Answered step by step

Verified Expert Solution

Question

1 Approved Answer

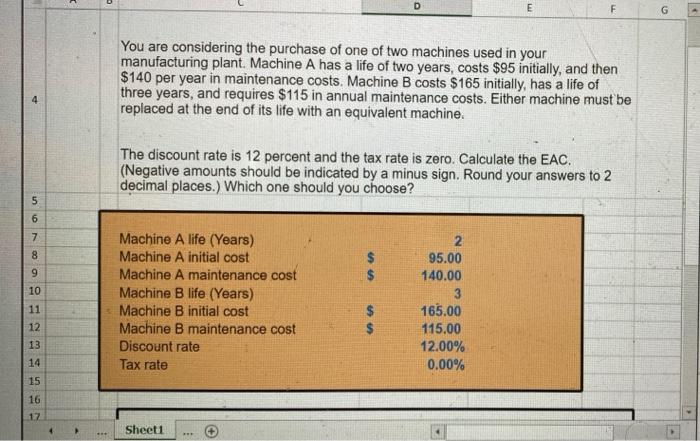

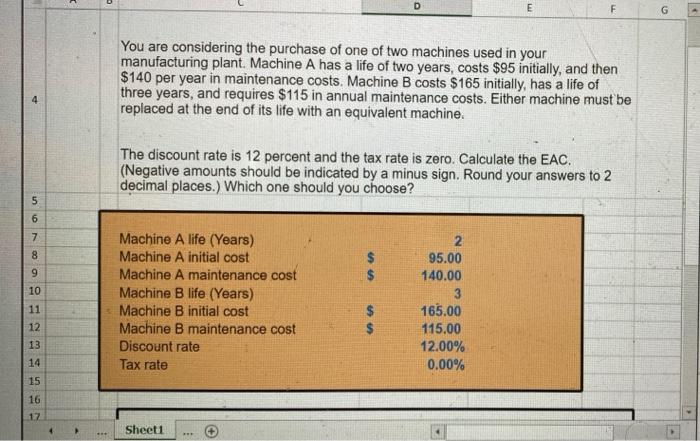

need the excel formulas for this question. Thanks E F G . You are considering the purchase of one of two machines used in your

need the excel formulas for this question. Thanks

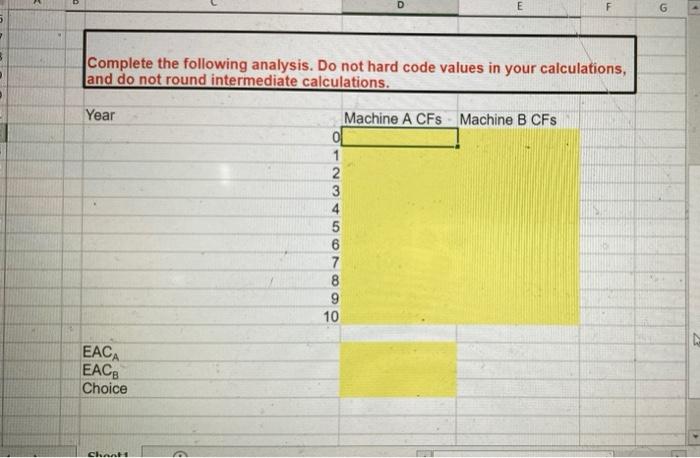

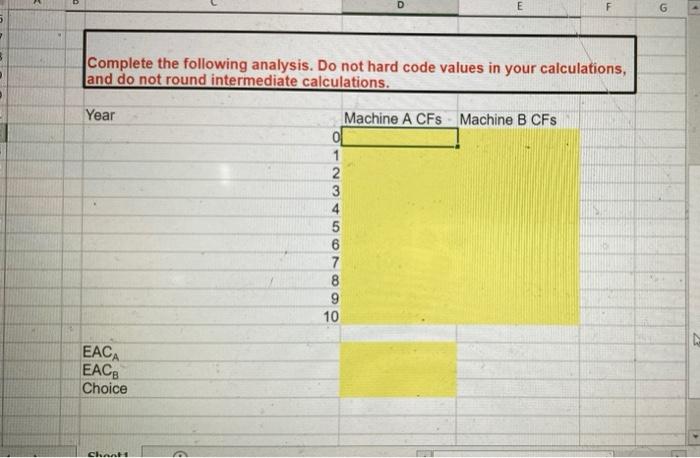

E F G . You are considering the purchase of one of two machines used in your manufacturing plant. Machine A has a life of two years, costs $95 initially, and then $140 per year in maintenance costs. Machine B costs $165 initially, has a life of three years, and requires $115 in annual maintenance costs. Either machine must be replaced at the end of its life with an equivalent machine. 4 The discount rate is 12 percent and the tax rate is zero. Calculate the EAC. (Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places. Which one should you choose? 5 6 7 8 9 10 Machine A life (Years) Machine A initial cost Machine A maintenance cost Machine B life (Years) Machine B initial cost Machine B maintenance cost Discount rate Tax rate 2 95.00 140.00 3 165.00 115.00 12.00% 0.00% $ A 11 12 13 14 15 16 17 Sheet1 + E G G 6 2 Complete the following analysis. Do not hard code values in your calculations, and do not round intermediate calculations. Year WN Machine A CFs Machine B CFs 0 1 2 3 4 5 6 7 8 9 10 IN EACA EACE Choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started