500.00 each per year and they have been increasing at a rate of 3 percent per year: (3) you are in a 24 percent marginal tax bracket and plan to occupy the property as your principal residence for at least four years: (4) the capital gains exclusion would apply when you sell the property, (5) selling costs would be 7 percent in the year of sele; and (6) property taxes have generally been about 2 percent of property value each year. Based on this information you must decide Required: a. In order to earn a 10 percent IRR after taxes on your equity, should you buy the property or rent it for a four-year period of ownership? b. What if your expected period of ownership was to change to five years? Would owning or renting be better if you wanted to com a 10 percent IRR after taxes? c. Approximately, what level of rents would make you indifferent between owning and renting for a four-year period? Assume that a 5 percent after-tax IRR would be the minimum you would need to earn on capital invested in the home. Complete this question by entering your answers in the tabs below. Proy 1 of 4 !!! Next > Help Save & EX Ched Required: a. In order to earn a 10 percent IRR after taxes on your equity, should you buy the property or rent it for a four-year period of ownership? b. What if your expected period of ownership was to change to five years? Would owning or renting be better if you wanted to earn a 10 percent IRR after taxes? c. Approximately, what level of rents would make you indifferent between owning and renting for a four-year period? Assume that a 5 percent after-tax IRR would be the minimum you would need to earn on capital invested in the home. Complete this question by entering your answers in the tabs below. ces Required A Required B Required Approximately, what level of rents would make you indifferent between owning and renting for a four-year period? Assume that a 5 percent after-tax IRR would be the minimum you would need to earn on capital invested in the home. (Do not round Intermediate calculations. Round your final answer to nearest whole dollar amount.) Indifference rent $ 1,309 OUT Check my work 1 OOK TI You are considering an option to purchase or rent a single residential property. You can rent it for $2,000 per month and the owner would be responsible for maintenance, property Insurance, and property taxes. Alternatively, you can purchase this property for $200,000 and finance it with on 80 percent mortgage loan at 4 percent interest that will fully amortize over a 30-year period. The loan can be prepald at any time with no penalty. You have done research in the market area and found that (t) properties have historically appreciated at an annual rate of 2 percent per year, and rents on similar properties have also increased at 2 percent annually, (2) maintenance and Insurance are currently $1,500.00 each per year and they have been increasing at a rate of 3 percent per year: (3) you are in a 24 percent marginal tax bracket and plan to occupy the property as your principal residence for at least four years: (4) the capital gains exclusion would apply when you sell the property, (5) selling costs would be 7 percent in the year of sele; and (6) property taxes have generally been about 2 percent of property value each year. Based on this information you must decide Required: a. In order to earn a 10 percent IRR after taxes on your equity, should you buy the property or rent it for a four-year period of ownership? b. What if your expected period of ownership was to change to five years? Would owning or renting be better if you wanted to com a 10 percent IRR after taxes? c. Approximately, what level of rents would make you indifferent between owning and renting for a four-year period? Assume that a 5 percent after-tax IRR would be the minimum you would need to earn on capital invested in the home. Complete this question by entering your answers in the tabs below. Proy 1 of 4 !!! Next > Help Save & EX Ched Required: a. In order to earn a 10 percent IRR after taxes on your equity, should you buy the property or rent it for a four-year period of ownership? b. What if your expected period of ownership was to change to five years? Would owning or renting be better if you wanted to earn a 10 percent IRR after taxes? c. Approximately, what level of rents would make you indifferent between owning and renting for a four-year period? Assume that a 5 percent after-tax IRR would be the minimum you would need to earn on capital invested in the home. Complete this question by entering your answers in the tabs below. ces Required A Required B Required Approximately, what level of rents would make you indifferent between owning and renting for a four-year period? Assume that a 5 percent after-tax IRR would be the minimum you would need to earn on capital invested in the home. (Do not round Intermediate calculations. Round your final answer to nearest whole dollar amount.) Indifference rent $ 1,309

OUT Check my work 1 OOK TI You are considering an option to purchase or rent a single residential property. You can rent it for $2,000 per month and the owner would be responsible for maintenance, property Insurance, and property taxes. Alternatively, you can purchase this property for $200,000 and finance it with on 80 percent mortgage loan at 4 percent interest that will fully amortize over a 30-year period. The loan can be prepald at any time with no penalty. You have done research in the market area and found that (t) properties have historically appreciated at an annual rate of 2 percent per year, and rents on similar properties have also increased at 2 percent annually, (2) maintenance and Insurance are currently $1,500.00 each per year and they have been increasing at a rate of 3 percent per year: (3) you are in a 24 percent marginal tax bracket and plan to occupy the property as your principal residence for at least four years: (4) the capital gains exclusion would apply when you sell the property, (5) selling costs would be 7 percent in the year of sele; and (6) property taxes have generally been about 2 percent of property value each year. Based on this information you must decide Required: a. In order to earn a 10 percent IRR after taxes on your equity, should you buy the property or rent it for a four-year period of ownership? b. What if your expected period of ownership was to change to five years? Would owning or renting be better if you wanted to com a 10 percent IRR after taxes? c. Approximately, what level of rents would make you indifferent between owning and renting for a four-year period? Assume that a 5 percent after-tax IRR would be the minimum you would need to earn on capital invested in the home. Complete this question by entering your answers in the tabs below. Proy 1 of 4 !!! Next > Help Save & EX Ched Required: a. In order to earn a 10 percent IRR after taxes on your equity, should you buy the property or rent it for a four-year period of ownership? b. What if your expected period of ownership was to change to five years? Would owning or renting be better if you wanted to earn a 10 percent IRR after taxes? c. Approximately, what level of rents would make you indifferent between owning and renting for a four-year period? Assume that a 5 percent after-tax IRR would be the minimum you would need to earn on capital invested in the home. Complete this question by entering your answers in the tabs below. ces Required A Required B Required Approximately, what level of rents would make you indifferent between owning and renting for a four-year period? Assume that a 5 percent after-tax IRR would be the minimum you would need to earn on capital invested in the home. (Do not round Intermediate calculations. Round your final answer to nearest whole dollar amount.) Indifference rent $ 1,309 OUT Check my work 1 OOK TI You are considering an option to purchase or rent a single residential property. You can rent it for $2,000 per month and the owner would be responsible for maintenance, property Insurance, and property taxes. Alternatively, you can purchase this property for $200,000 and finance it with on 80 percent mortgage loan at 4 percent interest that will fully amortize over a 30-year period. The loan can be prepald at any time with no penalty. You have done research in the market area and found that (t) properties have historically appreciated at an annual rate of 2 percent per year, and rents on similar properties have also increased at 2 percent annually, (2) maintenance and Insurance are currently $1,500.00 each per year and they have been increasing at a rate of 3 percent per year: (3) you are in a 24 percent marginal tax bracket and plan to occupy the property as your principal residence for at least four years: (4) the capital gains exclusion would apply when you sell the property, (5) selling costs would be 7 percent in the year of sele; and (6) property taxes have generally been about 2 percent of property value each year. Based on this information you must decide Required: a. In order to earn a 10 percent IRR after taxes on your equity, should you buy the property or rent it for a four-year period of ownership? b. What if your expected period of ownership was to change to five years? Would owning or renting be better if you wanted to com a 10 percent IRR after taxes? c. Approximately, what level of rents would make you indifferent between owning and renting for a four-year period? Assume that a 5 percent after-tax IRR would be the minimum you would need to earn on capital invested in the home. Complete this question by entering your answers in the tabs below. Proy 1 of 4 !!! Next > Help Save & EX Ched Required: a. In order to earn a 10 percent IRR after taxes on your equity, should you buy the property or rent it for a four-year period of ownership? b. What if your expected period of ownership was to change to five years? Would owning or renting be better if you wanted to earn a 10 percent IRR after taxes? c. Approximately, what level of rents would make you indifferent between owning and renting for a four-year period? Assume that a 5 percent after-tax IRR would be the minimum you would need to earn on capital invested in the home. Complete this question by entering your answers in the tabs below. ces Required A Required B Required Approximately, what level of rents would make you indifferent between owning and renting for a four-year period? Assume that a 5 percent after-tax IRR would be the minimum you would need to earn on capital invested in the home. (Do not round Intermediate calculations. Round your final answer to nearest whole dollar amount.) Indifference rent $ 1,309

need part C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started