Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need sol of ques 2 by usind data of ques 1 want typed answer not handwritten. Need answer of question 2 by using data pf

need sol of ques 2 by usind data of ques 1

need sol of ques 2 by usind data of ques 1 want typed answer not handwritten.

want typed answer not handwritten.

Need answer of question 2 by using data pf question 1

SOLVE QUESTION NO 2 please

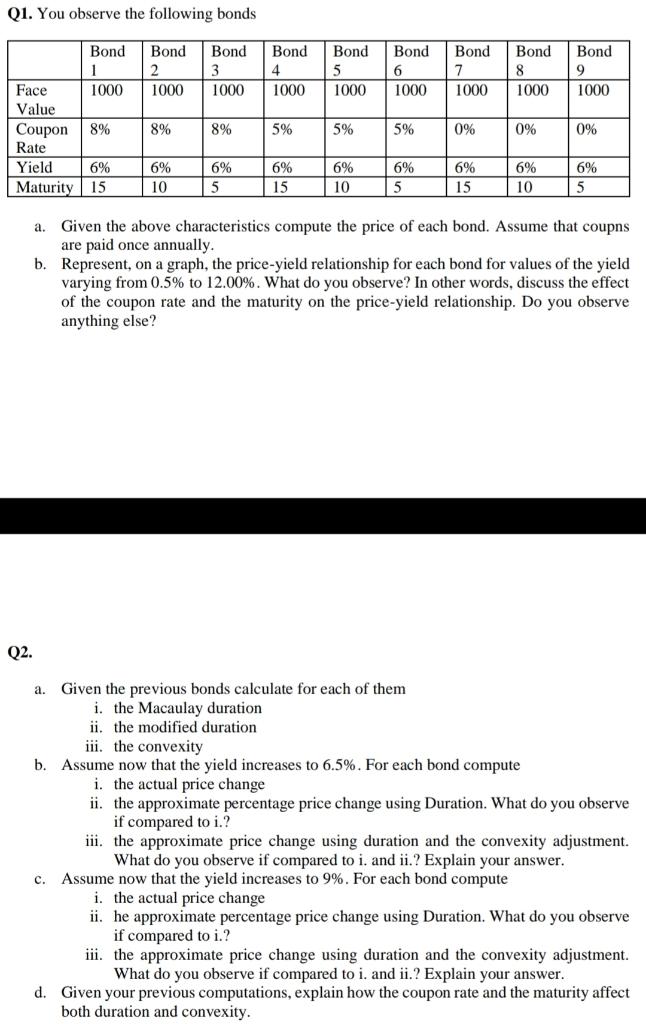

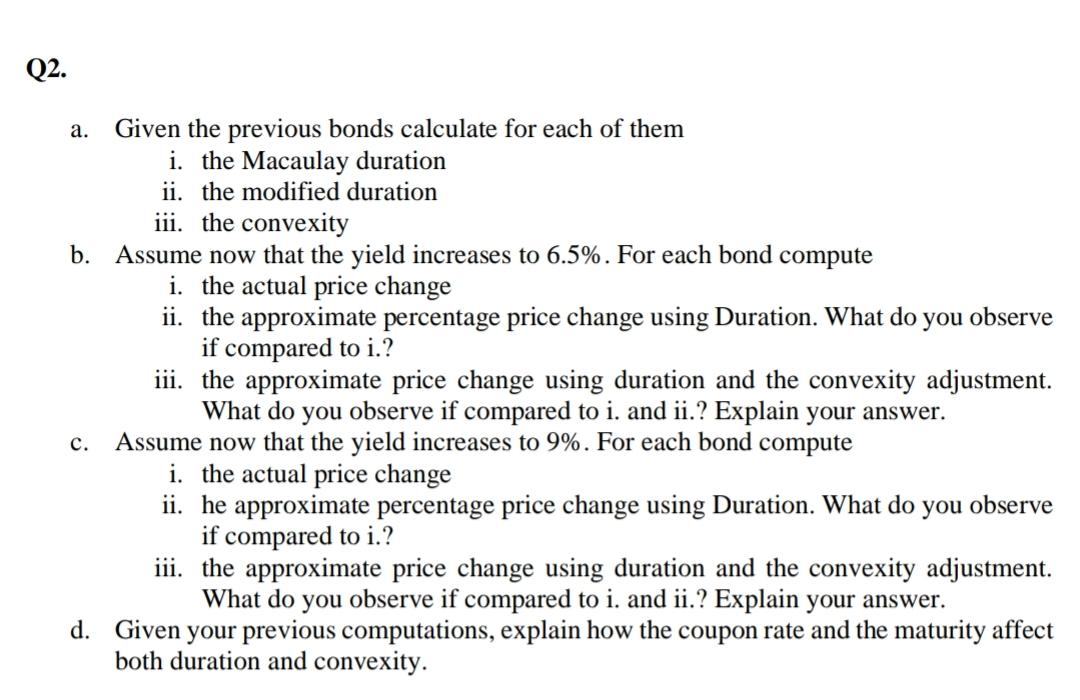

Q1. You observe the following bonds a. Given the above characteristics compute the price of each bond. Assume that coupns are paid once annually. b. Represent, on a graph, the price-yield relationship for each bond for values of the yield varying from 0.5% to 12.00%. What do you observe? In other words, discuss the effect of the coupon rate and the maturity on the price-yield relationship. Do you observe anything else? Q2. a. Given the previous bonds calculate for each of them i. the Macaulay duration ii. the modified duration iii. the convexity b. Assume now that the yield increases to 6.5%. For each bond compute i. the actual price change ii. the approximate percentage price change using Duration. What do you observe if compared to i.? iii. the approximate price change using duration and the convexity adjustment. What do you observe if compared to i. and ii.? Explain your answer. c. Assume now that the yield increases to 9%. For each bond compute i. the actual price change ii. he approximate percentage price change using Duration. What do you observe if compared to i.? iii. the approximate price change using duration and the convexity adjustment. What do you observe if compared to i. and ii.? Explain your answer. d. Given your previous computations, explain how the coupon rate and the maturity affect both duration and convexity. a. Given the previous bonds calculate for each of them i. the Macaulay duration ii. the modified duration iii. the convexity b. Assume now that the yield increases to 6.5%. For each bond compute i. the actual price change ii. the approximate percentage price change using Duration. What do you observe if compared to i.? iii. the approximate price change using duration and the convexity adjustment. What do you observe if compared to i. and ii.? Explain your answer. c. Assume now that the yield increases to 9%. For each bond compute i. the actual price change ii. he approximate percentage price change using Duration. What do you observe if compared to i.? iii. the approximate price change using duration and the convexity adjustment. What do you observe if compared to i. and ii.? Explain your answer. d. Given your previous computations, explain how the coupon rate and the maturity affect Q1. You observe the following bonds a. Given the above characteristics compute the price of each bond. Assume that coupns are paid once annually. b. Represent, on a graph, the price-yield relationship for each bond for values of the yield varying from 0.5% to 12.00%. What do you observe? In other words, discuss the effect of the coupon rate and the maturity on the price-yield relationship. Do you observe anything else? Q2. a. Given the previous bonds calculate for each of them i. the Macaulay duration ii. the modified duration iii. the convexity b. Assume now that the yield increases to 6.5%. For each bond compute i. the actual price change ii. the approximate percentage price change using Duration. What do you observe if compared to i.? iii. the approximate price change using duration and the convexity adjustment. What do you observe if compared to i. and ii.? Explain your answer. c. Assume now that the yield increases to 9%. For each bond compute i. the actual price change ii. he approximate percentage price change using Duration. What do you observe if compared to i.? iii. the approximate price change using duration and the convexity adjustment. What do you observe if compared to i. and ii.? Explain your answer. d. Given your previous computations, explain how the coupon rate and the maturity affect both duration and convexity. a. Given the previous bonds calculate for each of them i. the Macaulay duration ii. the modified duration iii. the convexity b. Assume now that the yield increases to 6.5%. For each bond compute i. the actual price change ii. the approximate percentage price change using Duration. What do you observe if compared to i.? iii. the approximate price change using duration and the convexity adjustment. What do you observe if compared to i. and ii.? Explain your answer. c. Assume now that the yield increases to 9%. For each bond compute i. the actual price change ii. he approximate percentage price change using Duration. What do you observe if compared to i.? iii. the approximate price change using duration and the convexity adjustment. What do you observe if compared to i. and ii.? Explain your answer. d. Given your previous computations, explain how the coupon rate and the maturity affectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started