Need some help, thx!

And hope you guys stay safe!

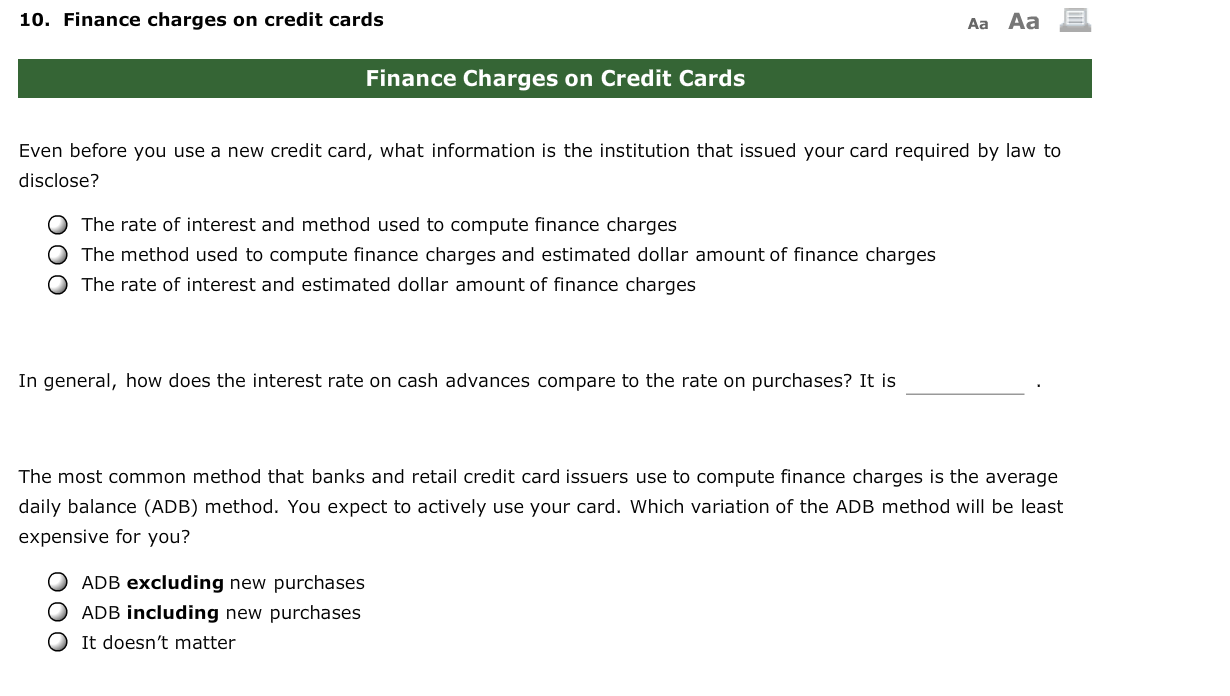

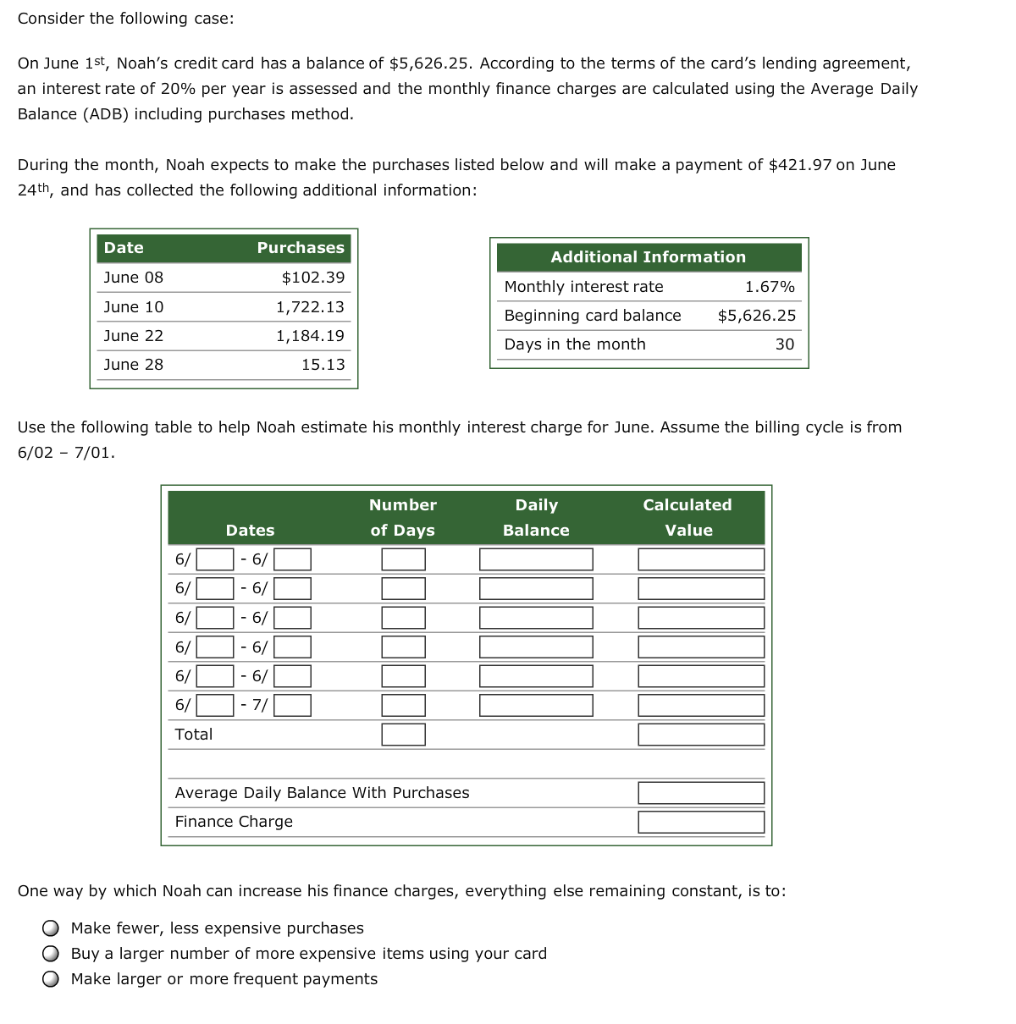

10. Finance charges on credit cards Aa Aa E Finance Charges on Credit Cards Even before you use a new credit card, what information is the institution that issued your card required by law to disclose? O O The rate of interest and method used to compute finance charges The method used to compute finance charges and estimated dollar amount of finance charges The rate of interest and estimated dollar amount of finance charges In general, how does the interest rate on cash advances compare to the rate on purchases? It is The most common method that banks and retail credit card issuers use to compute finance charges is the average daily balance (ADB) method. You expect to actively use your card. Which variation of the ADB method will be least expensive for you? O ADB excluding new purchases O ADB including new purchases It doesn't matter Consider the following case: On June 1st, Noah's credit card has a balance of $5,626.25. According to the terms of the card's lending agreement, an interest rate of 20% per year is assessed and the monthly finance charges are calculated using the Average Daily Balance (ADB) including purchases method. During the month, Noah expects to make the purchases listed below and will make a payment of $421.97 on June 24th, and has collected the following additional information: Purchases Date June 08 June 10 June 22 June 28 $102.39 1,722.13 1,184.19 15.13 Additional Information Monthly interest rate 1.67% Beginning card balance $5,626.25 Days in the month 30 Use the following table to help Noah estimate his monthly interest charge for June. Assume the billing cycle is from 6/02 - 7/01. Number of Days Daily Balance Calculated Value Dates 6/ -6/O 610 -6/ -611 60-6/ 60-611 6/ 0 -71 Total Average Daily Balance With Purchases Finance Charge One way by which Noah can increase his finance charges, everything else remaining constant, is to: O Make fewer, less expensive purchases O Buy a larger number of more expensive items using your card O Make larger or more frequent payments 10. Finance charges on credit cards Aa Aa E Finance Charges on Credit Cards Even before you use a new credit card, what information is the institution that issued your card required by law to disclose? O O The rate of interest and method used to compute finance charges The method used to compute finance charges and estimated dollar amount of finance charges The rate of interest and estimated dollar amount of finance charges In general, how does the interest rate on cash advances compare to the rate on purchases? It is The most common method that banks and retail credit card issuers use to compute finance charges is the average daily balance (ADB) method. You expect to actively use your card. Which variation of the ADB method will be least expensive for you? O ADB excluding new purchases O ADB including new purchases It doesn't matter Consider the following case: On June 1st, Noah's credit card has a balance of $5,626.25. According to the terms of the card's lending agreement, an interest rate of 20% per year is assessed and the monthly finance charges are calculated using the Average Daily Balance (ADB) including purchases method. During the month, Noah expects to make the purchases listed below and will make a payment of $421.97 on June 24th, and has collected the following additional information: Purchases Date June 08 June 10 June 22 June 28 $102.39 1,722.13 1,184.19 15.13 Additional Information Monthly interest rate 1.67% Beginning card balance $5,626.25 Days in the month 30 Use the following table to help Noah estimate his monthly interest charge for June. Assume the billing cycle is from 6/02 - 7/01. Number of Days Daily Balance Calculated Value Dates 6/ -6/O 610 -6/ -611 60-6/ 60-611 6/ 0 -71 Total Average Daily Balance With Purchases Finance Charge One way by which Noah can increase his finance charges, everything else remaining constant, is to: O Make fewer, less expensive purchases O Buy a larger number of more expensive items using your card O Make larger or more frequent payments