need some help

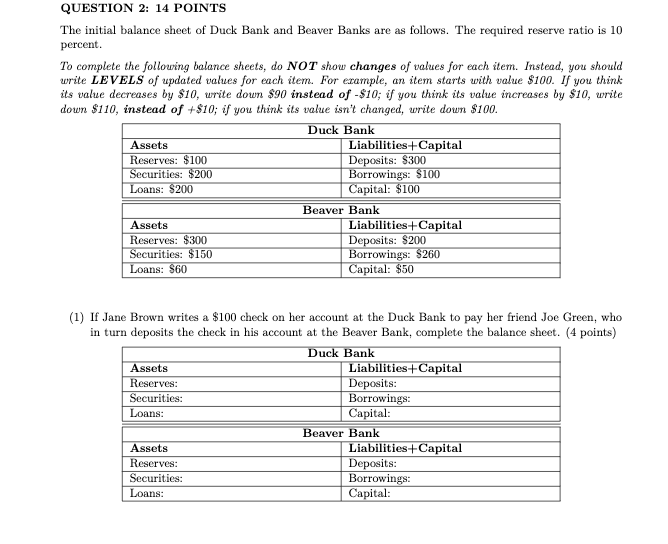

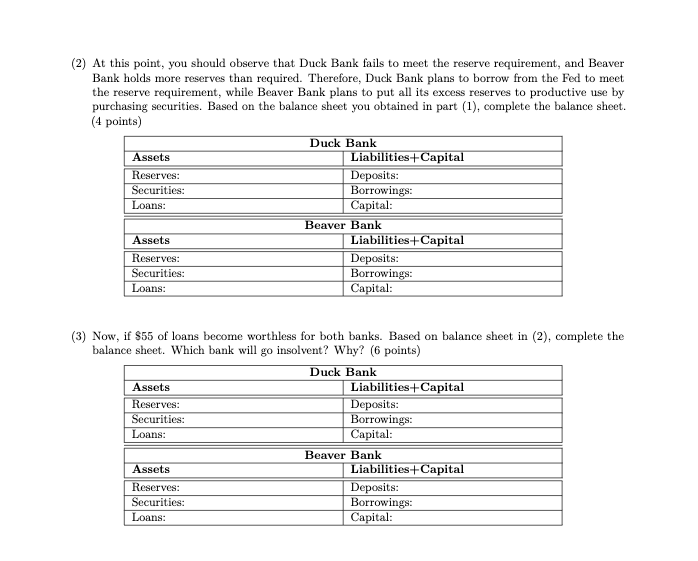

QUESTION 2: 14 POINTS The initial balance sheet of Duck Bank and Beaver Banks are as follows. The required reserve ratio is 10 percent. To complete the following balance sheets, do NOT show changes of values for each item. Instead, you should write LEVELS of updated values for each item. For example, an item starts with value $100. If you think its value decreases by $10, write down $90 instead of -$10; if you think its value increases by $10, write down $110, instead of +$10; if you think its value isn't changed, write down $100. Duck Bank Assets Liabilities +Capital Reserves: $100 Deposits: $300 Securities: $200 Borrowings: $100 Loans: $200 Capital: $100 Beaver Bank Liabilities+Capital Reserves: $300 Deposits: $200 Securities: $150 Borrowings: $260 Loans: $60 Capital: $50 Assets (1) If Jane Brown writes a $100 check on her account at the Duck Bank to pay her friend Joe Green, who in turn deposits the check in his account at the Beaver Bank, complete the balance sheet. (4 points) Duck Bank Assets Liabilities Capital Reserves: Deposits: Securities: Borrowings: Capital: Beaver Bank Liabilities Capital Reserves: Deposits: Securities: Borrowings: Loans: Capital: Loans: Assets (2) At this point, you should observe that Duck Bank fails to meet the reserve requirement, and Beaver Bank holds more reserves than required. Therefore, Duck Bank plans to borrow from the Fed to meet the reserve requirement, while Beaver Bank plans to put all its excess reserves to productive use by purchasing securities. Based on the balance sheet you obtained in part (1), complete the balance sheet. (4 points) Assets Reserves: Securities: Loans: Duck Bank Liabilities Capital Deposits: Borrowings: Capital: Beaver Bank Liabilities+Capital Deposits: Borrowings: Capital: Assets Reserves: Securities: Loans: (3) Now, if $55 of loans become worthless for both banks. Based on balance sheet in (2), complete the balance sheet. Which bank will go insolvent? Why? (6 points) Assets Reserves: Securities: Loans: Duck Bank Liabilities +Capital Deposits: Borrowings: Capital: Beaver Bank Liabilities Capital Deposits: Borrowings: Capital: Assets Reserves: Securities: Loans