Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need please with #2 please. = Homework: Exercise 11-21 & 22 Question 2, E12-22 (book/static) HW Score: 70%, 1.4 of 2 points Points: 0.4 of

need please with #2 please.

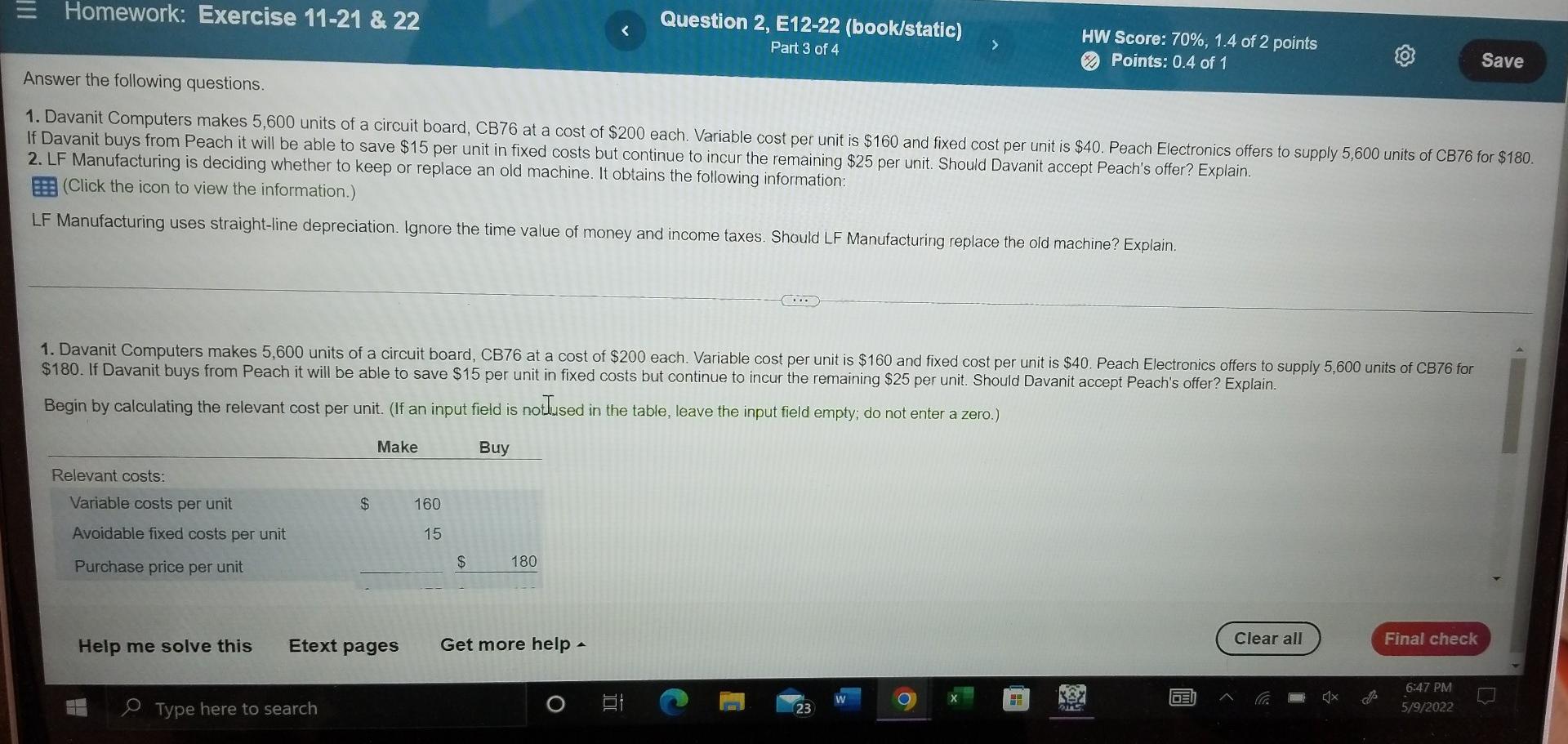

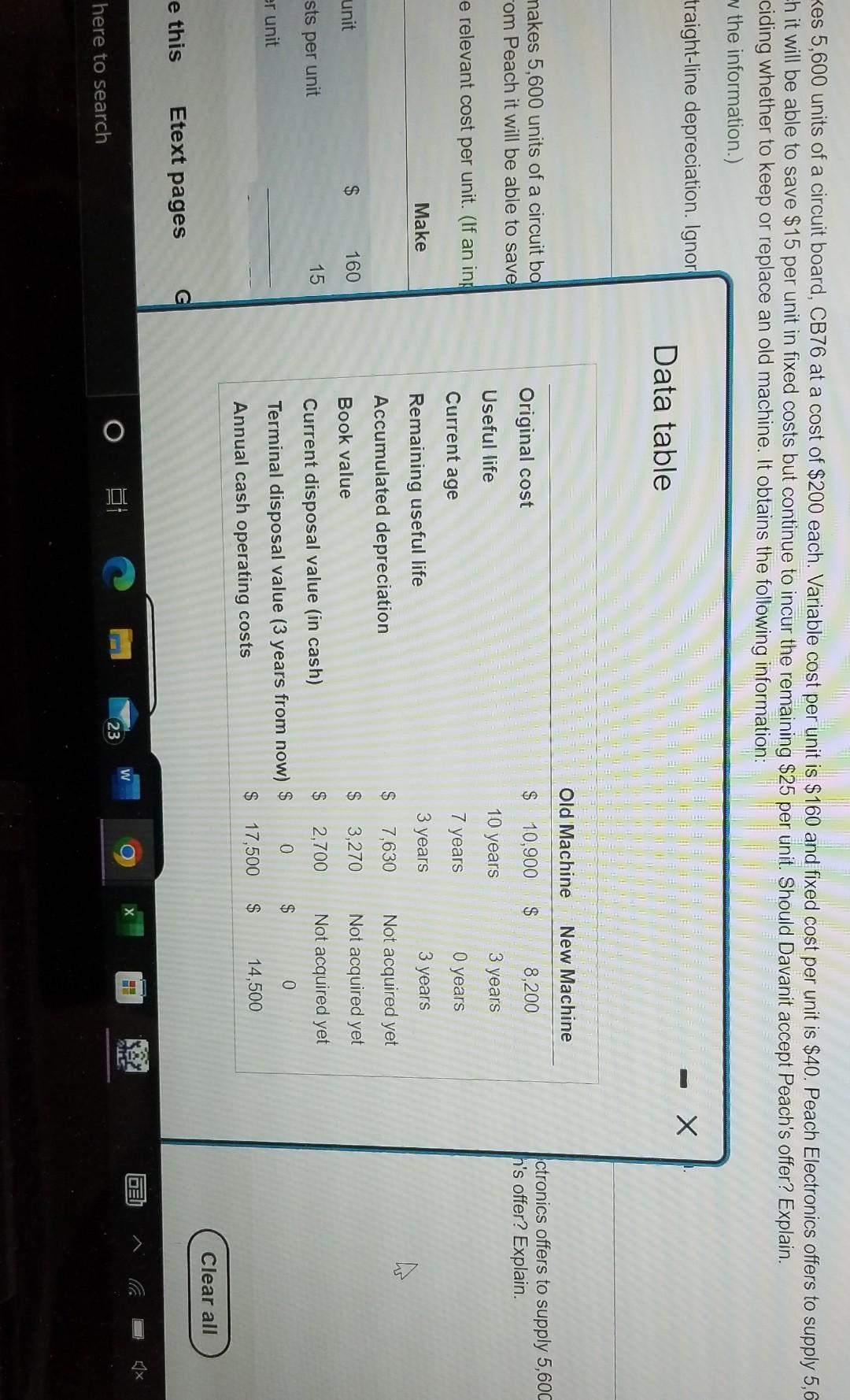

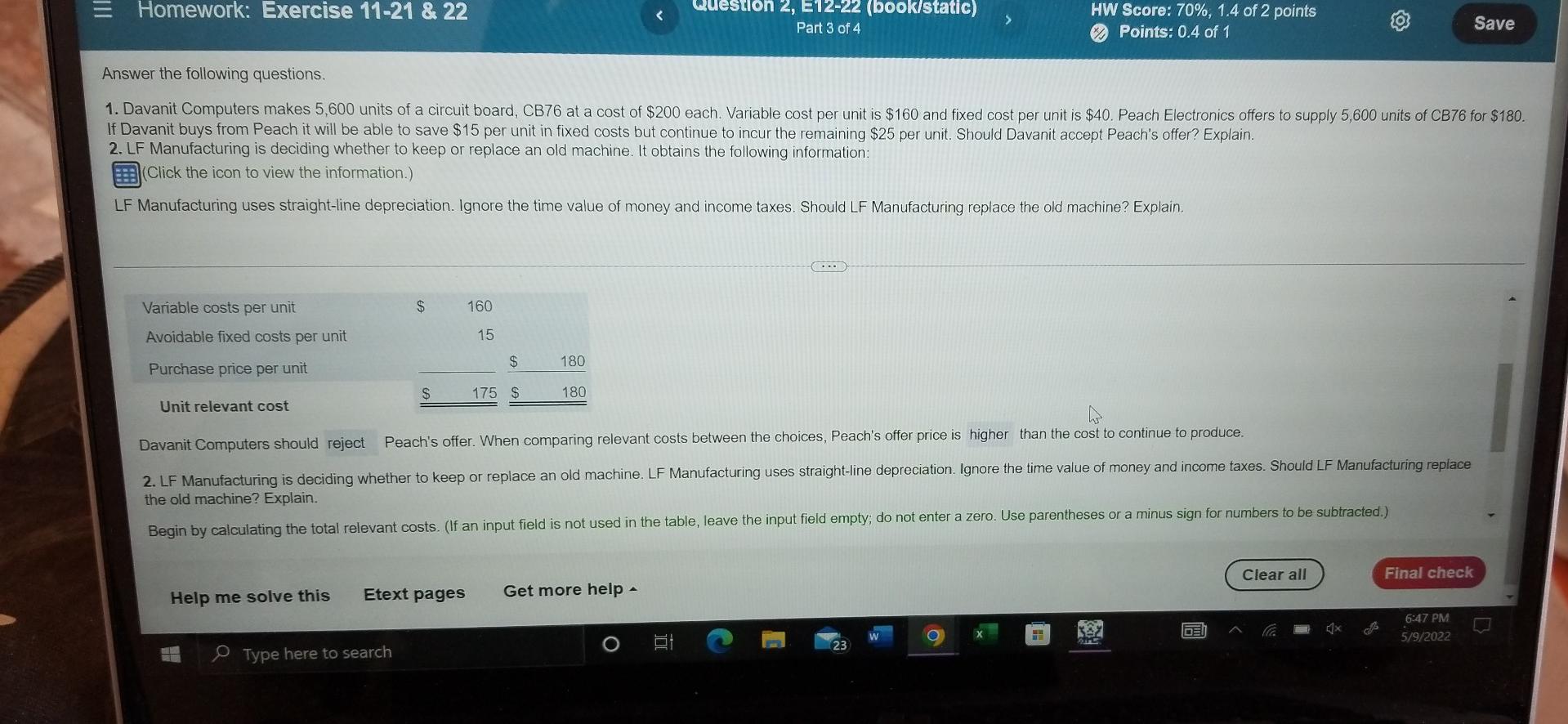

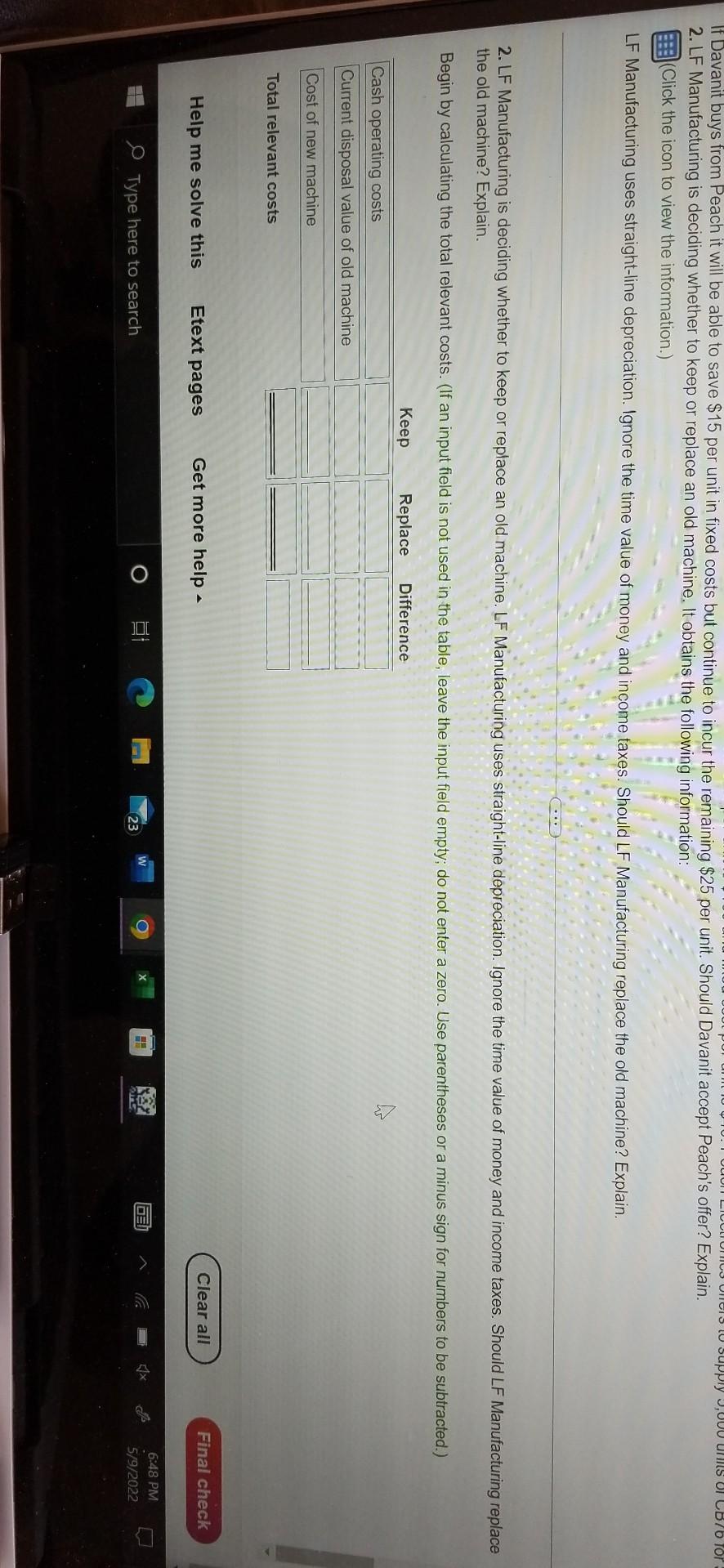

= Homework: Exercise 11-21 & 22 Question 2, E12-22 (book/static) HW Score: 70%, 1.4 of 2 points Points: 0.4 of 1 Save Answer the following questions. 1. Davanit Computers makes 5,600 units of a circuit board, CB76 at a cost of $200 each. Variable cost per unit is $160 and fixed cost per unit is $40. Peach Electronics offers to supply 5,600 units of CB76 for $180. If Davanit buys from Peach it will be able to save $15 per unit in fixed costs but continue to incur the remaining $25 per unit. Should Davanit accept Peach's offer? Explain. 2. LF Manufacturing is deciding whether to keep or replace an old machine. It obtains the following information: B (Click the icon to view the information.) LF Manufacturing uses straight-line depreciation. Ignore the time value of money and income taxes. Should LF Manufacturing replace the old machine? Explain. 1. Davanit Computers makes 5,600 units of a circuit board, CB76 at a cost of $200 each. Variable cost per unit is $160 and fixed cost per unit is $40. Peach Electronics offers to supply 5,600 units of CB76 for $180. If Davanit buys from Peach it will be able to save $15 per unit in fixed costs but continue to incur the remaining $25 per unit. Should Davanit accept Peach's offer? Explain. Begin by calculating the relevant cost per unit. (If an input field is notlused in the table, leave the input field empty; do not enter a zero.) Make Buy Relevant costs: Variable costs per unit Avoidable fixed costs per unit $ 160 15 Purchase price per unit $ 180 Clear all Help me solve this Etext pages Get more help Final check W O g gi HE O Type here to search DEU 6:47 PM 5/9/2022 23 kes 5,600 units of a circuit board, CB76 at a cost of $200 each. Variable cost per unit is $160 and fixed cost per unit is $40. Peach Electronics offers to supply 5,6 =h it will be able to save $15 per unit in fixed costs but continue to incur the remaining $25 per unit. Should Davanit accept Peach's offer? Explain. ciding whether to keep or replace an old machine. It obtains the following information: v the information.) traight-line depreciation. Ignor Data table Old Machine New Machine makes 5,600 units of a circuit bo om Peach it will be able to save $ $ 10,900 Original cost 8,200 ctronics offers to supply 5,60C h's offer? Explain. Useful life 10 years 3 years e relevant cost per unit. (If an in Current age 7 years O years Make 3 years 3 years Remaining useful life Accumulated depreciation 2 7,630 unit $ 160 Book value 3,270 $ $ Not acquired yet Not acquired yet Not acquired yet 15 sts per unit 2,700 0 $ 0 er unit Current disposal value (in cash) $ Terminal disposal value (3 years from now) $ Annual cash operating costs $ 17,500 $ 14,500 Clear all e this Etext pages >> O EL 23 here to search = Homework: Exercise 11-21 & 22 Question 2, E12-22 (book/static) Part 3 of 4 HW Score: 70%, 1.4 of 2 points Points: 0,4 of 1 Save Answer the following questions. 1. Davanit Computers makes 5,600 units of a circuit board, CB76 at a cost of $200 each. Variable cost per unit is $160 and fixed cost per unit is $40. Peach Electronics offers to supply 5,600 units of CB76 for $180. If Davanit buys from Peach it will be able to save $15 per unit in fixed costs but continue to incur the remaining $25 per unit. Should Davanit accept Peach's offer? Explain. 2. LF Manufacturing is deciding whether to keep or replace an old machine. It obtains the following information: 3 Click the icon to view the information.) LF Manufacturing uses straight-line depreciation. Ignore the time value of money and income taxes. Should LF Manufacturing replace the old machine? Explain $ 160 Variable costs per unit Avoidable fixed costs per unit 15 $ 180 Purchase price per unit $ 175 $ 180 Unit relevant cost Davanit Computers should reject Peach's offer. When comparing relevant costs between the choices, Peach's offer price is higher than the cost to continue to produce. 2. LF Manufacturing is deciding whether to keep or replace an old machine. LF Manufacturing uses straight-line depreciation. Ignore the time value of money and income taxes. Should LF Manufacturing replace the old machine? Explain. Begin by calculating the total relevant costs. (If an input field is not used in the table, leave the input field empty; do not enter a zero. Use parentheses or a minus sign for numbers to be subtracted.) Clear all Final check Help me solve this Etext pages Get more help DEN x 6:47 PM 5/9/2022 23 O Type here to search UNCI SU Supply JUUU UINS OF CB75 TOT If Davanit buys from Peach it will be able to save $15 per unit in fixed costs but continue to incur the remaining $25 per unit. Should Davanit accept Peach's offer? Explain. 2. LF Manufacturing is deciding whether to keep or replace an old machine. It obtains the following information: (Click the icon to view the information.) LF Manufacturing uses straight-line depreciation. Ignore the time value of money and income taxes. Should LF Manufacturing replace the old machine? Explain. ... 2. LF Manufacturing is deciding whether to keep or replace an old machine. LF Manufacturing uses straight-line depreciation. Ignore the time value of money and income taxes. Should LF Manufacturing replace the old machine? Explain. Begin by calculating the total relevant costs. (If an input field is not used in the table, leave the input field empty; do not enter a zero. Use parentheses or a minus sign for numbers to be subtracted.) Keep Replace Difference Cash operating costs Current disposal value of old machine Cost of new machine Total relevant costs Etext pages Clear all Get more help Help me solve this Final check W O E DEI O Type here to search g 6:48 PM 5/9/2022 23Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started