Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need the right answers only. please show working. Use EXCEL please Some of the information found on a detailed inventory card for Bramble Stationery Ltd.

Need the right answers only. please show working. Use EXCEL please

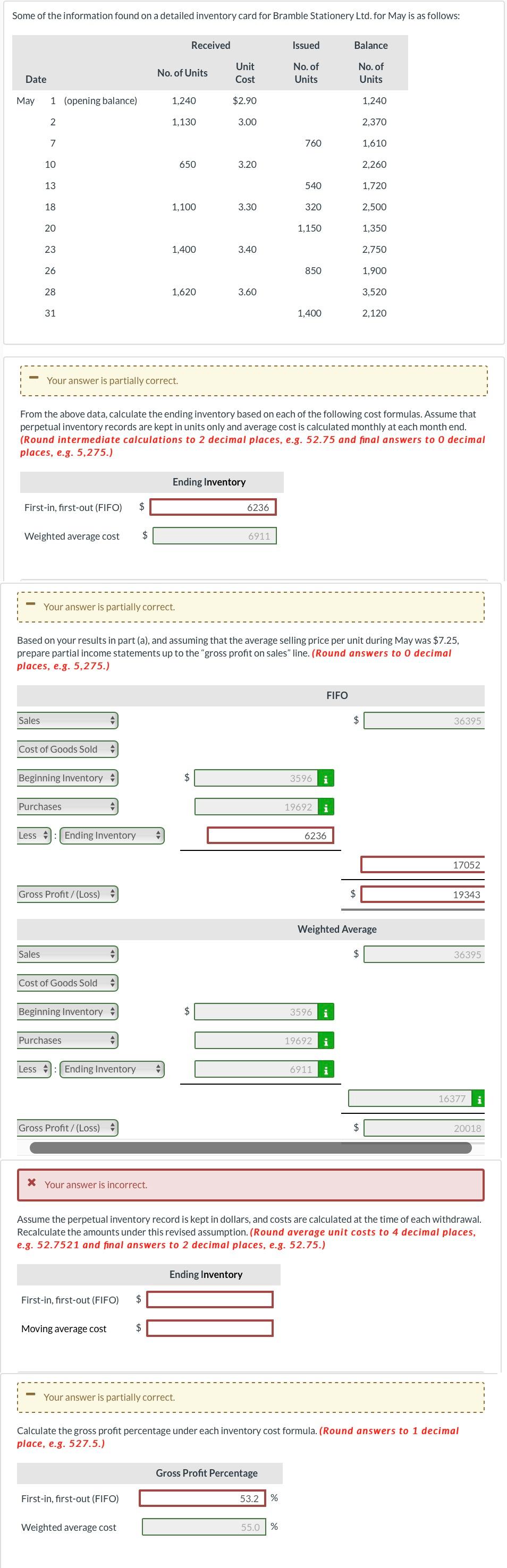

Some of the information found on a detailed inventory card for Bramble Stationery Ltd. for May is as follows: Received Issued Balance No. of Units Unit Cost No. of Units No. of Units Date May 1 (opening balance) 1,240 $2.90 1,240 2 1,130 3.00 2,370 7 760 1,610 10 650 3.20 2,260 13 540 1,720 18 1,100 3.30 320 2,500 20 1,150 1,350 23 1,400 3.40 2.750 26 850 1,900 28 1,620 3.60 3,520 31 1,400 2,120 Your answer is partially correct. From the above data, calculate the ending inventory based on each of the following cost formulas. Assume that perpetual inventory records are kept in units only and average cost is calculated monthly at each month end. (Round intermediate calculations to 2 decimal places, e.g. 52.75 and final answers to O decimal places, e.g. 5,275.) Ending Inventory First-in, first-out (FIFO) $ 6236 Weighted average cost $ 6911 Your answer is partially correct. Based on your results in part (a), and assuming that the average selling price per unit during May was $7.25, prepare partial income statements up to the "gross profit on sales" line. (Round answers to O decimal places, e.g. 5,275.) FIFO Sales $ 36395 Cost of Goods Sold Beginning Inventory $ 3596 Purchases 19692 i Less 4 Ending Inventory 6236 17052 Gross Profit/(Loss) 19343 Weighted Average Sales $ 36395 Cost of Goods Sold Beginning Inventory 3596 i Purchases 19692 i Less : Ending Inventory 6911 16377 Gross Profit/(Loss) 20018 X Your answer is incorrect. Assume the perpetual inventory record is kept in dollars, and costs are calculated at the time of each withdrawal. Recalculate the amounts under this revised assumption. (Round average unit costs to 4 decimal places, e.g. 52.7521 and final answers to 2 decimal places, e.g. 52.75.) Ending Inventory First-in, first-out (FIFO) $ Moving average cost $ Your answer is partially correct. Calculate the gross profit percentage under each inventory cost formula. (Round answers to 1 decimal place, e.g. 527.5.) Gross Profit Percentage First-in, first-out (FIFO) 53.2 % Weighted average cost 55.0 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started