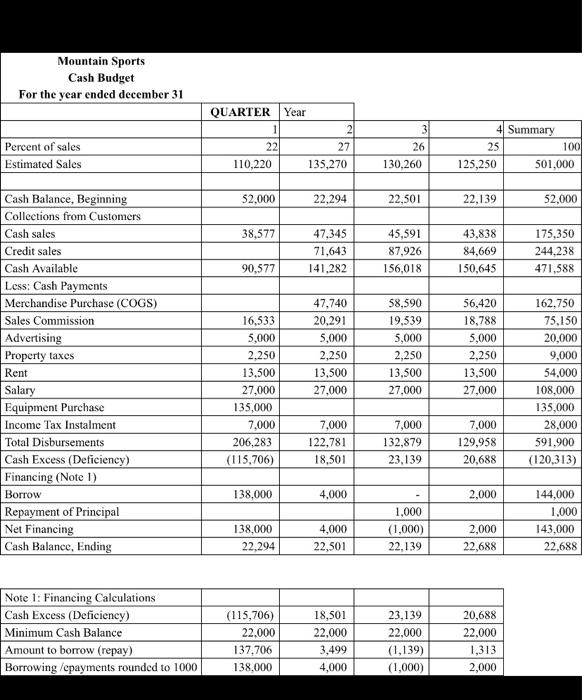

need the calculated the Cash Balance , beginning. Provide working for it. I provide answer the fitst picture with answer for it. But need to know how to calculated the cash Balance, beggining in excel format. Thanks you

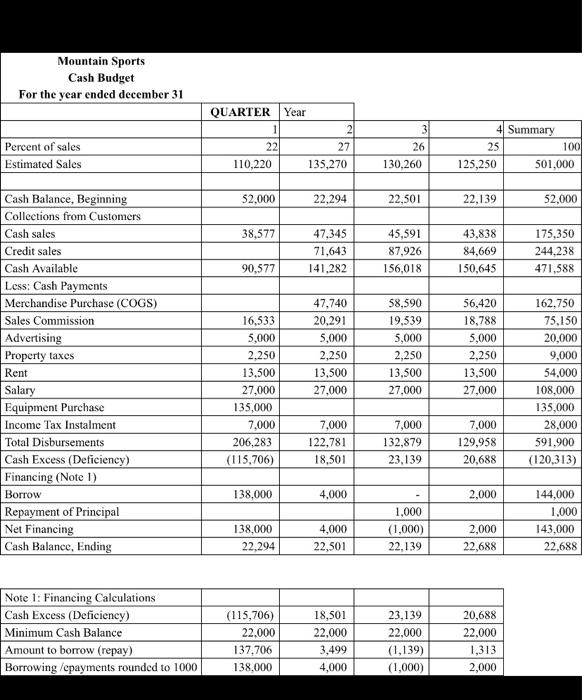

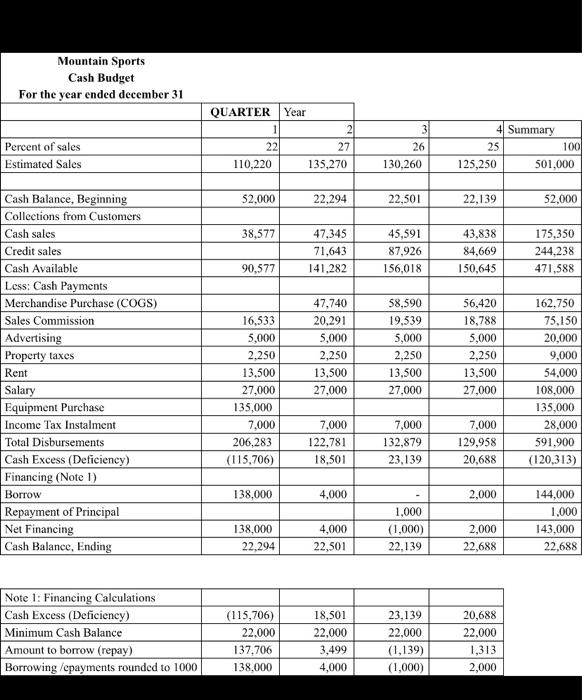

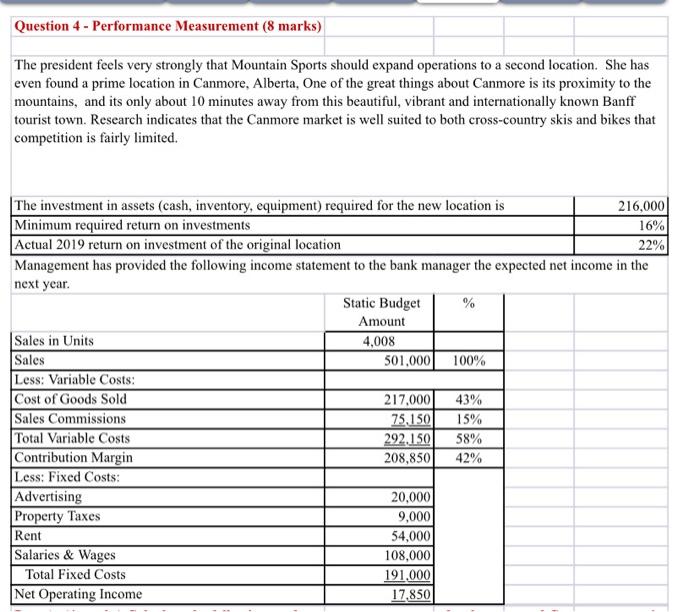

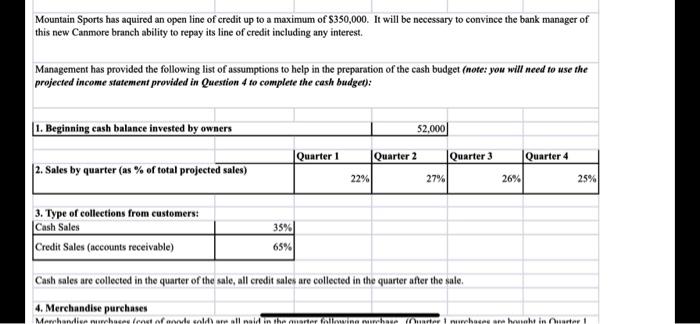

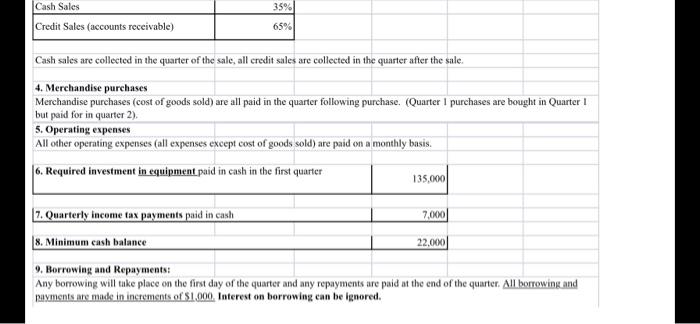

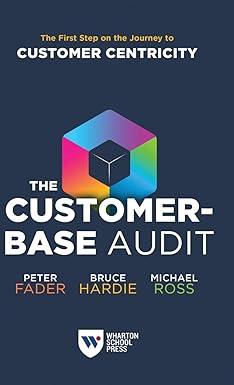

Mountain Sports Cash Budget For the year ended december 31 QUARTER Year 1 21 22 27 110,220 135,270 Percent of sales Estimated Sales 3 26 130,260 4 Summary 25 100 125,250 501,000 52,000 22,294 22,501 22,139 52,000 38,577 47,345 71,643 141.282 45,591 87,926 156,018 43,838 84,669 150,645 175,350 244.238 471,588 90,577 Cash Balance, Beginning Collections from Customers Cash sales Credit sales Cash Available Less: Cash Payments Merchandise Purchase (COGS) Sales Commission Advertising Property taxes Rent Salary Equipment Purchase Income Tax Instalment Total Disbursements Cash Excess (Deficiency) Financing (Note 1) Borrow Repayment of Principal Net Financing Cash Balance, Ending 16,533 5,000 2,250 13.500 27,000 135,000 7,000 206,283 (115.706) 47,740 20.291 5,000 2,250 13,500 27,000 58,590 19,539 5,000 2,250 13.500 27,000 56,420 18,788 5,000 2,250 13,500 27,000 162.750 75,150 20,000 9,000 54.000 108,000 135,000 28,000 591.900 (120,313) 7.000 122.781 18,501 7,000 132.879 23,139 7,000 129,958 20,688 138.000 4,000 2,000 144,000 1,000 143,000 22,688 138,000 22,294 1,000 (1,000) 22,139 4,000 22,501 2,000 22,688 Note 1: Financing Calculations Cash Excess (Deficiency) Minimum Cash Balance Amount to borrow (repay) Borrowing/cpayments rounded to 1000 (115,706) 22.000 137,706 138,000 18,501 22,000 3,499 4,000 23.139 22,000 (1,139) (1,000) 20,688 22,000 1,313 2,000 Question 4 - Performance Measurement (8 marks) The president feels very strongly that Mountain Sports should expand operations to a second location. She has even found a prime location in Canmore, Alberta, One of the great things about Canmore is its proximity to the mountains, and its only about 10 minutes away from this beautiful, vibrant and internationally known Banff tourist town. Research indicates that the Canmore market is well suited to both cross-country skis and bikes that competition is fairly limited. The investment in assets (cash, inventory, equipment) required for the new location is 216,000 Minimum required return on investments 16% Actual 2019 return on investment of the original location 22% Management has provided the following income statement to the bank manager the expected net income in the next year. Static Budget Amount Sales in Units 4,008 Sales 501,000 100% Less: Variable Costs: Cost of Goods Sold 217.000 43% Sales Commissions 75,150 15% Total Variable Costs 292,150 58% Contribution Margin 208,850 42% Less: Fixed Costs: Advertising 20,000 Property Taxes 9,000 Rent 54,000 Salaries & Wages 108,000 Total Fixed Costs 191.000 Net Operating Income 17,850 Mountain Sports has aquired an open line of credit up to a maximum of $350,000. It will be necessary to convince the bank manager of this new Canmore branch ability to repay its line of credit including any interest. Management has provided the following list of assumptions to help in the preparation of the cash budget (note: you will need to use the projected income statement provided in Question 4 to complete the cash budget): 1. Beginning cash balance invested by owners 52,000 Quarter 1 Quarter 2 Quarter 3 Quarter 4 2. Sales by quarter (as % of total projected sales) 22% 27% 26% 25% 3. Type of collections from customers: Cash Sales Credit Sales (accounts receivable) 35% 65% Cash sales are collected in the quarter of the sale, all credit sales are collected in the quarter after the sale. 4. Merchandise purchases Merchandise whose langt afate saldare all aid in the unter Aina muhase Charter turchese are wat in Carte 1 Cash Sales 35% Credit Sales (accounts receivable) 65% Cash sales are collected in the quarter of the sale, all credit sales are collected in the quarter after the sale. 4. Merchandise purchases Merchandise purchases (cost of goods sold) are all paid in the quarter following purchase. (Quarter I purchases are bought in Quarter 1 but paid for in quarter 2) 5. Operating expenses All other operating expenses (all expenses except cost of goods sold) are paid on a monthly basis. 6. Required investment in equipment paid in cash in the first quarter 135.000 7. Quarterly income tax payments paid in cash 7.000 8. Minimum cash balance 22.000 9. Borrowing and Repayments: Any borrowing will take place on the first day of the quarter and any repayments are paid at the end of the quarter. All borrowing and payments are made in increments of $1.000. Interest on borrowing can be ignored. 9. Borrowing and Repayments Any borrowing will take place on the first day of the quarter and any repayments are paid at the end of the quartet All becoming payments are made in increments of S1000. Interest on borrowing can be ignored Required. Prepare a cash budget for the first year of operation in Cantere by quarter and in total Show clearly on year budget the quarters) in which borrowing will be needed and the quarter(s) in which repayments can be made, as requested by the company's bank Mountain Sports Cash Budget For the year ended December 31 Quarter Year Percent of Sales Estimated Sales 52.000 CASH BALANCE. Beginning Collections from customers Cash Sales Credit Sales CASH AVAILABLE Less: Cash Payments Merchandise purchases (Cois) Sales Com Advertising Property Taxes Rent salaries & Wages Equipment Purchase Income tax Installment Total Disbursements Cash Excess Deficiency) Financing (Note 1) Borrow Repayment of Principal shows negative) Net Financing Cash Balance, Ending Note 1: Financing Calculations Cash excess Deficiency) Minimum cash balance Amount to borrow repay Borrowing (Repayments) Rounded to increment of 1,000