NEED THIS CALCULATED FOR YEARS 1-4

NEED THIS CALCULATED FOR YEARS 1-4

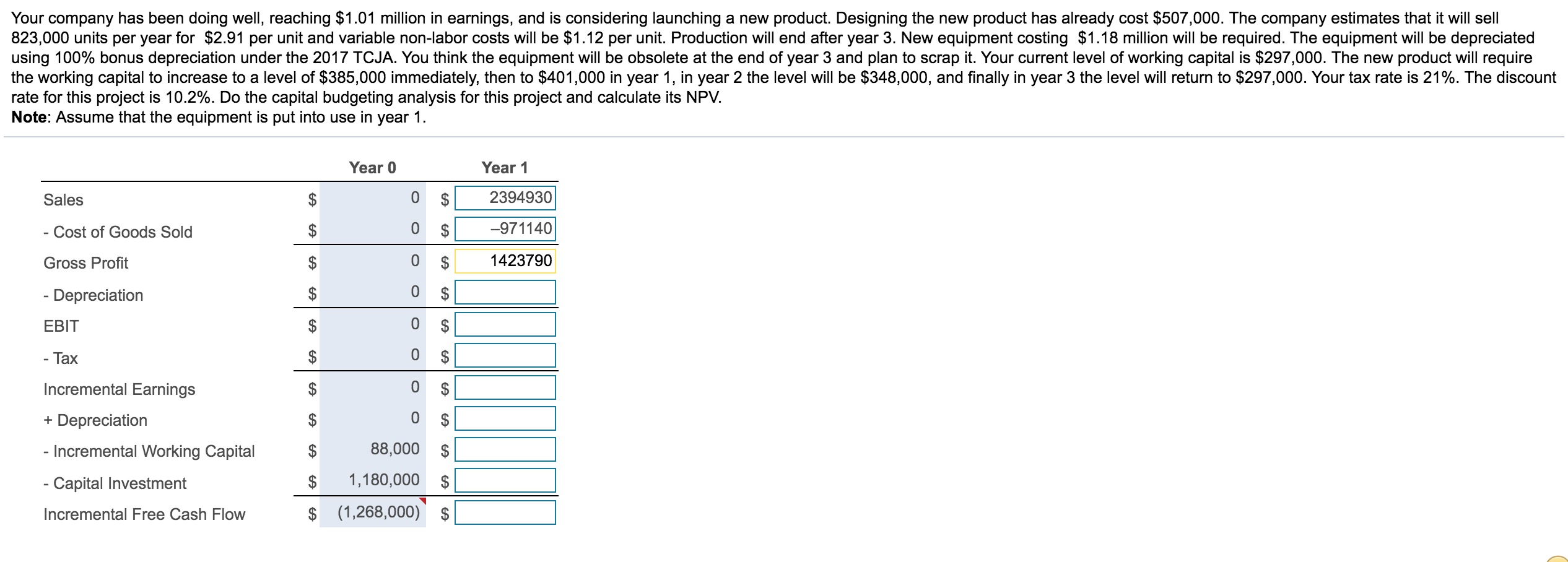

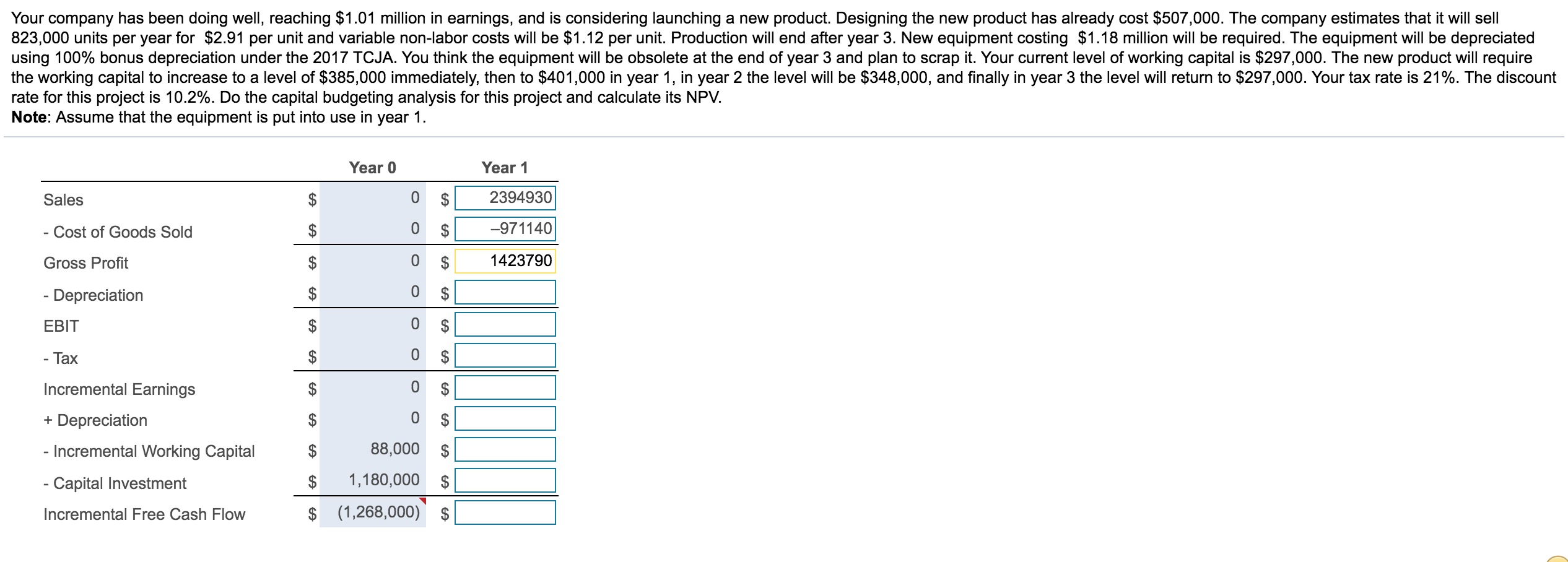

Your company has been doing well, reaching $1.01 million in earnings, and is considering launching a new product. Designing the new product has already cost $507,000. The company estimates that it will sell 823,000 units per year for $2.91 per unit and variable non-labor costs will be $1.12 per unit. Production will end after year 3. New equipment costing $1.18 million will be required. The equipment will be depreciated using 100% bonus depreciation under the 2017 TCJA. You think the equipment will be obsolete at the end of year 3 and plan to scrap it. Your current level of working capital is $297,000. The new product will require the working capital to increase to a level of $385,000 immediately, then to $401,000 in year 1, in year 2 the level will be $348,000, and finally in year 3 the level will return to $297,000. Your tax rate is 21%. The discount rate for this project is 10.2%. Do the capital budgeting analysis for this project and calculate its NPV. Note: Assume that the equipment is put into use in year 1. Year 0 Year 1 Sales 0 0 $ $ 2394930) -971140 AT 0 - Cost of Goods Sold Gross Profit - Depreciation 1423790 0 EBIT 0 Is to sto s o f t to 0 - Tax Incremental Earnings $ $ 0 $ 0 $ 0 $ 0 $ 0 $ 88,000 $ 1,180,000 $ 0 + Depreciation - Incremental Working Capital - Capital Investment Incremental Free Cash Flow Your company has been doing well, reaching $1.01 million in earnings, and is considering launching a new product. Designing the new product has already cost $507,000. The company estimates that it will sell 823,000 units per year for $2.91 per unit and variable non-labor costs will be $1.12 per unit. Production will end after year 3. New equipment costing $1.18 million will be required. The equipment will be depreciated using 100% bonus depreciation under the 2017 TCJA. You think the equipment will be obsolete at the end of year 3 and plan to scrap it. Your current level of working capital is $297,000. The new product will require the working capital to increase to a level of $385,000 immediately, then to $401,000 in year 1, in year 2 the level will be $348,000, and finally in year 3 the level will return to $297,000. Your tax rate is 21%. The discount rate for this project is 10.2%. Do the capital budgeting analysis for this project and calculate its NPV. Note: Assume that the equipment is put into use in year 1. Year 0 Year 1 Sales 0 0 $ $ 2394930) -971140 AT 0 - Cost of Goods Sold Gross Profit - Depreciation 1423790 0 EBIT 0 Is to sto s o f t to 0 - Tax Incremental Earnings $ $ 0 $ 0 $ 0 $ 0 $ 0 $ 88,000 $ 1,180,000 $ 0 + Depreciation - Incremental Working Capital - Capital Investment Incremental Free Cash Flow

NEED THIS CALCULATED FOR YEARS 1-4

NEED THIS CALCULATED FOR YEARS 1-4