need the qurestions asnwered and if possible added to excel!

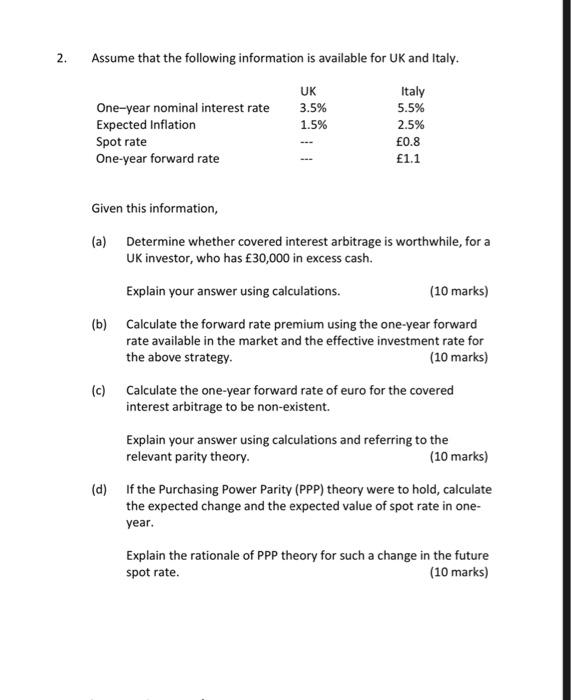

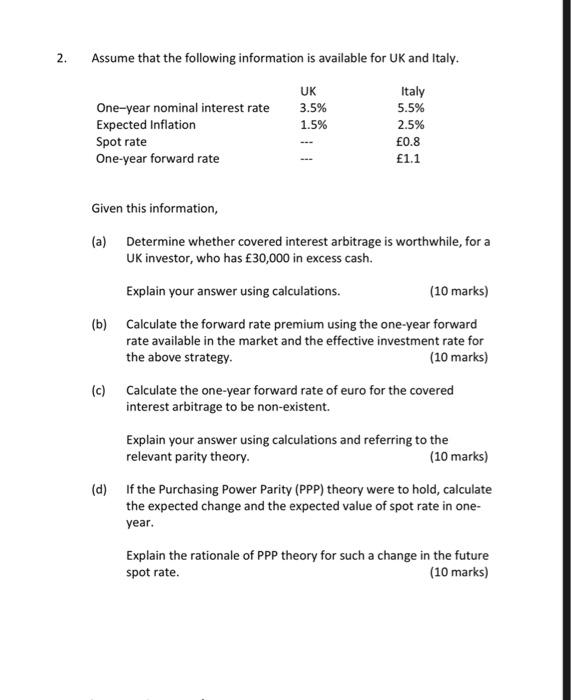

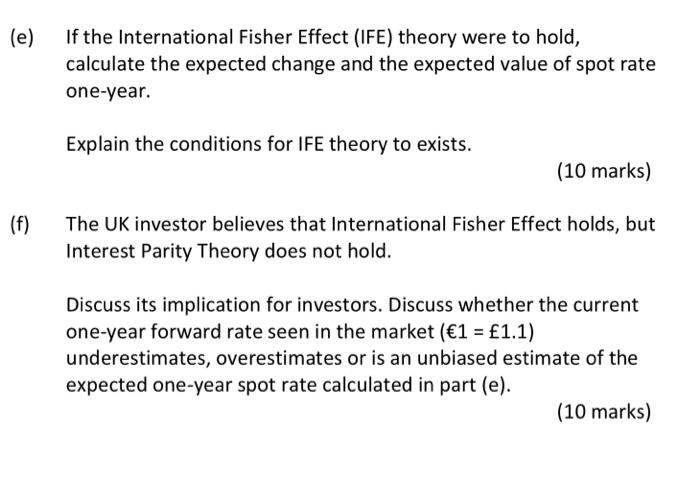

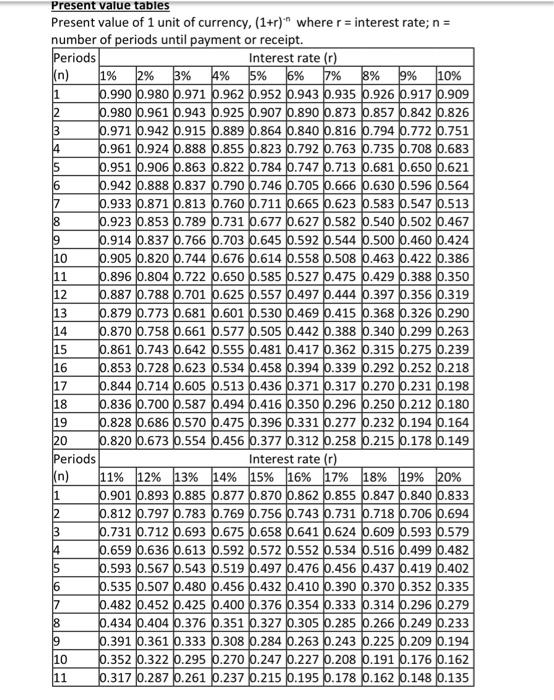

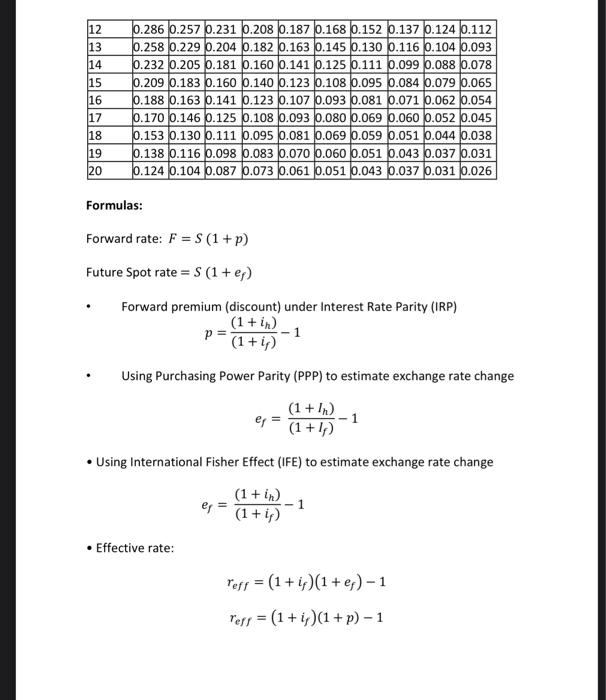

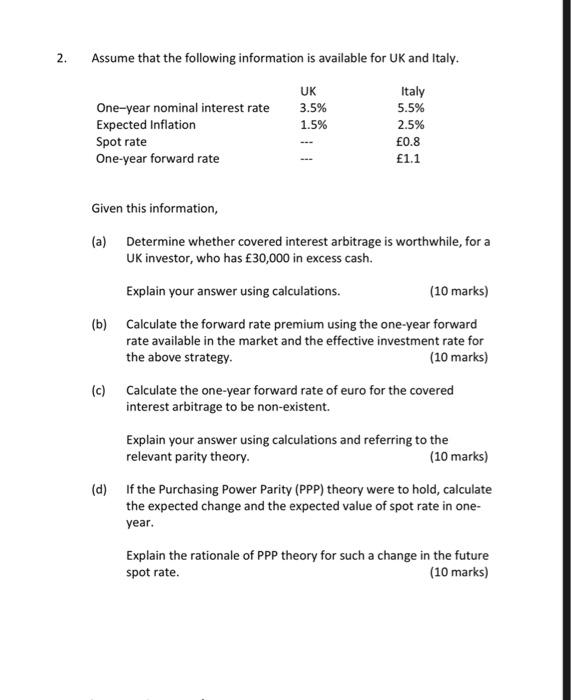

2. Assume that the following information is available for UK and Italy. UK 3.5% 1.5% One-year nominal interest rate Expected Inflation Spot rate One-year forward rate Italy 5.5% 2.5% 0.8 1.1 Given this information, (a) Determine whether covered interest arbitrage is worthwhile, for a UK investor, who has 30,000 in excess cash. Explain your answer using calculations. (10 marks) (b) Calculate the forward rate premium using the one-year forward rate available in the market and the effective investment rate for the above strategy (10 marks) (c) Calculate the one-year forward rate of euro for the covered interest arbitrage to be non-existent. Explain your answer using calculations and referring to the relevant parity theory. (10 marks) (d) If the Purchasing Power Parity (PPP) theory were to hold, calculate the expected change and the expected value of spot rate in one- year. Explain the rationale of PPP theory for such a change in the future spot rate. (10 marks) (e) If the International Fisher Effect (IFE) theory were to hold, calculate the expected change and the expected value of spot rate one-year. Explain the conditions for IFE theory to exists. (10 marks) (f) The UK investor believes that International Fisher Effect holds, but Interest Parity Theory does not hold. Discuss its implication for investors. Discuss whether the current one-year forward rate seen in the market (1 = 1.1) underestimates, overestimates or is an unbiased estimate of the expected one-year spot rate calculated in part (e). (10 marks) 3% 18 Present value tables Present value of 1 unit of currency, (1+r)" where r = interest rate; n = number of periods until payment or receipt. Periods Interest rate() (n) 1% 2% 4% 5% 6% 7% 8% 9% 10% 1 6.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 5.857 0.842 0.826 3 60.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 4 6.961 0.924 0.888 6.855 6.823 0.792 0.763 0.735 0.708 0.683 15 6.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 16 6.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 7 0.933 0.871 0.813 6.760 0.711 0.665 0.623 0.583 0.547 0.513 6.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 19 6.914 0.837 0.766 5.703 0.645 0.592 6.544 6.500 0.460 0.424 10 6.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 11 0.896 0.804 0.722 6.650 0.585 0.527 0.475 0.429 0.388 0.350 12 6.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 13 0.879 0.773 0.681 6.601 0.530 0.469 0.415 0.368 0.326 0.290 14 6.870 0.758 0.661 6.577 0.505 0.442 0.388 6.340 0.299 0.263 15 0.861 0.743 0.642 6.555 0.481 0.417 0.362 0.315 0.275 0.239 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 6.250 0.212 0.180 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 6.215 0.178 0.149 Periods Interest rate (r) (n) 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1 6.901 0.893 0.885 0.877 6.870 0.862 0.855 0.847 0.840 0.833 2 6.812 0.797 0.783 0.769 0.756 0.743 0.731 0.7180.706 0.694 3 0.731 0.712 0.693 6.675 0.658 0.641 0.624 0.609 0.593 0.579 4 0.659 0.636 0.613 6.592 0.572 0.552 0.534 0.516 0.499 0.482 15 6.593 0.567 0.543 6.519 0.497 0.476 0.456 0.437 0.419 0.402 6 0.535 0.507 0.480 6.456 0.432 0.410 0.390 0.370 0.352 0.335 17 6.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 18 6.434 0.404 0.376 0.351 0.327 0.305 0.285 6.266 0.2490.233 9 0.391 0.361 0.333 6.308 0.284 0.263 0.243 0.225 0.209 0.194 10 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 11 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 12 13 14 15 16 17 18 19 20 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.232 0.205 0.181 6.160 0.141 0.125 0.111 0.099 0.088 0.078 0.209 0.183 6.160 5.140 0.123 0.108 0.095 0.084 0.079 0.065 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.153 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.124 0.104 0.087 6.073 0.061 0.051 0.043 0.037 0.031 0.026 Formulas: Forward rate: F = S(1 + p) Future Spot rate = 5 (1 + en) Forward premium (discount) under Interest Rate Parity (IRP) (1 + in) p= - 1 (1 + i) Using Purchasing Power Parity (PPP) to estimate exchange rate change er = (1 + I) (1 +11) . Using International Fisher Effect (IFE) to estimate exchange rate change er = (1 + in -1 (1 + ip) Effective rate: refs= (1 + i)(1 + r) - 1 rere = (1 + i)(1 +p) - 1 2. Assume that the following information is available for UK and Italy. UK 3.5% 1.5% One-year nominal interest rate Expected Inflation Spot rate One-year forward rate Italy 5.5% 2.5% 0.8 1.1 Given this information, (a) Determine whether covered interest arbitrage is worthwhile, for a UK investor, who has 30,000 in excess cash. Explain your answer using calculations. (10 marks) (b) Calculate the forward rate premium using the one-year forward rate available in the market and the effective investment rate for the above strategy (10 marks) (c) Calculate the one-year forward rate of euro for the covered interest arbitrage to be non-existent. Explain your answer using calculations and referring to the relevant parity theory. (10 marks) (d) If the Purchasing Power Parity (PPP) theory were to hold, calculate the expected change and the expected value of spot rate in one- year. Explain the rationale of PPP theory for such a change in the future spot rate. (10 marks) (e) If the International Fisher Effect (IFE) theory were to hold, calculate the expected change and the expected value of spot rate one-year. Explain the conditions for IFE theory to exists. (10 marks) (f) The UK investor believes that International Fisher Effect holds, but Interest Parity Theory does not hold. Discuss its implication for investors. Discuss whether the current one-year forward rate seen in the market (1 = 1.1) underestimates, overestimates or is an unbiased estimate of the expected one-year spot rate calculated in part (e). (10 marks) 3% 18 Present value tables Present value of 1 unit of currency, (1+r)" where r = interest rate; n = number of periods until payment or receipt. Periods Interest rate() (n) 1% 2% 4% 5% 6% 7% 8% 9% 10% 1 6.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 5.857 0.842 0.826 3 60.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 4 6.961 0.924 0.888 6.855 6.823 0.792 0.763 0.735 0.708 0.683 15 6.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 16 6.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 7 0.933 0.871 0.813 6.760 0.711 0.665 0.623 0.583 0.547 0.513 6.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 19 6.914 0.837 0.766 5.703 0.645 0.592 6.544 6.500 0.460 0.424 10 6.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 11 0.896 0.804 0.722 6.650 0.585 0.527 0.475 0.429 0.388 0.350 12 6.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 13 0.879 0.773 0.681 6.601 0.530 0.469 0.415 0.368 0.326 0.290 14 6.870 0.758 0.661 6.577 0.505 0.442 0.388 6.340 0.299 0.263 15 0.861 0.743 0.642 6.555 0.481 0.417 0.362 0.315 0.275 0.239 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 6.250 0.212 0.180 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 6.215 0.178 0.149 Periods Interest rate (r) (n) 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1 6.901 0.893 0.885 0.877 6.870 0.862 0.855 0.847 0.840 0.833 2 6.812 0.797 0.783 0.769 0.756 0.743 0.731 0.7180.706 0.694 3 0.731 0.712 0.693 6.675 0.658 0.641 0.624 0.609 0.593 0.579 4 0.659 0.636 0.613 6.592 0.572 0.552 0.534 0.516 0.499 0.482 15 6.593 0.567 0.543 6.519 0.497 0.476 0.456 0.437 0.419 0.402 6 0.535 0.507 0.480 6.456 0.432 0.410 0.390 0.370 0.352 0.335 17 6.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 18 6.434 0.404 0.376 0.351 0.327 0.305 0.285 6.266 0.2490.233 9 0.391 0.361 0.333 6.308 0.284 0.263 0.243 0.225 0.209 0.194 10 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 11 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 12 13 14 15 16 17 18 19 20 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.232 0.205 0.181 6.160 0.141 0.125 0.111 0.099 0.088 0.078 0.209 0.183 6.160 5.140 0.123 0.108 0.095 0.084 0.079 0.065 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.153 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.124 0.104 0.087 6.073 0.061 0.051 0.043 0.037 0.031 0.026 Formulas: Forward rate: F = S(1 + p) Future Spot rate = 5 (1 + en) Forward premium (discount) under Interest Rate Parity (IRP) (1 + in) p= - 1 (1 + i) Using Purchasing Power Parity (PPP) to estimate exchange rate change er = (1 + I) (1 +11) . Using International Fisher Effect (IFE) to estimate exchange rate change er = (1 + in -1 (1 + ip) Effective rate: refs= (1 + i)(1 + r) - 1 rere = (1 + i)(1 +p) - 1