Answered step by step

Verified Expert Solution

Question

1 Approved Answer

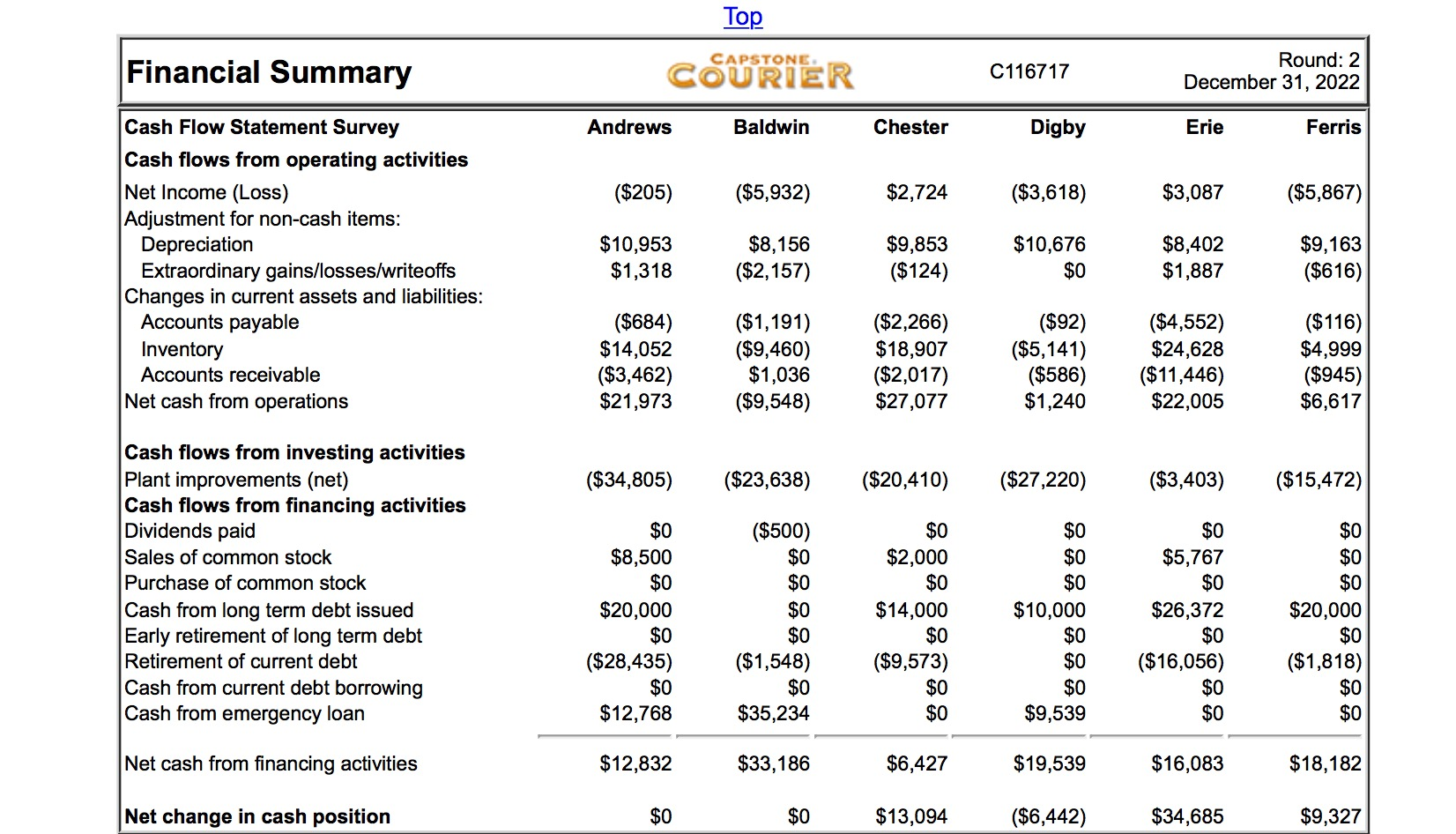

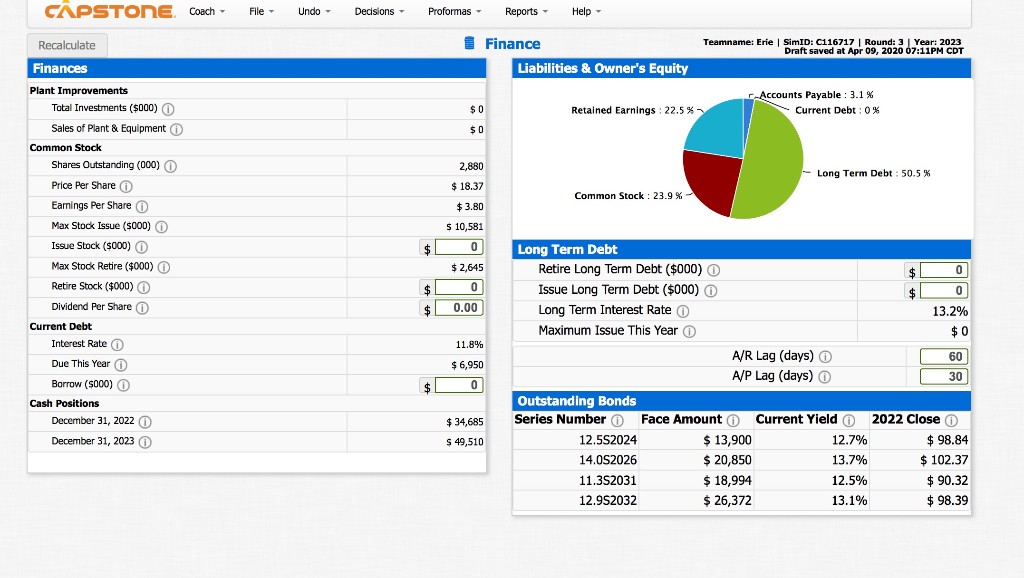

Need suggestions on what should be filled in for the blanks on the second picture. Top Financial Summary COURIER C116717 Round: 2 December 31, 2022

Need suggestions on what should be filled in for the blanks on the second picture.

Top Financial Summary COURIER C116717 Round: 2 December 31, 2022 Andrews Baldwin Chester Digby Erie Ferris ($205) ($5,932) $2,724 ($3,618) $3,087 ($5,867) Cash Flow Statement Survey Cash flows from operating activities Net Income (Loss) | Adjustment for non-cash items: Depreciation Extraordinary gains/losses/writeoffs Changes in current assets and liabilities: Accounts payable Inventory Accounts receivable Net cash from operations $10,953 $1,318 $8,156 ($2,157) $9,853 ($124) $10,676 $0 $8,402 $1,887 $9,163 ($616) ($684) $14,052 ($3,462) $21,973 ($1,191) ($9,460) $1,036 ($9,548) ($2,266) $18,907 ($2,017) $27,077 ($92) ($5,141) ($586) $1,240 ($4,552) $24,628 ($11,446) $22,005 ($116) $4,999 ($945) $6, 617 ($34,805) ($23,638) ($20,410) ($27,220) ($3,403) ($15,472) $0 Sa ($500) $0 $0 $5,767 $0 $8,500 $0 $0 Cash flows from investing activities Plant improvements (net) Cash flows from financing activities Dividends paid Sales of common stock Purchase of common stock Cash from long term debt issued Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan $0 $2,000 $0 $14,000 $0 $0 $0 $0 $20,000 $20,000 $0 SO $0 $26,372 $0 ($16,056) $0 ($28,435) ($1,548) $10,000 $0 $0 $0 $9,539 ($9,573) ($1,818) $0 $0 $0 $0 $0 $12,768 $35,234 $0 $0 Net cash from financing activities $12,832 $33,186 $6,427 $19,539 $16,083 $18,182 Net change in cash position $0 $0 $13,094 ($6,442) $34,685 $9,327 CAPSTONE Coach File - Undo Decisions Proformas - Reports - Help Teamname: Erie SimID: C116717 Round: 3 Year: 2023 Draft saved at Apr 09, 2020 07:11PM CDT Finance Liabilities & Owner's Equity -Accounts Payable : 3.1% Current Debt: 0% $ 0 Retained Earnings : 22.5% $0 2,880 - Long Term Debt: 50.5% $ 18.37 Common Stock : 23.9% $ 3.80 S 10,581 Recalculate Finances Plant Improvements Total Investments ($000) Sales of Plant & Equipment Common Stock Shares Outstanding (000) Price Per Share o Earnings Per Share Max Stock Issue (5000) Issue Stock (5000) Max Stock Retire ($000) Retire Stock ($000) Dividend Per Share o Current Debt Interest Rate Due This Year Borrow (5000) Cash Positions December 31, 2022 December 31, 2023 $ 2,645 0 0.00 13.2% $0 11.8% 60 $ 6,950 10 Long Term Debt Retire Long Term Debt ($000) O Issue Long Term Debt ($000) Long Term Interest Rate O Maximum Issue This Year A/R Lag (days) A/P Lag (days) Outstanding Bonds Series Number Face Amount Current Yield 12.5S2024 $ 13,900 12.7% 14.0S2026 $ 20,850 13.7% 11.352031 $ 18,994 12.5% 12.952032 $ 26,372 13.1% 30 $ 34,685 $ 49,510 2022 Close $ 98.84 $ 102.37 $ 90.32 $ 98.39 Top Financial Summary COURIER C116717 Round: 2 December 31, 2022 Andrews Baldwin Chester Digby Erie Ferris ($205) ($5,932) $2,724 ($3,618) $3,087 ($5,867) Cash Flow Statement Survey Cash flows from operating activities Net Income (Loss) | Adjustment for non-cash items: Depreciation Extraordinary gains/losses/writeoffs Changes in current assets and liabilities: Accounts payable Inventory Accounts receivable Net cash from operations $10,953 $1,318 $8,156 ($2,157) $9,853 ($124) $10,676 $0 $8,402 $1,887 $9,163 ($616) ($684) $14,052 ($3,462) $21,973 ($1,191) ($9,460) $1,036 ($9,548) ($2,266) $18,907 ($2,017) $27,077 ($92) ($5,141) ($586) $1,240 ($4,552) $24,628 ($11,446) $22,005 ($116) $4,999 ($945) $6, 617 ($34,805) ($23,638) ($20,410) ($27,220) ($3,403) ($15,472) $0 Sa ($500) $0 $0 $5,767 $0 $8,500 $0 $0 Cash flows from investing activities Plant improvements (net) Cash flows from financing activities Dividends paid Sales of common stock Purchase of common stock Cash from long term debt issued Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan $0 $2,000 $0 $14,000 $0 $0 $0 $0 $20,000 $20,000 $0 SO $0 $26,372 $0 ($16,056) $0 ($28,435) ($1,548) $10,000 $0 $0 $0 $9,539 ($9,573) ($1,818) $0 $0 $0 $0 $0 $12,768 $35,234 $0 $0 Net cash from financing activities $12,832 $33,186 $6,427 $19,539 $16,083 $18,182 Net change in cash position $0 $0 $13,094 ($6,442) $34,685 $9,327 CAPSTONE Coach File - Undo Decisions Proformas - Reports - Help Teamname: Erie SimID: C116717 Round: 3 Year: 2023 Draft saved at Apr 09, 2020 07:11PM CDT Finance Liabilities & Owner's Equity -Accounts Payable : 3.1% Current Debt: 0% $ 0 Retained Earnings : 22.5% $0 2,880 - Long Term Debt: 50.5% $ 18.37 Common Stock : 23.9% $ 3.80 S 10,581 Recalculate Finances Plant Improvements Total Investments ($000) Sales of Plant & Equipment Common Stock Shares Outstanding (000) Price Per Share o Earnings Per Share Max Stock Issue (5000) Issue Stock (5000) Max Stock Retire ($000) Retire Stock ($000) Dividend Per Share o Current Debt Interest Rate Due This Year Borrow (5000) Cash Positions December 31, 2022 December 31, 2023 $ 2,645 0 0.00 13.2% $0 11.8% 60 $ 6,950 10 Long Term Debt Retire Long Term Debt ($000) O Issue Long Term Debt ($000) Long Term Interest Rate O Maximum Issue This Year A/R Lag (days) A/P Lag (days) Outstanding Bonds Series Number Face Amount Current Yield 12.5S2024 $ 13,900 12.7% 14.0S2026 $ 20,850 13.7% 11.352031 $ 18,994 12.5% 12.952032 $ 26,372 13.1% 30 $ 34,685 $ 49,510 2022 Close $ 98.84 $ 102.37 $ 90.32 $ 98.39Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started