Need question 3 and 4 please.

Thanks!

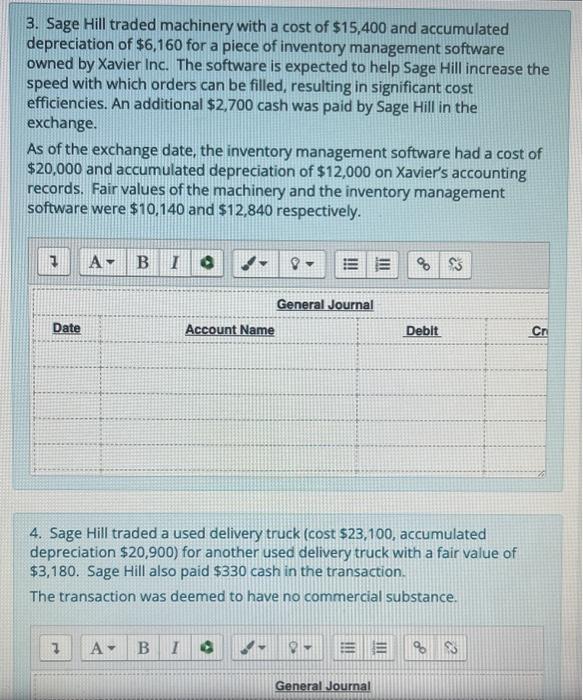

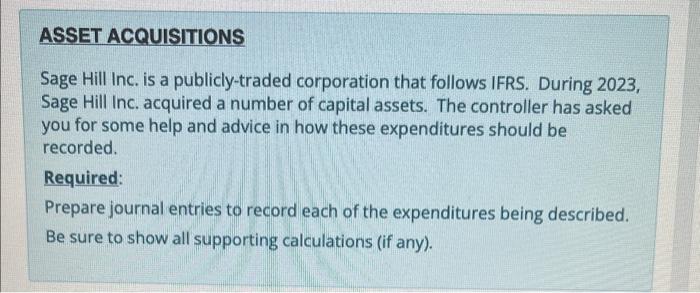

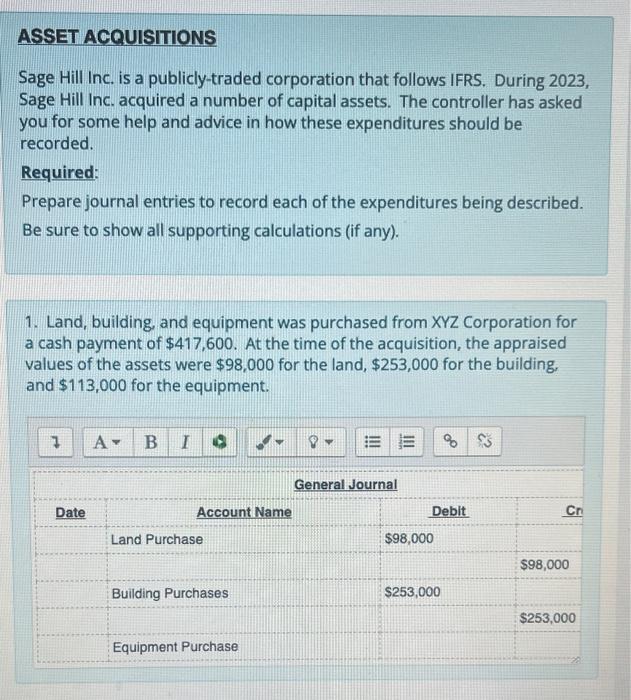

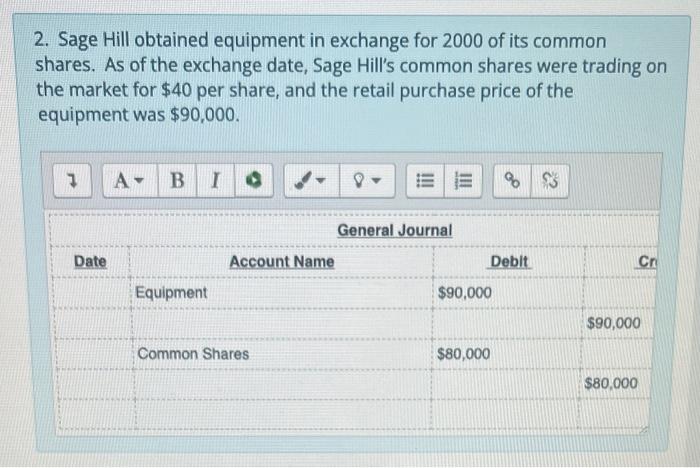

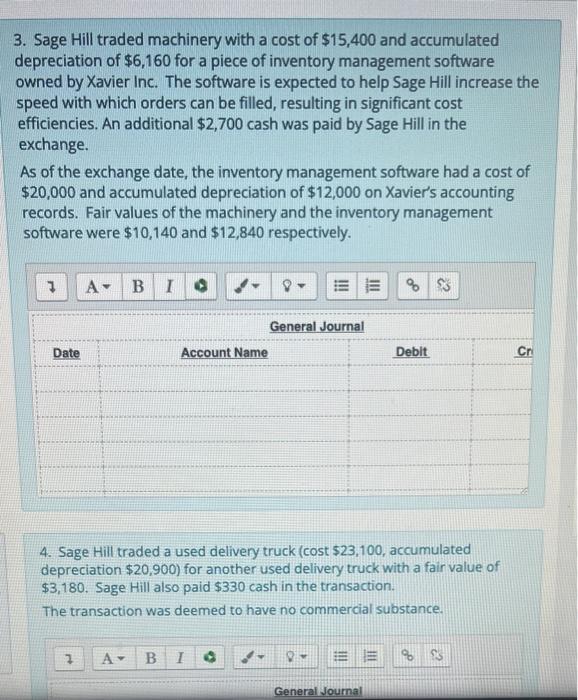

3. Sage Hill traded machinery with a cost of $15,400 and accumulated depreciation of $6,160 for a piece of inventory management software owned by Xavier Inc. The software is expected to help Sage Hill increase the speed with which orders can be filled, resulting in significant cost efficiencies. An additional $2,700 cash was paid by Sage Hill in the exchange. As of the exchange date, the inventory management software had a cost of $20,000 and accumulated depreciation of $12,000 on Xavier's accounting records. Fair values of the machinery and the inventory management software were $10,140 and $12,840 respectively. 4. Sage Hill traded a used delivery truck (cost $23,100, accumulated depreciation $20,900 ) for another used delivery truck with a fair value of $3,180. Sage Hill also paid $330 cash in the transaction. The transaction was deemed to have no commercial substance. ASSET ACQUISITIONS Sage Hill Inc. is a publicly-traded corporation that follows IFRS. During 2023, Sage Hill Inc. acquired a number of capital assets. The controller has asked you for some help and advice in how these expenditures should be recorded. Required: Prepare journal entries to record each of the expenditures being described. Be sure to show all supporting calculations (if any). ASSET ACQUISITIONS Sage Hill Inc. is a publicly-traded corporation that follows IFRS. During 2023, Sage Hill Inc. acquired a number of capital assets. The controller has asked you for some help and advice in how these expenditures should be recorded. Required: Prepare journal entries to record each of the expenditures being described. Be sure to show all supporting calculations (if any). 1. Land, building, and equipment was purchased from XYZ Corporation for a cash payment of $417,600. At the time of the acquisition, the appraised values of the assets were $98,000 for the land, $253,000 for the building, and $113,000 for the equipment. 2. Sage Hill obtained equipment in exchange for 2000 of its common shares. As of the exchange date, Sage Hill's common shares were trading on the market for $40 per share, and the retail purchase price of the equipment was $90,000. 3. Sage Hill traded machinery with a cost of $15,400 and accumulated depreciation of $6,160 for a piece of inventory management software owned by Xavier Inc. The software is expected to help Sage Hill increase the speed with which orders can be filled, resulting in significant cost efficiencies. An additional $2,700 cash was paid by Sage Hill in the exchange. As of the exchange date, the inventory management software had a cost of $20,000 and accumulated depreciation of $12,000 on Xavier's accounting records. Fair values of the machinery and the inventory management software were $10,140 and $12,840 respectively. 4. Sage Hill traded a used delivery truck (cost $23,100, accumulated depreciation $20,900 ) for another used delivery truck with a fair value of $3,180. Sage Hill also paid $330 cash in the transaction. The transaction was deemed to have no commercial substance