Question: Need the below information based on UPS' 2021 10k information. UPS is looking to expand its operations by 10% of the firm's net property, plant,

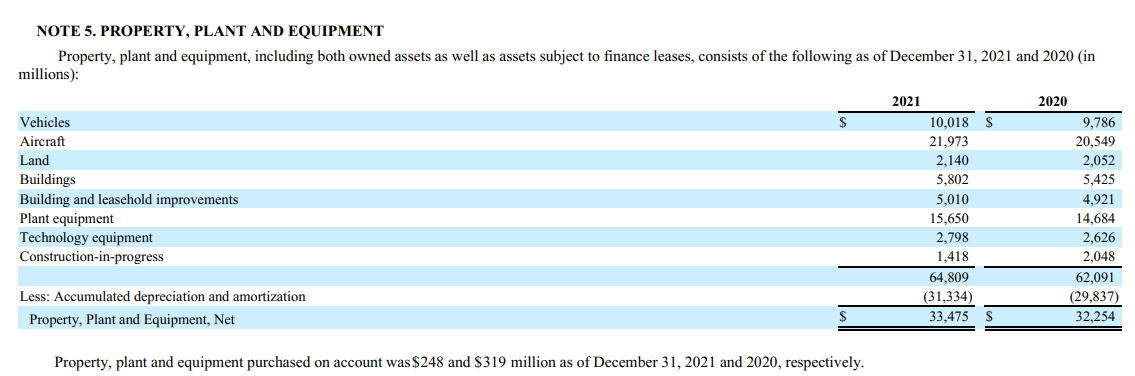

Need the below information based on UPS' 2021 10k information. UPS is looking to expand its operations by 10% of the firm's net property, plant, and equipment. (Calculate this amount by taking 10% of the property, plant, and equipment figure that appears on the firm's balance sheet.)

3,347,500,000 - 10% of property, plant & equipment

With this info, we need the following:

1. Calculations for the amount of property, plant, and equipment and the annual depreciation for the project

2. Your calculations that convert the project's EBIT to free cash flow for the 12 years of the project.

3. The following capital budgeting results for the project: a. Net present value, b. Internal rate of return, c. Profitability Index

4. Your discussion of the results that you calculated above, including a recommendation for acceptance or rejection of the project

NOTE 5. PROPERTY, PLANT AND EQUIPMENT Property, plant and equipment, including both owned assets as well as assets subject to finance leases, consists of the following as of December 31 , 2021 and 2020 (in millions): NOTE 5. PROPERTY, PLANT AND EQUIPMENT Property, plant and equipment, including both owned assets as well as assets subject to finance leases, consists of the following as of December 31 , 2021 and 2020 (in millions)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts