need this asap!

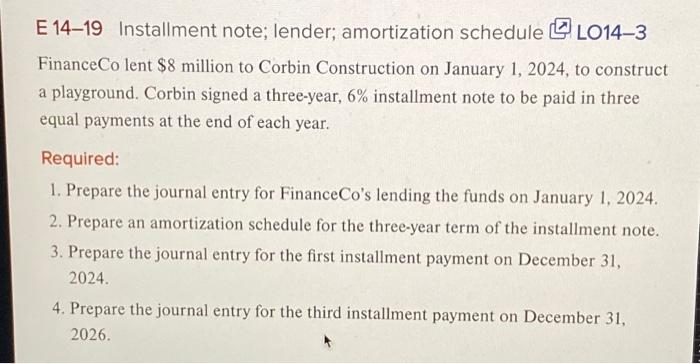

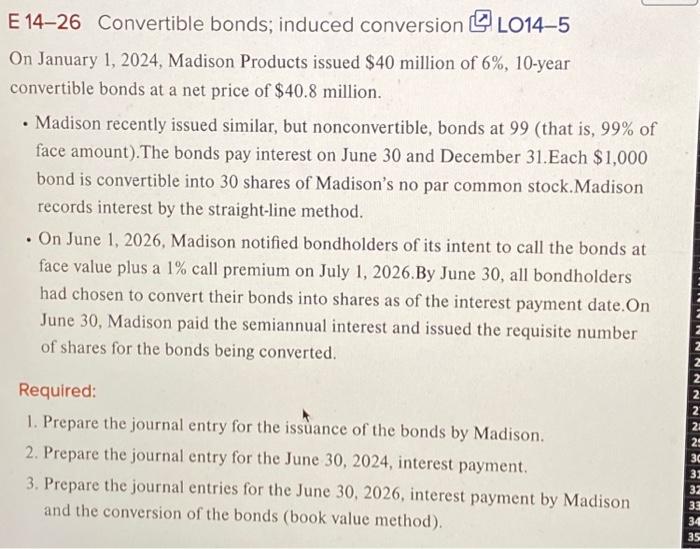

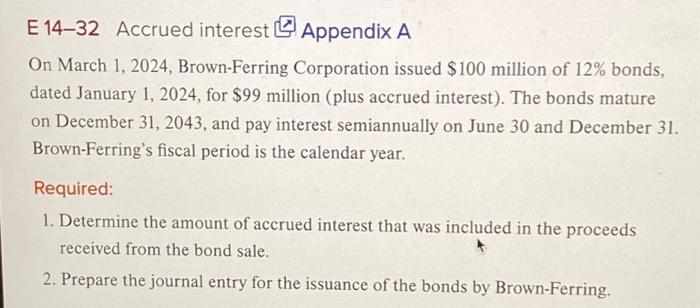

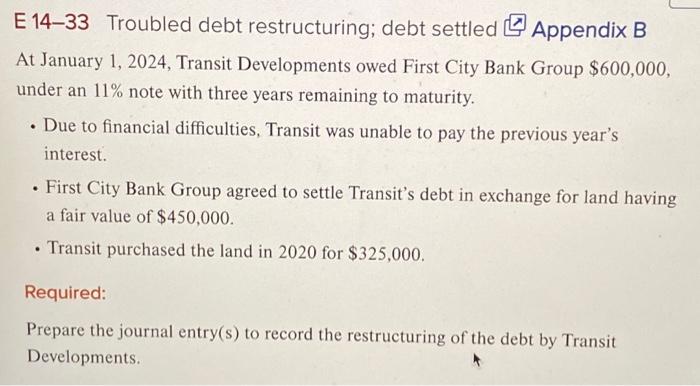

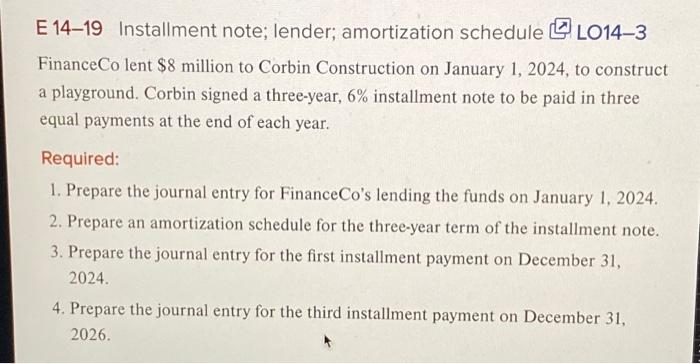

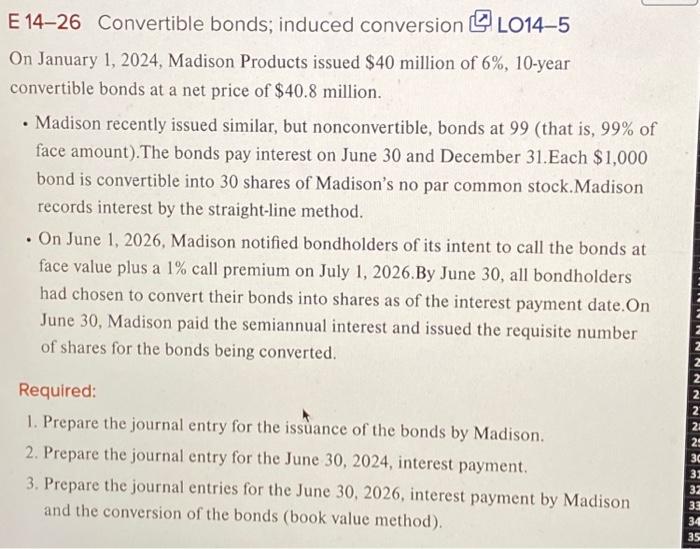

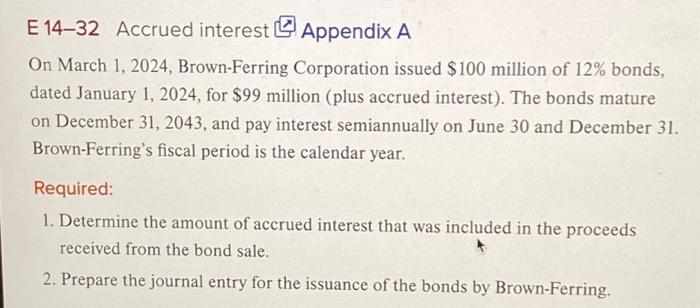

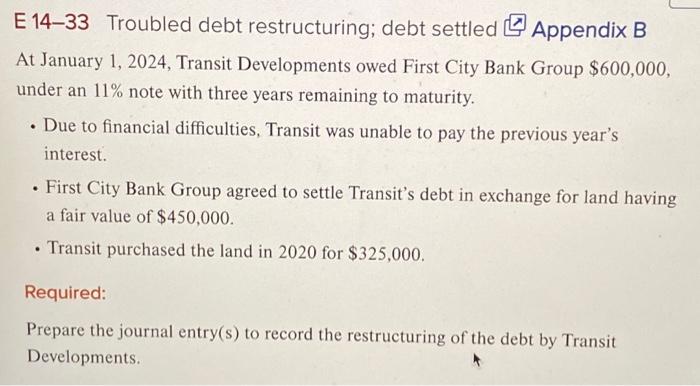

E 14-19 Installment note; lender; amortization schedule LO14-3 FinanceCo lent \$8 million to Corbin Construction on January 1, 2024, to construct a playground. Corbin signed a three-year, 6% installment note to be paid in three equal payments at the end of each year. Required: 1. Prepare the journal entry for FinanceCo's lending the funds on January 1, 2024. 2. Prepare an amortization schedule for the three-year term of the installment note. 3. Prepare the journal entry for the first installment payment on December 31 , 2024. 4. Prepare the journal entry for the third installment payment on December 31 , 2026. On January 1, 2024, Madison Products issued $40 million of 6%, 10-year convertible bonds at a net price of $40.8 million. - Madison recently issued similar, but nonconvertible, bonds at 99 (that is, 99% of face amount). The bonds pay interest on June 30 and December 31.Each $1,000 bond is convertible into 30 shares of Madison's no par common stock.Madison records interest by the straight-line method. - On June 1,2026, Madison notified bondholders of its intent to call the bonds at face value plus a 1% call premium on July 1, 2026. By June 30, all bondholders had chosen to convert their bonds into shares as of the interest payment date.On June 30, Madison paid the semiannual interest and issued the requisite number of shares for the bonds being converted. Required: 1. Prepare the journal entry for the issuance of the bonds by Madison. 2. Prepare the journal entry for the June 30,2024 , interest payment. 3. Prepare the journal entries for the June 30,2026 , interest payment by Madison and the conversion of the bonds (book value method). E 14-32 Accrued interest Appendix A On March 1, 2024, Brown-Ferring Corporation issued \$100 million of 12% bonds, dated January 1, 2024, for $99 million (plus accrued interest). The bonds mature on December 31, 2043, and pay interest semiannually on June 30 and December 31. Brown-Ferring's fiscal period is the calendar year. Required: 1. Determine the amount of accrued interest that was included in the proceeds received from the bond sale. 2. Prepare the journal entry for the issuance of the bonds by Brown-Ferring. E 14-33 Troubled debt restructuring; debt settled [[ Appendix B At January 1, 2024, Transit Developments owed First City Bank Group $600,000, under an 11% note with three years remaining to maturity. - Due to financial difficulties, Transit was unable to pay the previous year's interest. - First City Bank Group agreed to settle Transit's debt in exchange for land having a fair value of $450,000. - Transit purchased the land in 2020 for $325,000. Required: Prepare the journal entry(s) to record the restructuring of the debt by Transit Developments