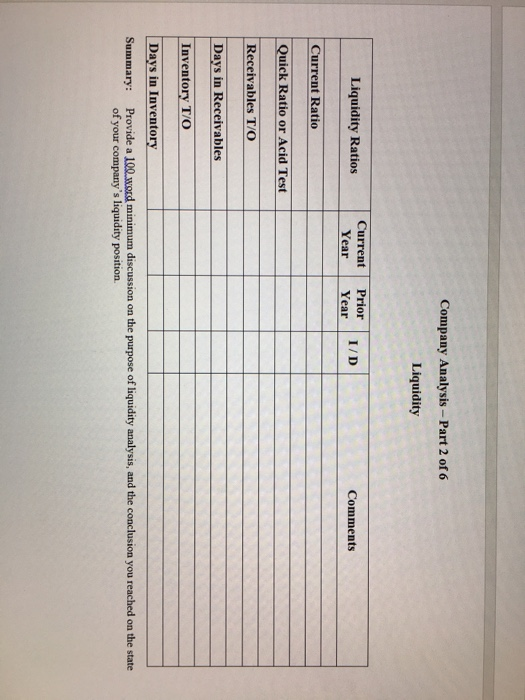

need ratios done, Cummins inc CMI. balance sheet is given

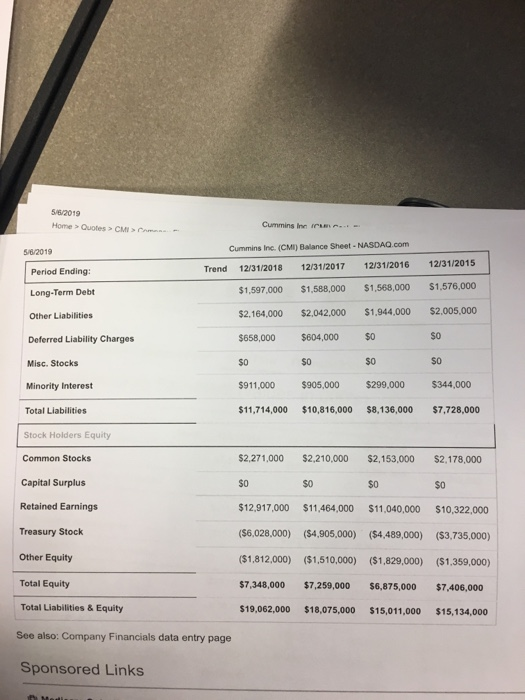

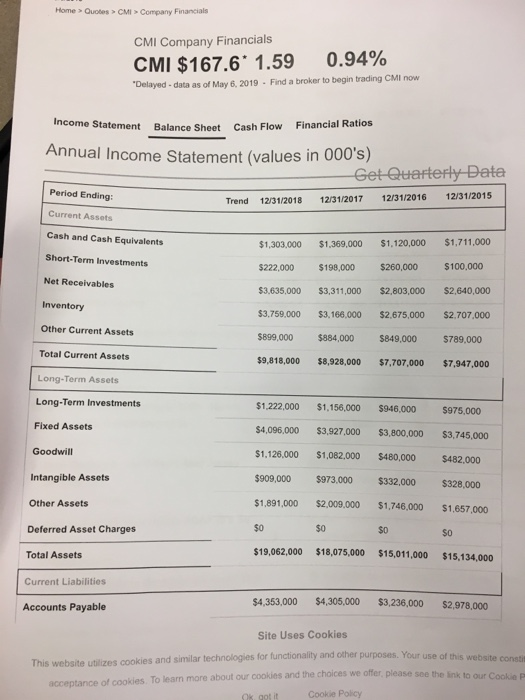

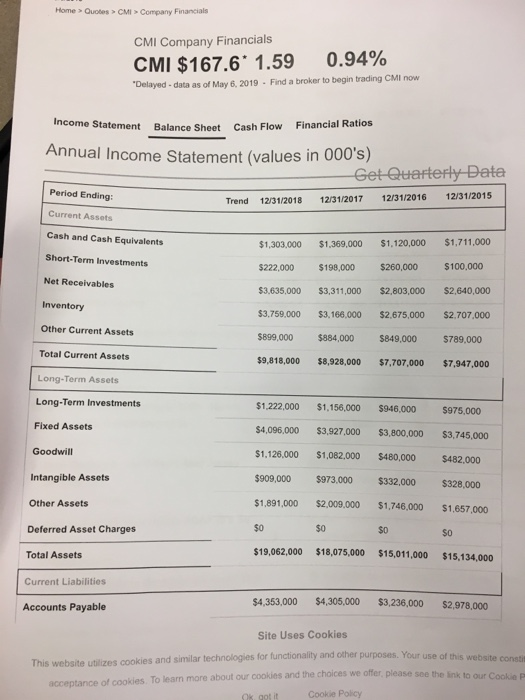

Home > Quotes CMI>Company Financials CMI Company Financials CMI $167.6. 1.59 0.94% Delayed-data as of May 6, 2019 Find a broker to begin trading CMI now Income Statement Financial Ratios Cash Flow Balance Sheet Annual Income Statement (values in 000's) Period Ending Current Assets Cash and Cash Equivalents Short-Term Investments Net Receivables Trend 12/31/2018 12/31/2017 12/31/2016 12/31/2015 $1,303,000 $1.369,000 $1,120,000 $1,711,000 $222,000 $198,000 $260,000 $100,000 $3,635,000 $3,311,000 $2,803,000 $2,640,000 $3,759,000 $3,166.000 $2.675,000 $2,707,000 $899,000 $884,000 $849,000 $789,000 $9,818,000 $8,928,000 $7,707,000 $7,947,000 Inventory Other Current Assets Total Current Assets Long-Term Assets Long-Term Investments Fixed Assets 1,222000 $1,156,000 $946,000 $975.000 $4,096,000 $3,927,000 $3,800,000 $3,745,000 $1,126,000 $1,082.000 $480,000$482.000 $909,000 $973,000 $332,000 $328,000 $1,891,000 $2,009.000 $1,746,000 $1,657,000 $0 $19,062,000 $18,075,000 $15,011,000 $15,134,000 Goodwill Intangible Assets Other Assets Deferred Asset Charges Total Assets Current Liabilities Accounts Payable $0 So So $4,353,000 $4,305,000 $3,236,000 $2,978,000 Site Uses Cookies cookies and similar technologies for functionality and other purposes. Your use of this website consti please see the link to our Cookie P acceptance of cookies. To learn mare about our cookies and the choices we offer 0% got itCookie Policy 56/2019 Cummins Inn c. Home > Quotes> CMI>Com Cummins Inc. (CMI) Balance Sheet-NASDAQ.com 8/2019 Trend 12/31/2018 12/31/2017 12/31/2016 12/31/2015 Period Ending Long-Term Debt Other Liabilities Deferred Liability Charges Misc. Stocks Minority Interest Total Liabilities $1,597,000 $1,588,000 $1,568,000 $1,576,000 $2,164,000 $2.042,000 $1,944,000 $2.005,000 $658,000 $604,000 $0 so $911,000 $905,000 $299,000 $344,000 $11,714,000 $10,816,000 $8,136,000 $7,728,000 So So So $0 Stock Holders Equity $2,271,000 $2,210,000 $2,153,000 $2.178,000 So $12,917,000 $11,464,000 $11,040,000 $10,322,000 ($6,028,000) ($4,905,000) ($4,489,000) ($3,735,000) ($1,812,000) ($1,510,000) ($1,829,000) ($1,359,000) $7,348,000 $7.259,000 $6,875,000 $7.406,000 $19,062,000 $18,075,000 $15,011,000$15,134,000 Common Stocks Capital Surplus Retained Earnings Treasury Stock Other Equity Total Equity Total Liabilities & Equity See also: Company Financials data entry page Sponsored Links $0 so $0

need ratios done, Cummins inc CMI. balance sheet is given

need ratios done, Cummins inc CMI. balance sheet is given