need requirements c,d,e

need requirements c,d,e

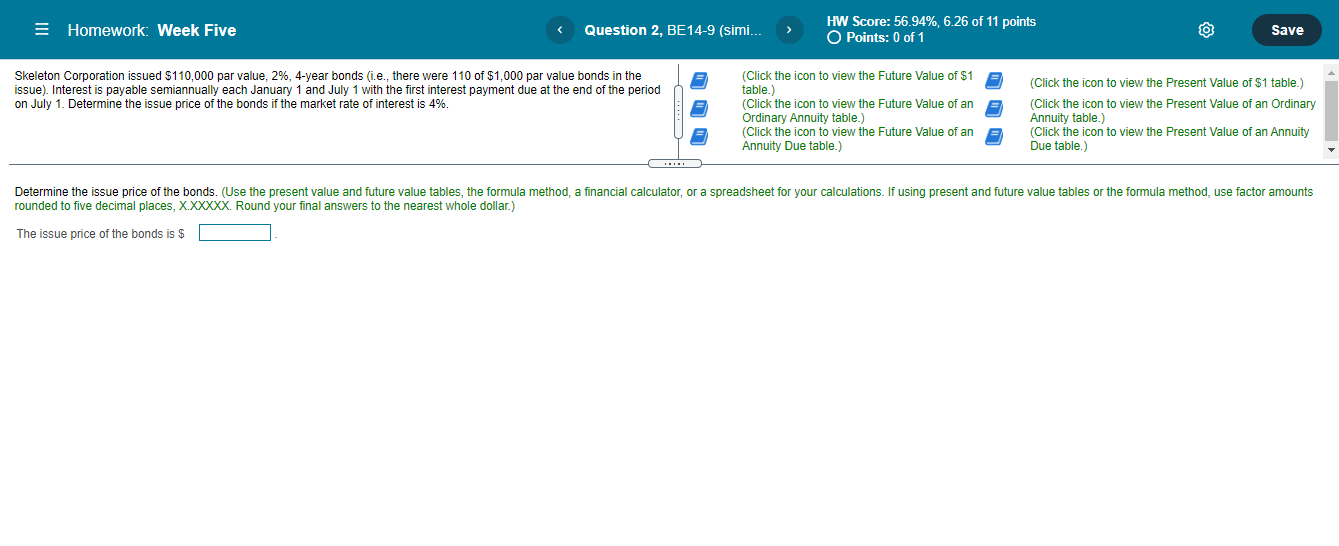

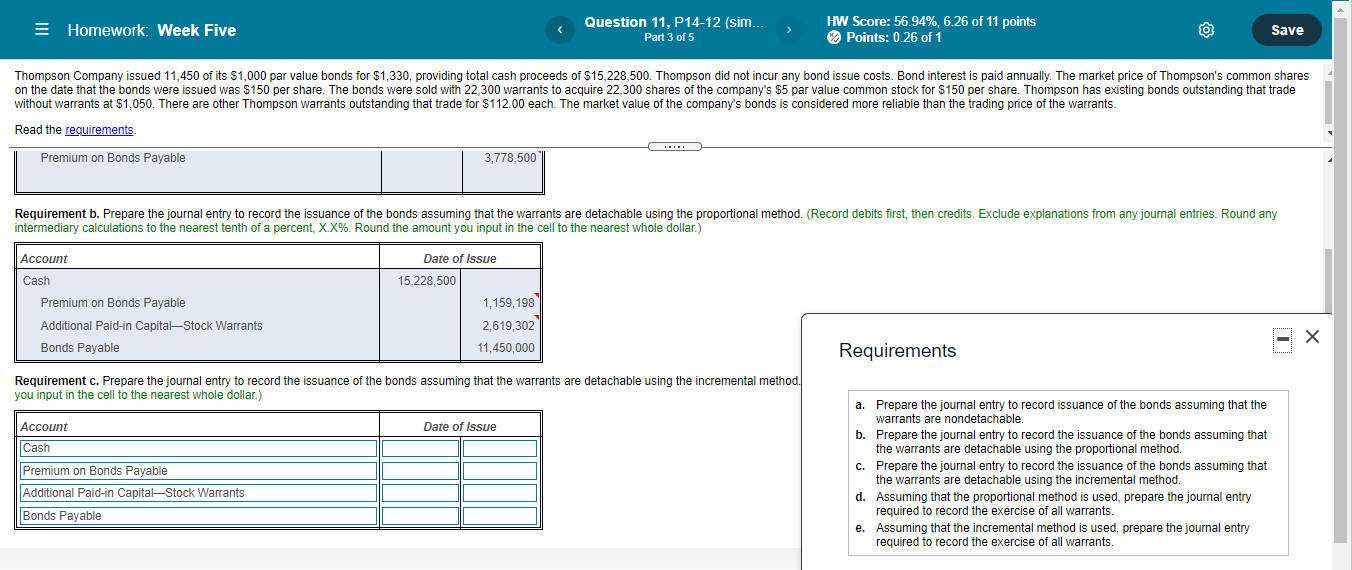

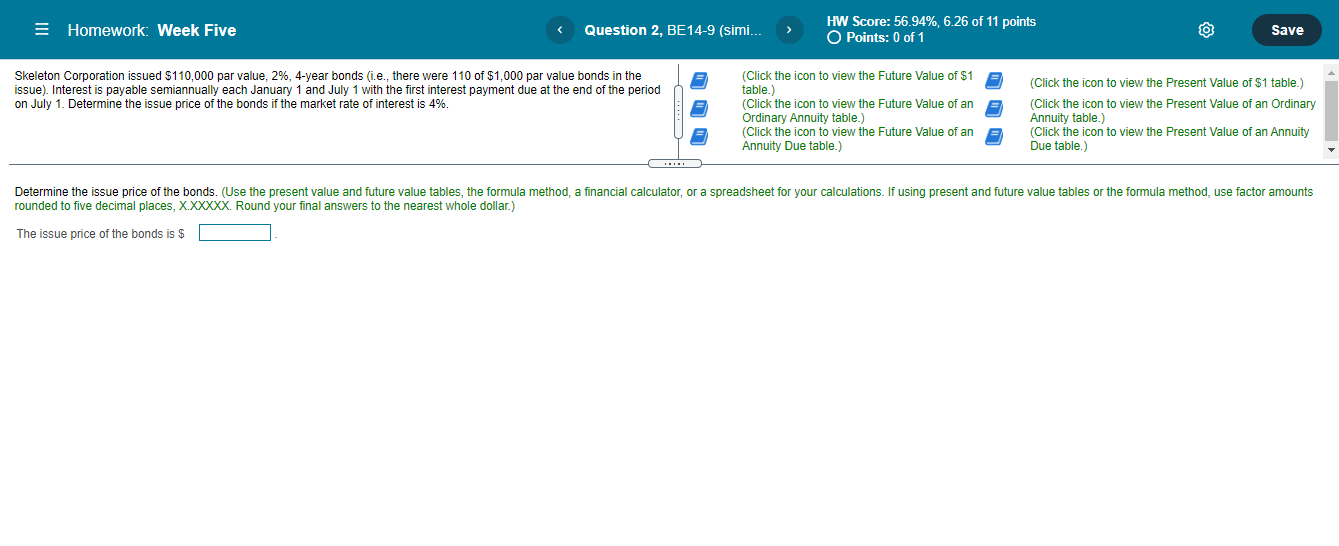

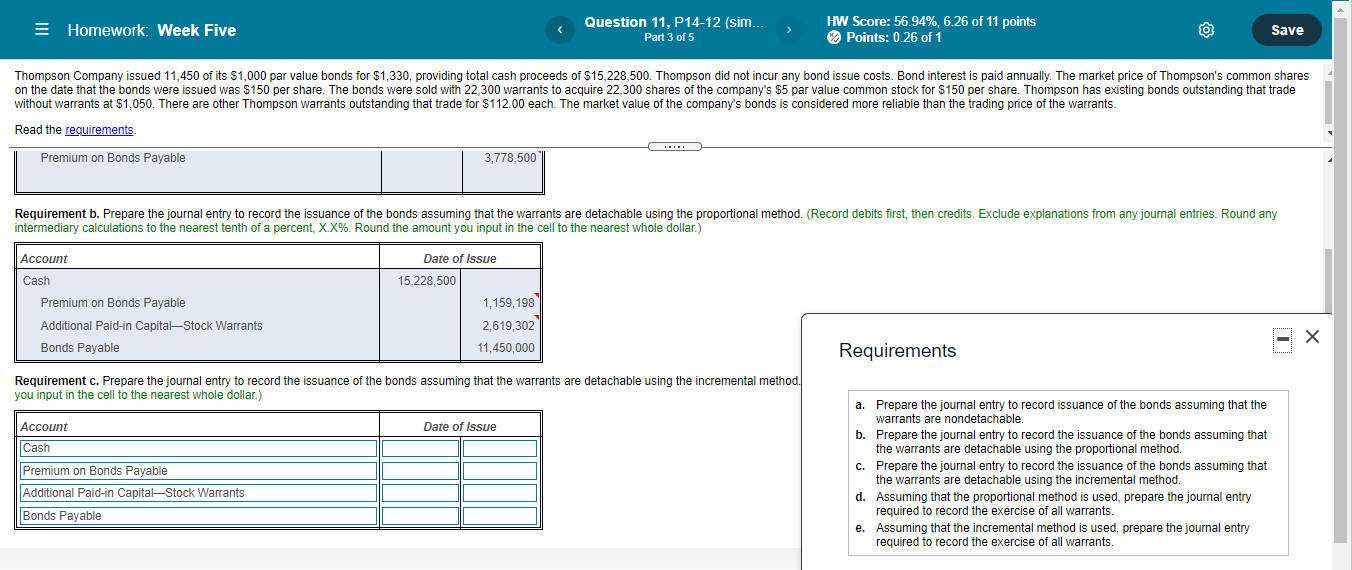

= Homework: Week Five Question 2, BE 14-9 (Simi... HW Score: 56.94%, 6.26 of 11 points O Points: 0 of 1 Save Skeleton Corporation issued $110,000 par value, 2%, 4-year bonds (i.e., there were 110 of $1,000 par value bonds in the issue). Interest is payable semiannually each January 1 and July 1 with the first interest payment due at the end of the period on July 1. Determine the issue price of the bonds if the market rate of interest is 4%. (Click the icon to view the Future Value of $1 table.) (Click the icon to view the Future Value of an Ordinary Annuity table.) (Click the icon to view the Future Value of an Annuity Due table.) (Click the icon to view the Present Value of $1 table.) (Click the icon to view the Present Value of an Ordinary Annuity table.) (Click the icon to view the Present Value of an Annuity Due table.) CHE Determine the issue price of the bonds. (Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round your final answers to the nearest whole dollar.) The issue price of the bonds is $ E Homework: Week Five Question 11, P14-12 (sim... Part 3 of 5 HW Score: 56.94%, 6.26 of 11 points Points: 0.26 of 1 Save Save Thompson Company issued 11,450 of its $1,000 par value bonds for $1,330, providing total cash proceeds of $15,228,500. Thompson did not incur any bond issue costs. Bond interest is paid annually. The market price of Thompson's common shares on the date that the bonds were issued was $150 per share. The bonds were sold with 22,300 warrants to acquire 22,300 shares of the company's $5 par value common stock for $150 per share. Thompson has existing bonds outstanding that trade without warrants at $1,050. There are other Thompson warrants outstanding that trade for $112.00 each. The market value of the company's bonds is considered more reliable than the trading price of the warrants Read the requirements ... Premium on Bonds Payable 3.778.500 Requirement b. Prepare the journal entry to record the issuance of the bonds assuming that the warrants are detachable using the proportional method. (Record debits first, then credits. Exclude explanations from any journal entries. Round any intermediary calculations to the nearest tenth of a percent, X.X%. Round the amount you input in the cell to the nearest whole dollar.) Account Cash Premium on Bonds Payable Additional Paid-in Capital-Stock Warrants Bonds Payable Date of Issue 15,228,500 1,159,198 2,619,302 11,450,000 Requirements Requirement c. Prepare the journal entry to record the issuance of the bonds assuming that the warrants are detachable using the incremental method. you input in the cell to the nearest whole dollar.) Date of Issue Account Cash Premium on Bonds Payable Additional Paid-in Capital-Stock Warrants Bonds Payable a. Prepare the journal entry to record issuance of the bonds assuming that the warrants are nondetachable. b. Prepare the journal entry to record the issuance of the bonds assuming that the warrants are detachable using the proportional method. c. Prepare the journal entry to record the issuance of the bonds assuming that the warrants are detachable using the incremental method. d. Assuming that the proportional method is used, prepare the journal entry required to record the exercise of all warrants. e. Assuming that the incremental method is used, prepare the journal entry required to record the exercise of all warrants

need requirements c,d,e

need requirements c,d,e