Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need the answers for 1-4 please!!! Use the figure on p. 19 to find the a) annual base premium, and b) annual premium. All policies

need the answers for 1-4 please!!!

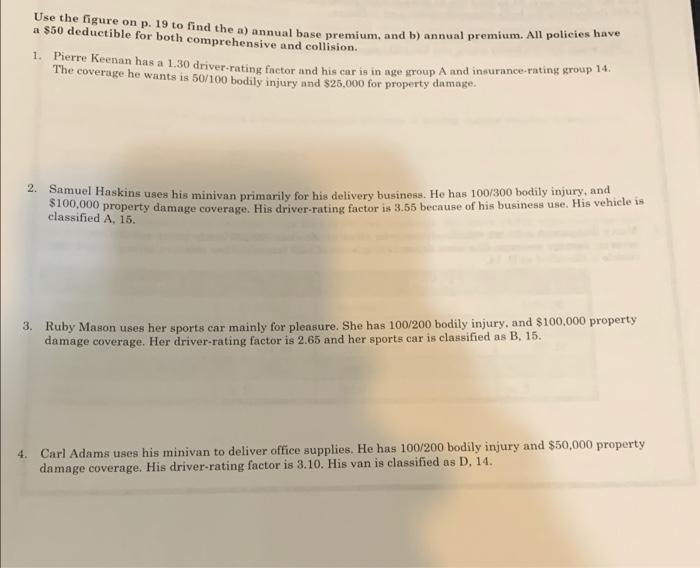

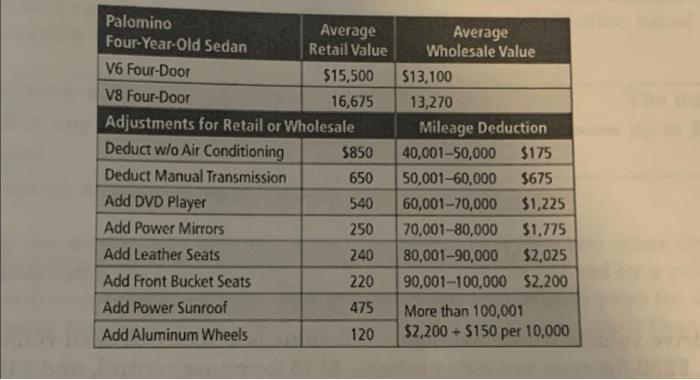

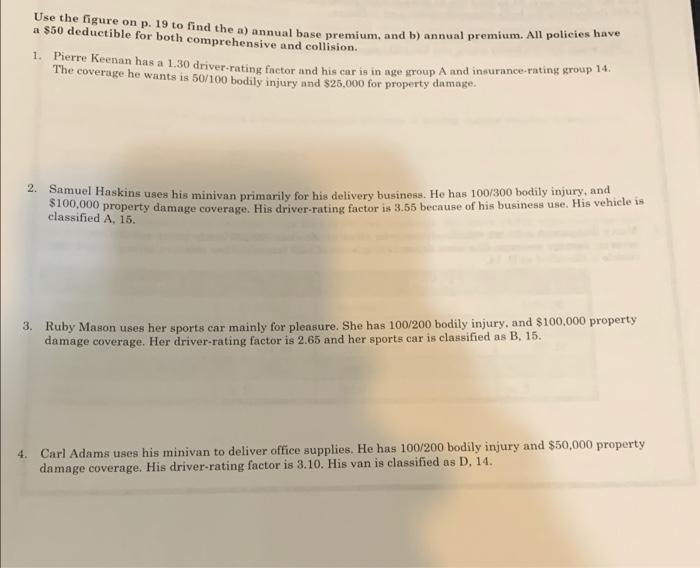

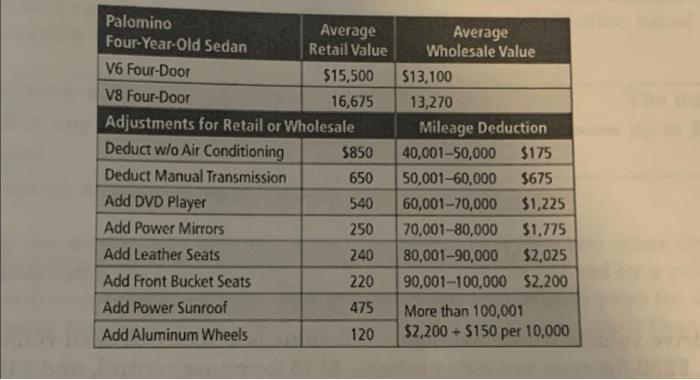

Use the figure on p. 19 to find the a) annual base premium, and b) annual premium. All policies have a $50 deductible for both comprehensive and collision. 1. Pierre Keenan has a 1.30 driver-rating factor and his car is in age group A and insurance-rating group 14. The coverage he wants is 50/100 bodily injury and $25,000 for property damage. 2. Samuel Haskins uses his minivan primarily for his delivery business. He has 100/300 bodily injury, and $100,000 property damage coverage. His driver-rating factor is 3.55 because of his business use. His vehicle is classified A, 15. 3. Ruby Mason uses her sports car mainly for pleasure. She has 100/200 bodily injury, and $100,000 property damage coverage. Her driver-rating factor is 2.65 and her sports car is classified as B, 15. 4. Carl Adams uses his minivan to deliver office supplies. He has 100/200 bodily injury and $50,000 property damage coverage. His driver-rating factor is 3.10. His van is classified as D, 14. Palomino Four-Year-Old Sedan Average Retail Value V6 Four-Door $15,500 V8 Four-Door 16,675 Adjustments for Retail or Wholesale Deduct w/o Air Conditioning $850 Deduct Manual Transmission 650 Add DVD Player 540 Add Power Mirrors 250 Add Leather Seats 240 Add Front Bucket Seats 220 Add Power Sunroof 475 Add Aluminum Wheels 120 Average Wholesale Value $13,100 13,270 Mileage Deduction 40,001-50,000 $175 50,001-60,000 $675 60,001-70,000 $1,225 70,001-80,000 $1,775 80,001-90,000 $2,025 90,001-100,000 $2,200 More than 100,001 $2,200+ $150 per 10,000 Use the figure on p. 19 to find the a) annual base premium, and b) annual premium. All policies have a $50 deductible for both comprehensive and collision. 1. Pierre Keenan has a 1.30 driver-rating factor and his car is in age group A and insurance-rating group 14. The coverage he wants is 50/100 bodily injury and $25,000 for property damage. 2. Samuel Haskins uses his minivan primarily for his delivery business. He has 100/300 bodily injury, and $100,000 property damage coverage. His driver-rating factor is 3.55 because of his business use. His vehicle is classified A, 15. 3. Ruby Mason uses her sports car mainly for pleasure. She has 100/200 bodily injury, and $100,000 property damage coverage. Her driver-rating factor is 2.65 and her sports car is classified as B, 15. 4. Carl Adams uses his minivan to deliver office supplies. He has 100/200 bodily injury and $50,000 property damage coverage. His driver-rating factor is 3.10. His van is classified as D, 14. Palomino Four-Year-Old Sedan Average Retail Value V6 Four-Door $15,500 V8 Four-Door 16,675 Adjustments for Retail or Wholesale Deduct w/o Air Conditioning $850 Deduct Manual Transmission 650 Add DVD Player 540 Add Power Mirrors 250 Add Leather Seats 240 Add Front Bucket Seats 220 Add Power Sunroof 475 Add Aluminum Wheels 120 Average Wholesale Value $13,100 13,270 Mileage Deduction 40,001-50,000 $175 50,001-60,000 $675 60,001-70,000 $1,225 70,001-80,000 $1,775 80,001-90,000 $2,025 90,001-100,000 $2,200 More than 100,001 $2,200+ $150 per 10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started