Answered step by step

Verified Expert Solution

Question

1 Approved Answer

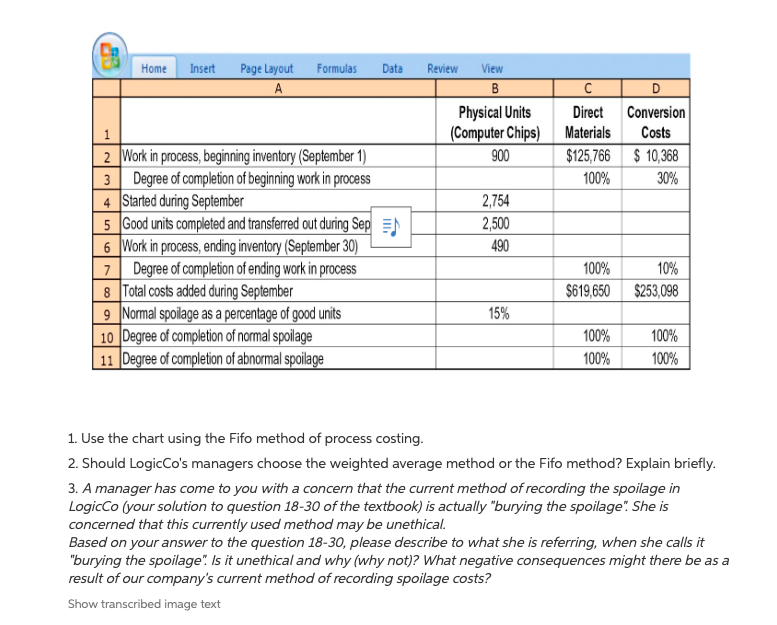

Need question 3 answered. Home Insert Page Layout Formulas Data Review View C Physical Units (Computer Chips) Direct Materials $125,766 100% D Conversion Costs $10,368

Need question 3 answered.

Home Insert Page Layout Formulas Data Review View C Physical Units (Computer Chips) Direct Materials $125,766 100% D Conversion Costs $10,368 30% 900 2,754 2,500 490 2 Work in process, beginning inventory (September 1) Degree of completion of beginning work in process 4 Started during September 5 Good units completed and transferred out during Sep 6 Work in process, ending inventory (September 30) 7 Degree of completion of ending work in process 8 Total costs added during September 9 Normal spoilage as a percentage of good units 10 Degree of completion of normal spoilage 11 Degree of completion of abnormal spoilage 100% 10% $253,098 $619,650 15% 100% 100% 100% 100% 1. Use the chart using the Fifo method of process costing. 2. Should LogicCo's managers choose the weighted average method or the Fifo method? Explain briefly. 3. A manager has come to you with a concern that the current method of recording the spoilage in LogicCo (your solution to question 18-30 of the textbook) is actually "burying the spoilage" She is concerned that this currently used method may be unethical. Based on your answer to the question 18-30, please describe to what she is referring, when she calls it "burying the spoilage" Is it unethical and why (why not)? What negative consequences might there be as a result of our company's current method of recording spoilage costs? Show transcribed image text Home Insert Page Layout Formulas Data Review View C Physical Units (Computer Chips) Direct Materials $125,766 100% D Conversion Costs $10,368 30% 900 2,754 2,500 490 2 Work in process, beginning inventory (September 1) Degree of completion of beginning work in process 4 Started during September 5 Good units completed and transferred out during Sep 6 Work in process, ending inventory (September 30) 7 Degree of completion of ending work in process 8 Total costs added during September 9 Normal spoilage as a percentage of good units 10 Degree of completion of normal spoilage 11 Degree of completion of abnormal spoilage 100% 10% $253,098 $619,650 15% 100% 100% 100% 100% 1. Use the chart using the Fifo method of process costing. 2. Should LogicCo's managers choose the weighted average method or the Fifo method? Explain briefly. 3. A manager has come to you with a concern that the current method of recording the spoilage in LogicCo (your solution to question 18-30 of the textbook) is actually "burying the spoilage" She is concerned that this currently used method may be unethical. Based on your answer to the question 18-30, please describe to what she is referring, when she calls it "burying the spoilage" Is it unethical and why (why not)? What negative consequences might there be as a result of our company's current method of recording spoilage costs? Show transcribed image textStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started