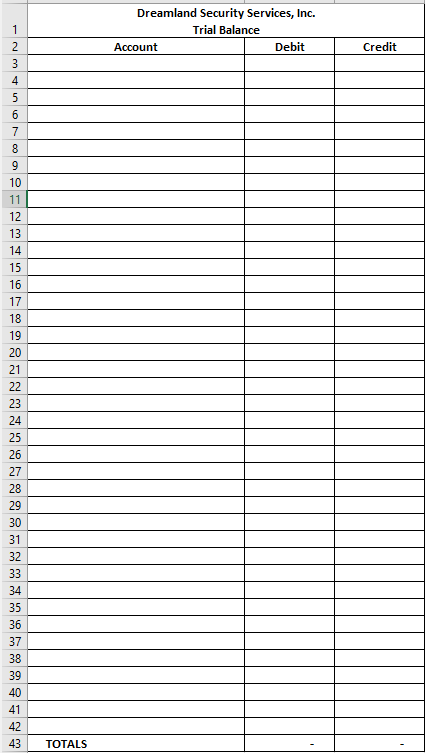

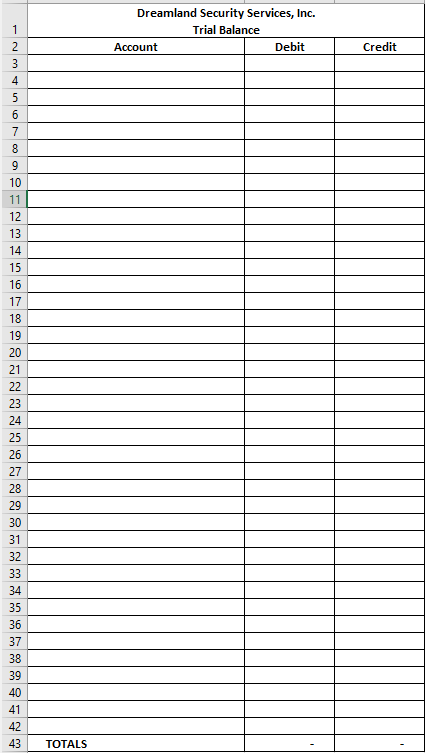

Need the Trial Balance (not General Journal) in spreadsheet form for the following:

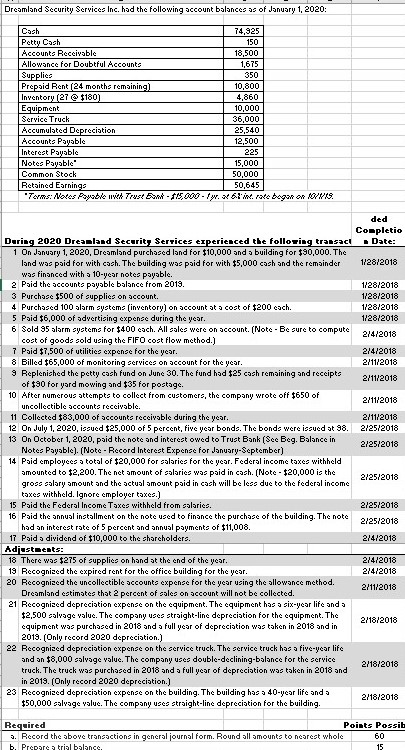

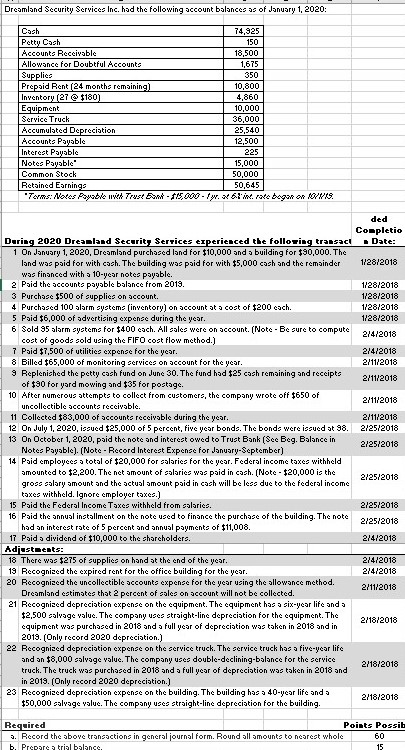

Dreamland Security Services Inc. had e following sccount balances of Jonuory 1, 2020: 74,925 150 18,500 350 0,800 4,860 10,000 36,000 25,540 12,500 225 15,000 50,000 50,645 27 $180 Payable Payable Common Stock Terms: Notes Payable with Tnst EaA- 5,000-t yr, at 6t int. ,ate began ot tours. ded Co pletio Daring 2020 Drealand Secarity Serrices eperienced the folloring tra sacl Date: 1 On January 1, 2020, Dreamland purchased land for $10,000 andbuilding for $30,000. The land wos paid for with c.The building wos paid for with $5,000 cash and the remainder wos financed witho 10-year notes poyable. Paid the sccounts payable balance from 2013 3 Purchase $500 of supplies on account. 4 Purchased 100 alarm systems (inventory) on account atcost of $200 each 5 Paid $6,000 of advertising expense during the year 6 Sold 35 alarm ystems for $400 each. All e were on account. (Note Be ure to compute 112812018 128/2018 112812018 12812018 cost of goods sold using the FIFO cost flow method.) 21412018 211112018 7 Paid $7,500 of utilities expense for the year. Billed $65,000 of monitoring services on account for the year Replenished the petty cash fund on June 30. The fund had 125 cach remaining and receipts 20 of $90 for yard mowing and $35 for postage. 10 After numerous attempts to collect from customers, the company wrote off $650 of 211112018 uncollectible accounts receivable. 11 Collected $83,000 of accounts receivable during the year 12 On July 1, 2020, isued $25,000 of 5 percent, five year bonds. The bonds were issued at 38. 212512018 13 On October 1, 2020, paid the note and interest owed to Trust Bank See Beg. Balance in 211112018 212512018 Notes Payable).(Note-Record Interest Expense for January-September) 14 paid employeestotal of $20,000 for salaries for the year. Federal income taxes withheld amounted to $2,200. The net mount of salaries was paid in cach. (Note $20,000 is the grossoy mount and the actual amount paid in cash will be less due to the federal income taxes withheld. Ignore employer taxes.) 15 Paid the Federal Income Taxes withheld from solarie 16 Paid the annual installment on the note used to finance the purchase of the buildin 212512018 .The not A. 212512018 had an interest rate of 5 percent and annual payments of $11,008 17 Paid o dividend of $10,000 to the sharcholder Adiusteats There was $275 of supplies on hand at the end of the year 21412018 1 Recognized the expired rent for the office building for the year 20 Recognized the uncollectible accounts expense for the year using the allowance method. 2111/2018 Dreamland estimates that 2 percent of soles on account will not be collected. 21 Recognized depreciation expense on the equipment. The equipment has six-year life and 2,500 lvage volue. The company uses straight-line depreciton for the equipment. The equipment was purchased in 2018 andfull year of depreciation was taken in 2018 and in 201. Only record 2020 depreciation.) 218/2018 22 Recognized depreciation expense on the service truck. The service truck has five-year life and an $3.000 salvage value. The company uses double-declining-balance for the service truck. The truck was purchased in 2018ndfull year of depreciation was taken in 2018 and in 2013. (Only record 2020 depreciation.) 2/18/2018 23 Recognized depreciation expense on the building. The building has40-year life and 218/2018 $50,000 salvoge value. The company uses straight-line depreciation for the building. Req ired Points Possib . Record the above transactions in general journal form. Round all amounts to nearest whole