Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need solution for question 3 This is the question that i would like to know the solution Peyton Sawyer enjoys listening to all types of

Need solution for question 3

This is the question that i would like to know the solution

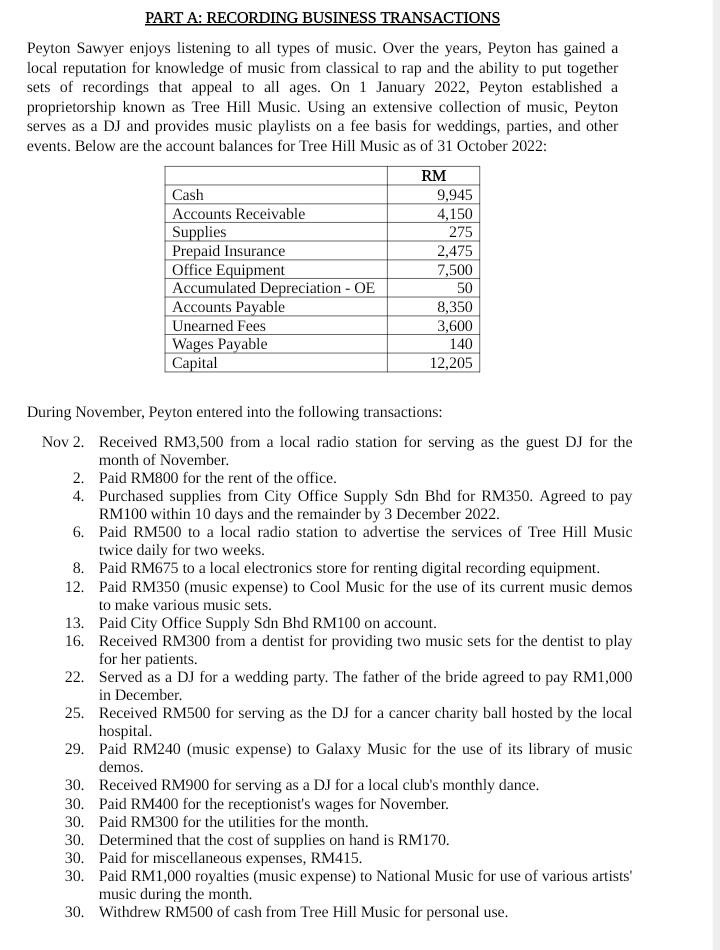

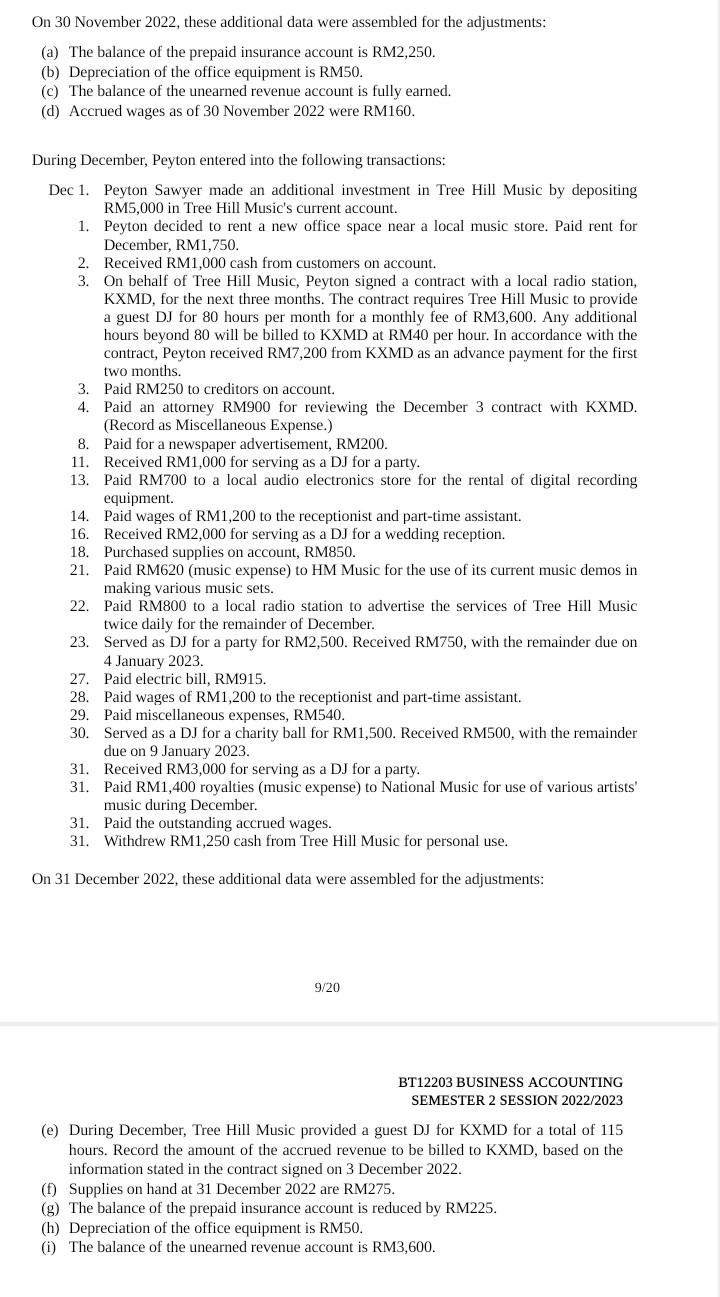

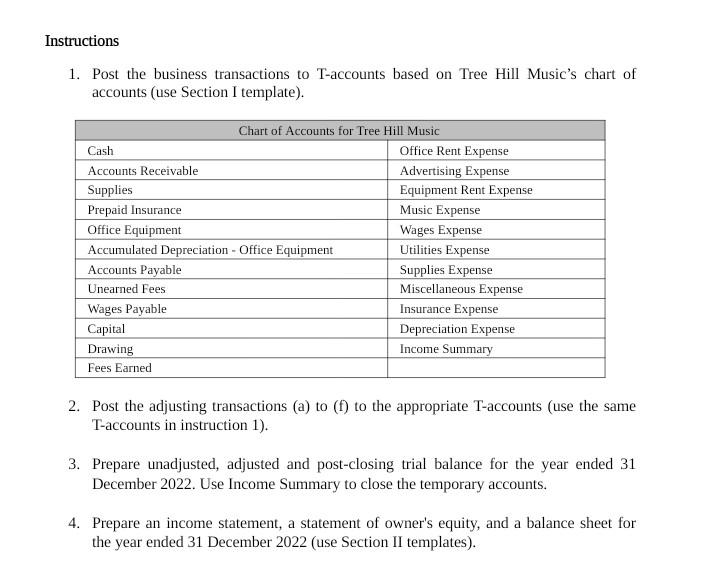

Peyton Sawyer enjoys listening to all types of music. Over the years, Peyton has gained a local reputation for knowledge of music from classical to rap and the ability to put together sets of recordings that appeal to all ages. On 1 January 2022, Peyton established a proprietorship known as Tree Hill Music. Using an extensive collection of music, Peyton serves as a DJ and provides music playlists on a fee basis for weddings, parties, and other events. Below are the account balances for Tree Hill Music as of 31 October 2022: During November, Peyton entered into the following transactions: Nov 2. Received RM3,500 from a local radio station for serving as the guest DJ for the month of November. 2. Paid RM800 for the rent of the office. 4. Purchased supplies from City Office Supply Sdn Bhd for RM350. Agreed to pay RM100 within 10 days and the remainder by 3 December 2022 . 6. Paid RM500 to a local radio station to advertise the services of Tree Hill Music twice daily for two weeks. 8. Paid RM675 to a local electronics store for renting digital recording equipment. 12. Paid RM350 (music expense) to Cool Music for the use of its current music demos to make various music sets. 13. Paid City Office Supply Sdn Bhd RM100 on account. 16. Received RM300 from a dentist for providing two music sets for the dentist to play for her patients. 22. Served as a DJ for a wedding party. The father of the bride agreed to pay RM1,000 in December. 25. Received RM500 for serving as the DJ for a cancer charity ball hosted by the local hospital. 29. Paid RM240 (music expense) to Galaxy Music for the use of its library of music demos. 30. Received RM900 for serving as a DJ for a local club's monthly dance. 30. Paid RM400 for the receptionist's wages for November. 30. Paid RM300 for the utilities for the month. 30. Determined that the cost of supplies on hand is RM170. 30. Paid for miscellaneous expenses, RM415. 30. Paid RM1,000 royalties (music expense) to National Music for use of various artists' music during the month. 30. Withdrew RM500 of cash from Tree Hill Music for personal use. On 30 November 2022 , these additional data were assembled for the adjustments: (a) The balance of the prepaid insurance account is RM2,250. (b) Depreciation of the office equipment is RM50. (c) The balance of the unearned revenue account is fully earned. (d) Accrued wages as of 30 November 2022 were RM160. During December, Peyton entered into the following transactions: Dec 1. Peyton Sawyer made an additional investment in Tree Hill Music by depositing RM5,000 in Tree Hill Music's current account. 1. Peyton decided to rent a new office space near a local music store. Paid rent for December, RM1,750. 2. Received RM1,000 cash from customers on account. 3. On behalf of Tree Hill Music, Peyton signed a contract with a local radio station, KXMD, for the next three months. The contract requires Tree Hill Music to provide a guest DJ for 80 hours per month for a monthly fee of RM3,600. Any additional hours beyond 80 will be billed to KXMD at RM40 per hour. In accordance with the contract, Peyton received RM7,200 from KXMD as an advance payment for the first two months. 3. Paid RM250 to creditors on account. 4. Paid an attorney RM900 for reviewing the December 3 contract with KXMD. (Record as Miscellaneous Expense.) 8. Paid for a newspaper advertisement, RM200. 11. Received RM1,000 for serving as a DJ for a party. 13. Paid RM700 to a local audio electronics store for the rental of digital recording equipment. 14. Paid wages of RM1,200 to the receptionist and part-time assistant. 16. Received RM2,000 for serving as a DJ for a wedding reception. 18. Purchased supplies on account, RM850. 21. Paid RM620 (music expense) to HM Music for the use of its current music demos in making various music sets. 22. Paid RM800 to a local radio station to advertise the services of Tree Hill Music twice daily for the remainder of December. 23. Served as DJ for a party for RM2,500. Received RM750, with the remainder due on 4 January 2023. 27. Paid electric bill, RM915. 28. Paid wages of RM1,200 to the receptionist and part-time assistant. 29. Paid miscellaneous expenses, RM540. 30. Served as a DJ for a charity ball for RM1,500. Received RM500, with the remainder due on 9 January 2023. 31. Received RM3,000 for serving as a DJ for a party. 31. Paid RM1,400 royalties (music expense) to National Music for use of various artists' music during December. 31. Paid the outstanding accrued wages. 31. Withdrew RM1,250 cash from Tree Hill Music for personal use. On 31 December 2022, these additional data were assembled for the adjustments: 9/20 BT12203 BUSINESS ACCOUNTING SEMESTER 2 SESSION 2022/2023 (e) During December, Tree Hill Music provided a guest DJ for KXMD for a total of 115 hours. Record the amount of the accrued revenue to be billed to KXMD, based on the information stated in the contract signed on 3 December 2022. (f) Supplies on hand at 31 December 2022 are RM275. (g) The balance of the prepaid insurance account is reduced by RM225. (h) Depreciation of the office equipment is RM50. (i) The balance of the unearned revenue account is RM3,600. 1. Post the business transactions to T-accounts based on Tree Hill Music's chart of accounts (use Section I template). 2. Post the adjusting transactions (a) to (f) to the appropriate T-accounts (use the same T-accounts in instruction 1). 3. Prepare unadjusted, adjusted and post-closing trial balance for the year ended 31 December 2022. Use Income Summary to close the temporary accounts. 4. Prepare an income statement, a statement of owner's equity, and a balance sheet for the year ended 31 December 2022 (use Section II templates). 3. Prepare unadjusted, adjusted and post-closing trial balance for the year ended 31 December 2022. Use Income Summary to close the temporary accounts. Peyton Sawyer enjoys listening to all types of music. Over the years, Peyton has gained a local reputation for knowledge of music from classical to rap and the ability to put together sets of recordings that appeal to all ages. On 1 January 2022, Peyton established a proprietorship known as Tree Hill Music. Using an extensive collection of music, Peyton serves as a DJ and provides music playlists on a fee basis for weddings, parties, and other events. Below are the account balances for Tree Hill Music as of 31 October 2022: During November, Peyton entered into the following transactions: Nov 2. Received RM3,500 from a local radio station for serving as the guest DJ for the month of November. 2. Paid RM800 for the rent of the office. 4. Purchased supplies from City Office Supply Sdn Bhd for RM350. Agreed to pay RM100 within 10 days and the remainder by 3 December 2022 . 6. Paid RM500 to a local radio station to advertise the services of Tree Hill Music twice daily for two weeks. 8. Paid RM675 to a local electronics store for renting digital recording equipment. 12. Paid RM350 (music expense) to Cool Music for the use of its current music demos to make various music sets. 13. Paid City Office Supply Sdn Bhd RM100 on account. 16. Received RM300 from a dentist for providing two music sets for the dentist to play for her patients. 22. Served as a DJ for a wedding party. The father of the bride agreed to pay RM1,000 in December. 25. Received RM500 for serving as the DJ for a cancer charity ball hosted by the local hospital. 29. Paid RM240 (music expense) to Galaxy Music for the use of its library of music demos. 30. Received RM900 for serving as a DJ for a local club's monthly dance. 30. Paid RM400 for the receptionist's wages for November. 30. Paid RM300 for the utilities for the month. 30. Determined that the cost of supplies on hand is RM170. 30. Paid for miscellaneous expenses, RM415. 30. Paid RM1,000 royalties (music expense) to National Music for use of various artists' music during the month. 30. Withdrew RM500 of cash from Tree Hill Music for personal use. On 30 November 2022 , these additional data were assembled for the adjustments: (a) The balance of the prepaid insurance account is RM2,250. (b) Depreciation of the office equipment is RM50. (c) The balance of the unearned revenue account is fully earned. (d) Accrued wages as of 30 November 2022 were RM160. During December, Peyton entered into the following transactions: Dec 1. Peyton Sawyer made an additional investment in Tree Hill Music by depositing RM5,000 in Tree Hill Music's current account. 1. Peyton decided to rent a new office space near a local music store. Paid rent for December, RM1,750. 2. Received RM1,000 cash from customers on account. 3. On behalf of Tree Hill Music, Peyton signed a contract with a local radio station, KXMD, for the next three months. The contract requires Tree Hill Music to provide a guest DJ for 80 hours per month for a monthly fee of RM3,600. Any additional hours beyond 80 will be billed to KXMD at RM40 per hour. In accordance with the contract, Peyton received RM7,200 from KXMD as an advance payment for the first two months. 3. Paid RM250 to creditors on account. 4. Paid an attorney RM900 for reviewing the December 3 contract with KXMD. (Record as Miscellaneous Expense.) 8. Paid for a newspaper advertisement, RM200. 11. Received RM1,000 for serving as a DJ for a party. 13. Paid RM700 to a local audio electronics store for the rental of digital recording equipment. 14. Paid wages of RM1,200 to the receptionist and part-time assistant. 16. Received RM2,000 for serving as a DJ for a wedding reception. 18. Purchased supplies on account, RM850. 21. Paid RM620 (music expense) to HM Music for the use of its current music demos in making various music sets. 22. Paid RM800 to a local radio station to advertise the services of Tree Hill Music twice daily for the remainder of December. 23. Served as DJ for a party for RM2,500. Received RM750, with the remainder due on 4 January 2023. 27. Paid electric bill, RM915. 28. Paid wages of RM1,200 to the receptionist and part-time assistant. 29. Paid miscellaneous expenses, RM540. 30. Served as a DJ for a charity ball for RM1,500. Received RM500, with the remainder due on 9 January 2023. 31. Received RM3,000 for serving as a DJ for a party. 31. Paid RM1,400 royalties (music expense) to National Music for use of various artists' music during December. 31. Paid the outstanding accrued wages. 31. Withdrew RM1,250 cash from Tree Hill Music for personal use. On 31 December 2022, these additional data were assembled for the adjustments: 9/20 BT12203 BUSINESS ACCOUNTING SEMESTER 2 SESSION 2022/2023 (e) During December, Tree Hill Music provided a guest DJ for KXMD for a total of 115 hours. Record the amount of the accrued revenue to be billed to KXMD, based on the information stated in the contract signed on 3 December 2022. (f) Supplies on hand at 31 December 2022 are RM275. (g) The balance of the prepaid insurance account is reduced by RM225. (h) Depreciation of the office equipment is RM50. (i) The balance of the unearned revenue account is RM3,600. 1. Post the business transactions to T-accounts based on Tree Hill Music's chart of accounts (use Section I template). 2. Post the adjusting transactions (a) to (f) to the appropriate T-accounts (use the same T-accounts in instruction 1). 3. Prepare unadjusted, adjusted and post-closing trial balance for the year ended 31 December 2022. Use Income Summary to close the temporary accounts. 4. Prepare an income statement, a statement of owner's equity, and a balance sheet for the year ended 31 December 2022 (use Section II templates). 3. Prepare unadjusted, adjusted and post-closing trial balance for the year ended 31 December 2022. Use Income Summary to close the temporary accountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started