Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NEED THIS DONE ASAP!!!! PLEASE ALSO INCLUDE A CCA TABLE Three close friends; Larry, Curly, and Moe; invested $ 1 0 0 , 0 0

NEED THIS DONE ASAP!!!! PLEASE ALSO INCLUDE A CCA TABLE

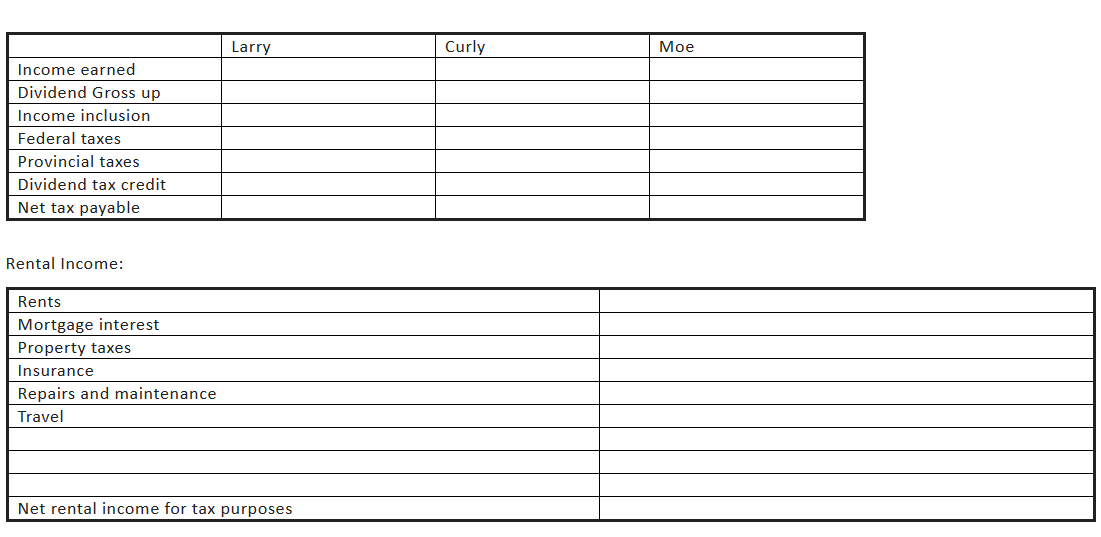

Three close friends; Larry, Curly, and Moe; invested $ in different ways on January of the current year. The following are their respective investment choices.

Larry invested in corporate bonds paying per year.

Curly invested in preferred shares that sold for $ per share and paid an annual dividend of $ per share. These dividends are considered eligible dividends.

Moe bought a rental property for $$ for the land and $ for the building and some furniture and appliances for the property costing $ The following represents the rental income and expenses earned by Moe.

Rents

Mortgage interest

Property taxes

Insurance

Repairs and maintenance

Travel

Each person is in the pays federal taxes and provincial taxes. The provincial dividend tax credit is

Required: Compete the following tables

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started