need salution plzz in an hour

need salution plzz in an hour

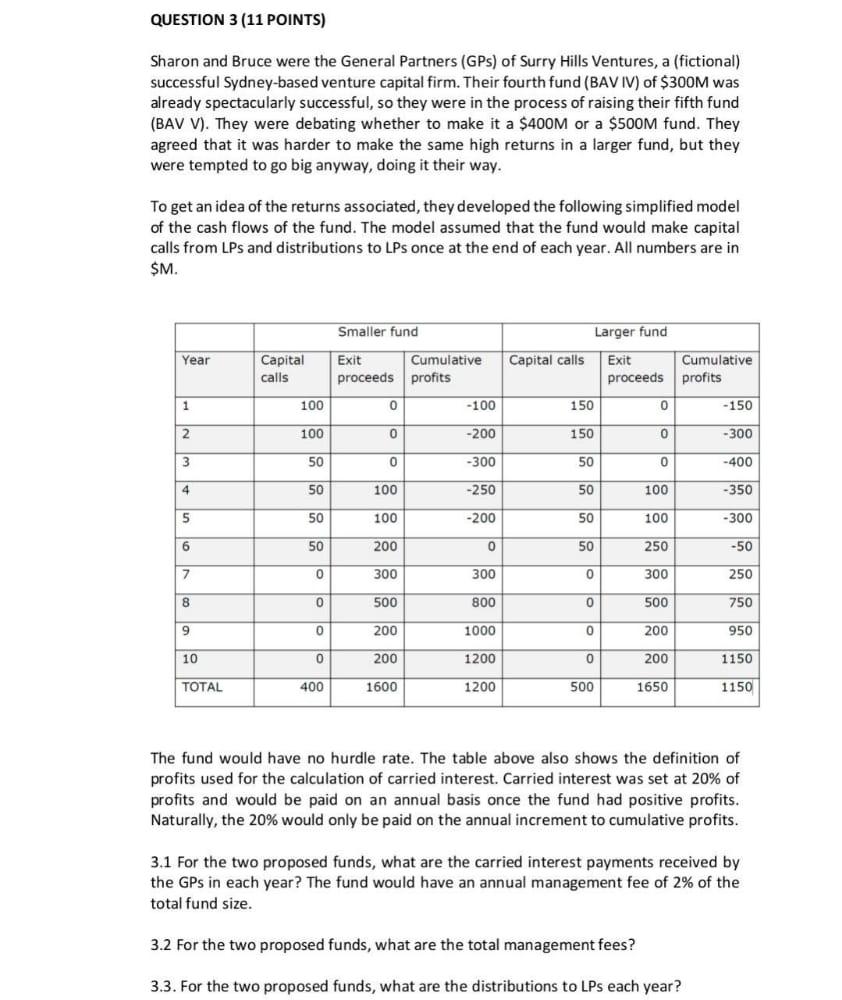

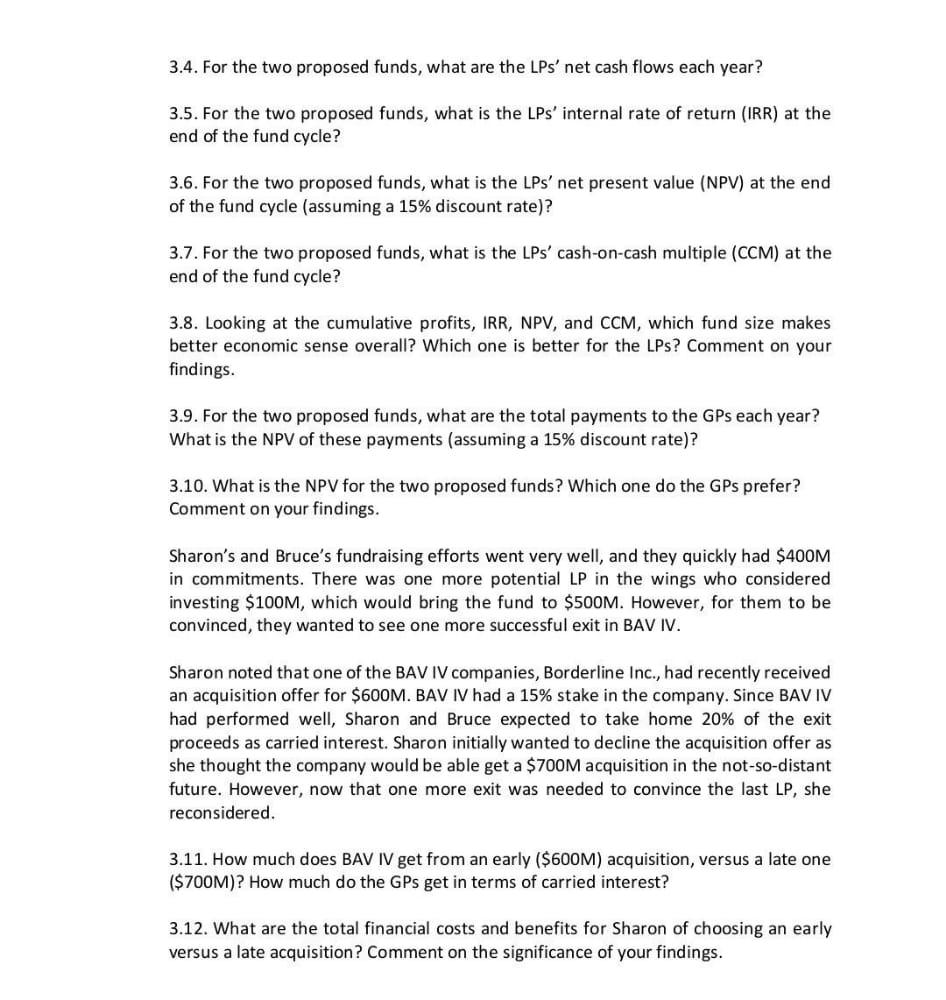

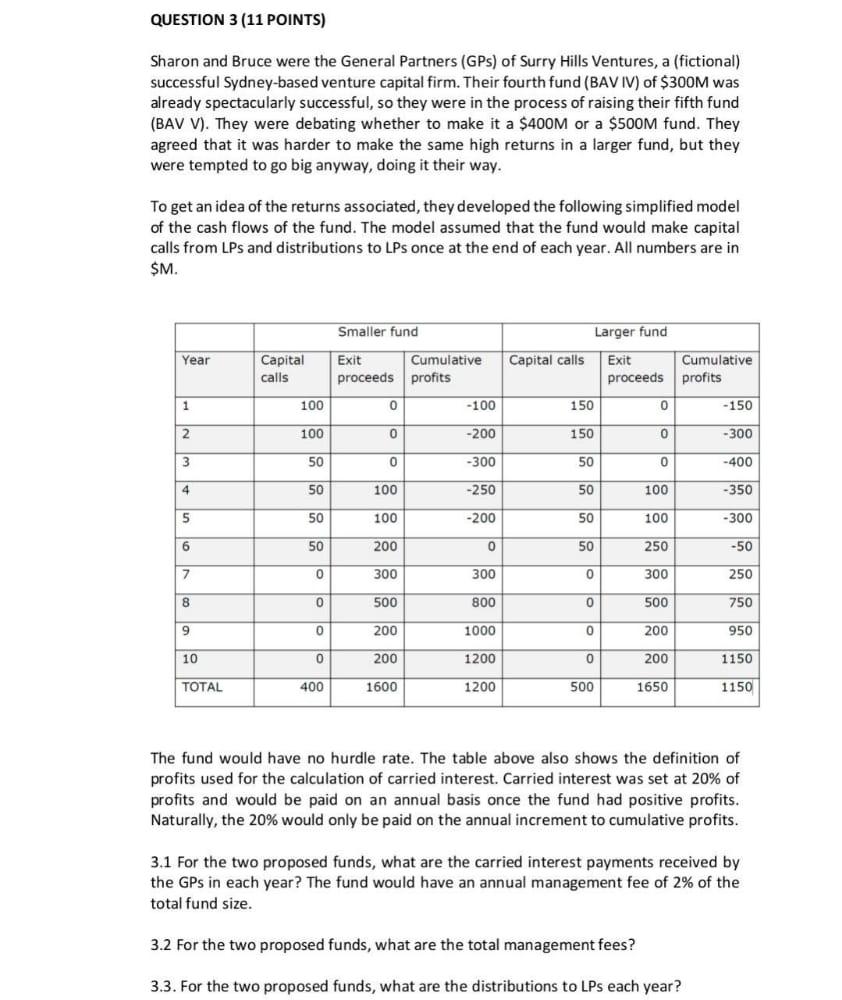

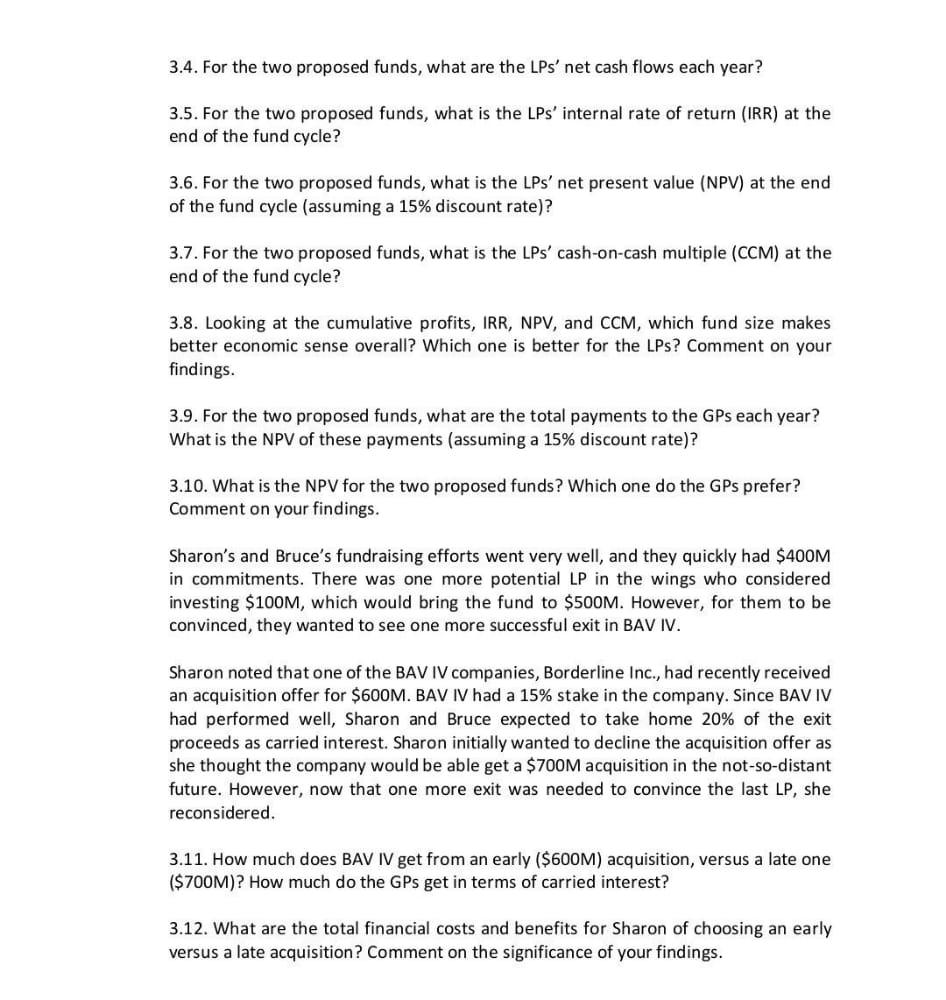

QUESTION 3 (11 POINTS) Sharon and Bruce were the General Partners (GPs) of Surry Hills Ventures, a (fictional) successful Sydney-based venture capital firm. Their fourth fund (BAVIV) of $300M was already spectacularly successful, so they were in the process of raising their fifth fund (BAV V). They were debating whether to make it a $400M or a $500M fund. They agreed that it was harder to make the same high returns in a larger fund, but they were tempted to go big anyway, doing it their way. To get an idea of the returns associated, they developed the following simplified model of the cash flows of the fund. The model assumed that the fund would make capital calls from LPs and distributions to LPs once at the end of each year. All numbers are in $M. Smaller fund Larger fund Year Capital calls 100 100 Exit Cumulative proceeds profits 0 -100 Capital calls Exit Cumulative proceeds profits 150 -150 1 0 2 0 -200 150 0 -300 3 50 0 -300 50 0 -400 4 50 100 -250 50 100 -350 5 50 100 -200 50 100 -300 6 50 200 0 50 250 -50 7 0 300 300 0 300 250 8 500 800 0 500 750 9 200 1000 200 950 8 oool 10 200 1200 200 1150 TOTAL 400 1600 1200 500 1650 1150 The fund would have no hurdle rate. The table above also shows the definition of profits used for the calculation of carried interest. Carried interest was set at 20% of profits and would be paid on an annual basis once the fund had positive profits. Naturally, the 20% would only be paid on the annual increment to cumulative profits. 3.1 For the two proposed funds, what are the carried interest payments received by the GPs in each year? The fund would have an annual management fee of 2% of the total fund size. 3.2 For the two proposed funds, what are the total management fees? 3.3. For the two proposed funds, what are the distributions to LPs each year? 3.4. For the two proposed funds, what are the LPs' net cash flows each year? 3.5. For the two proposed funds, what is the LPs' internal rate of return (IRR) at the end of the fund cycle? 3.6. For the two proposed funds, what is the LPs' net present value (NPV) at the end of the fund cycle (assuming a 15% discount rate)? 3.7. For the two proposed funds, what is the LPs' cash-on-cash multiple (CCM) at the end of the fund cycle? 3.8. Looking at the cumulative profits, IRR, NPV, and CCM, which fund size makes better economic sense overall? Which one is better for the LPs? Comment on your findings. 3.9. For the two proposed funds, what are the total payments to the GPs each year? What is the NPV of these payments (assuming a 15% discount rate)? 3.10. What is the NPV for the two proposed funds? Which one do the GPs prefer? Comment on your findings. Sharon's and Bruce's fundraising efforts went very well, and they quickly had $400M in commitments. There was one more potential LP in the wings who considered investing $100M, which would bring the fund to $500M. However, for them to be convinced, they wanted to see one more successful exit in BAV IV. Sharon noted that one of the BAV IV companies, Borderline Inc., had recently received an acquisition offer for $600M. BAV IV had a 15% stake in the company. Since BAVIV had performed well, Sharon and Bruce expected to take home 20% of the exit proceeds as carried interest. Sharon initially wanted to decline the acquisition offer as she thought the company would be able get a $700M acquisition in the not-so-distant future. However, now that one more exit was needed to convince the last LP, she reconsidered. 3.11. How much does BAV IV get from an early ($600M) acquisition, versus a late one ($700M)? How much do the GPs get in terms of carried interest? 3.12. What are the total financial costs and benefits for Sharon of choosing an early versus a late acquisition? Comment on the significance of your findings

need salution plzz in an hour

need salution plzz in an hour