need the answer for the following, thank you

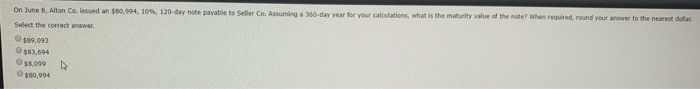

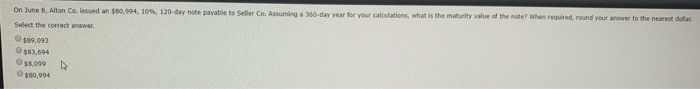

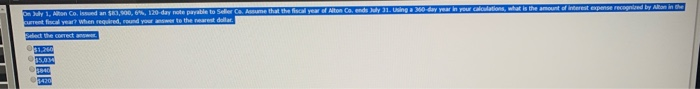

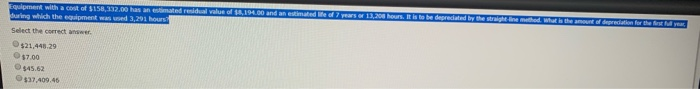

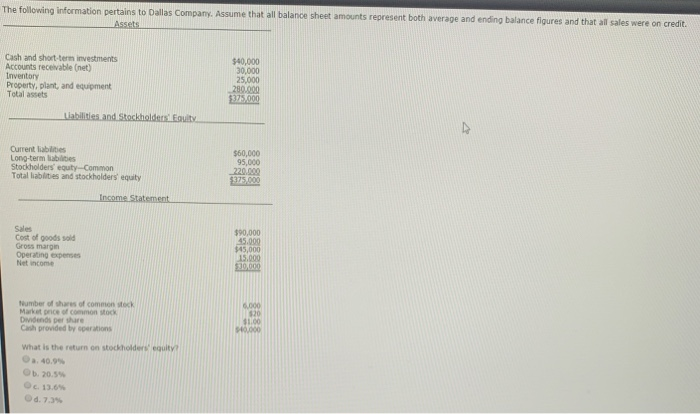

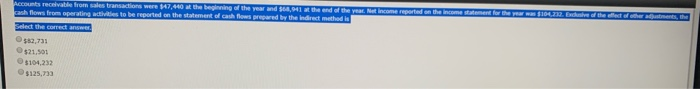

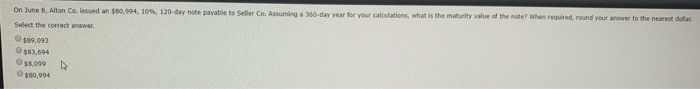

On June 8, Alton Co. issued an $0.914, 10%, 120-day note payable to Seller Co. Assuming a 360 day year for your calculations, what is the maturity value of the note? When required, round your answer to the nearest dollar Select the correct answer $89,093 $63,694 $8.09 580,994 Pndy 1. Aron Cound an $80,900,6', 120 day rate payable to Seller Co. Anume that the fiscal year ol Alton Caends July 21. Using a 30 day year in your calculations, what is the amount of interest expense recepted by Alton in the Sunt focal year? When required. Found you to the rear dollar. Select the correcta 31.260 35,03 3840 1420 Equipment with a cost of $156, 112.00 has an estimated muidul value of $0.194.00 and an estimated led years or 1.200 hours. Ils to be directed by the straight to method what is the amount sedation for the first Sing which the equipment was med 3,291 hours Select the correct answer $21,448.29 $7.00 $45.52 $37.409.46 The following information pertains to Dallas Company. Assume that all balance sheet amounts represent both average and ending balance figures and that all sales were on credit. Assets $40,000 30,000 Cash and short-term investments Accounts receivable (net) Inventory Property, plant, and equipment Total assets 25,000 280.000 $375,000 Labilities and Stockholders' Equity Current liabilities Long-term bibes Stockholders equity-Common Total liabilities and stockholders equity $60,000 95,000 220.00 $375.000 Income Statement Sales Cost of goods sold Gross marga Operating expenses Net income $90,000 45.000 $45,000 15.000 6.000 $20 Number of shares of common stock Market price of common stock Dividends per the Cash provided by operations 11.09 0.000 What is the return on stockholders' equity? b. 20.5 Accounts receivable from sales transactions were $47,440 at the beginning of the year and 64,911 at the end of the year. Net Income reported on the income statement for the rear was SOLIN Brive the dead of other arments, the cash flows from operating activities to be reported on the statement of cash flow prepared by the Indirect method is Select the correo $89.733 $21.501 $104,232 $125,733