Answered step by step

Verified Expert Solution

Question

1 Approved Answer

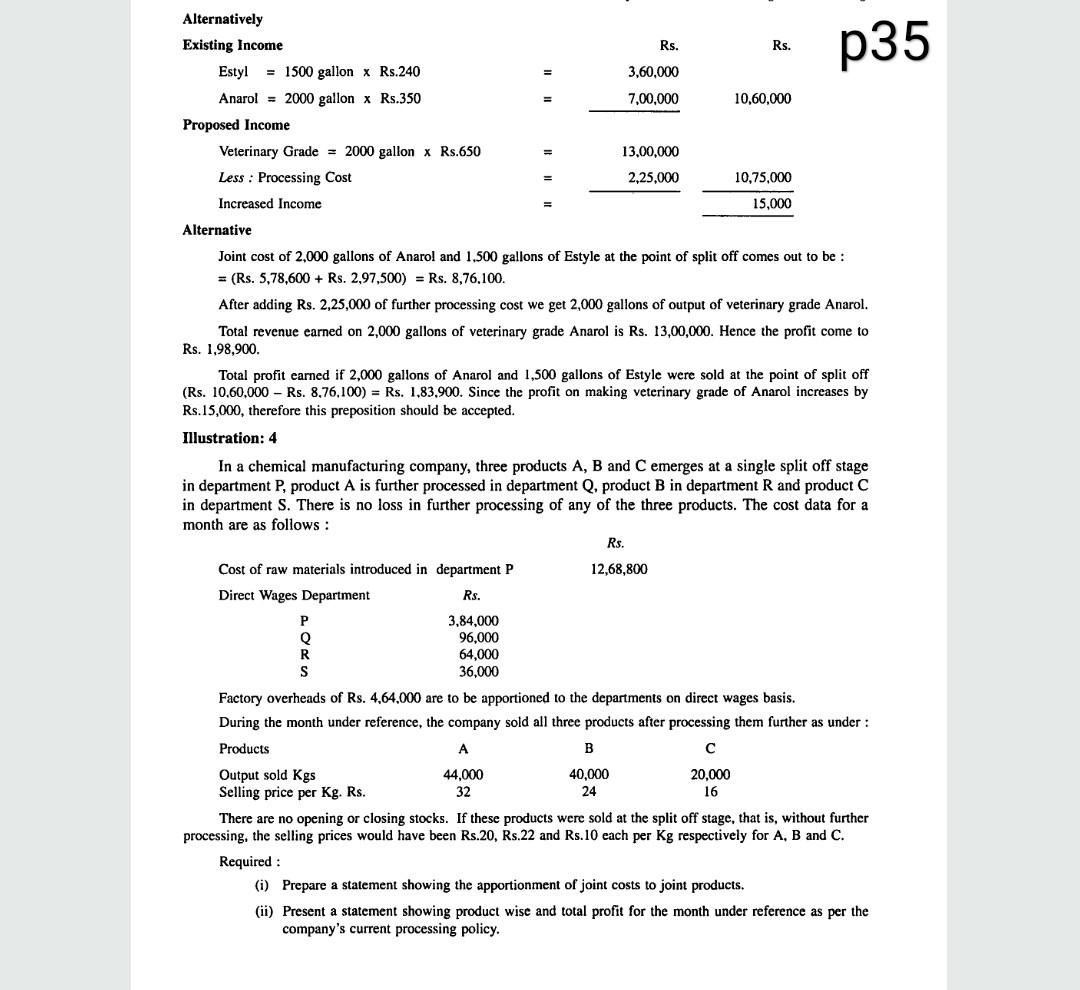

need right answer of my question thank you Rs. Rs. p35 Alternatively Existing Income Estyl = 1500 gallon x Rs.240 Anarol = 2000 gallon x

need right answer of my question thank you

Rs. Rs. p35 Alternatively Existing Income Estyl = 1500 gallon x Rs.240 Anarol = 2000 gallon x Rs.350 Proposed Income Veterinary Grade = 2000 gallon x Rs.650 Less : Processing Cost 3,60,000 7,00,000 10,60,000 13,00,000 2,25,000 10,75,000 Increased Income 15,000 Alternative Joint cost of 2,000 gallons of Anarol and 1.500 gallons of Estyle at the point of split off comes out to be : = (Rs. 5,78,600 + Rs. 2,97,500) = Rs. 8,76,100. After adding Rs. 2,25,000 of further processing cost we get 2,000 gallons of output of veterinary grade Anarol. Total revenue earned on 2,000 gallons of veterinary grade Anarol is Rs. 13,00,000. Hence the profit come to Rs. 1,98,900. Total profit earned if 2,000 gallons of Anarol and 1,500 gallons of Estyle were sold at the point of split off (Rs. 10,60,000 - Rs. 8,76,100) = Rs. 1,83,900. Since the profit on making veterinary grade of Anarol increases by Rs. 15,000, therefore this preposition should be accepted. Illustration: 4 In a chemical manufacturing company, three products A, B and C emerges at a single split off stage in department P, product A is further processed in department Q, product B in department R and product C in department S. There is no loss in further processing of any of the three products. The cost data for a month are as follows: Rs. 12,68,800 Cost of raw materials introduced in department P Direct Wages Department Rs. 3.84.000 Q 96.000 R 64,000 S 36,000 Factory overheads of Rs. 4,64,000 are to be apportioned to the departments on direct wages basis. During the month under reference, the company sold all three products after processing them further as under: Products A B Output sold Kgs 44,000 40,000 20,000 Selling price per Kg. Rs. 32 24 16 There are no opening or closing stocks. If these products were sold at the split off stage, that is, without further processing, the selling prices would have been Rs.20, Rs.22 and Rs.10 each per Kg respectively for A, B and C. Required: (i) Prepare a statement showing the apportionment of joint costs to joint products, (ii) Present a statement showing product wise and total profit for the month under reference as per the company's current processing policyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started