Answered step by step

Verified Expert Solution

Question

1 Approved Answer

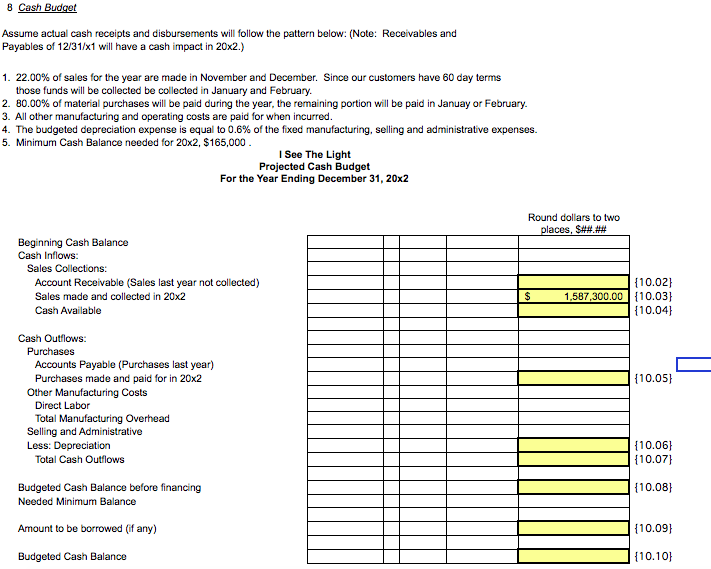

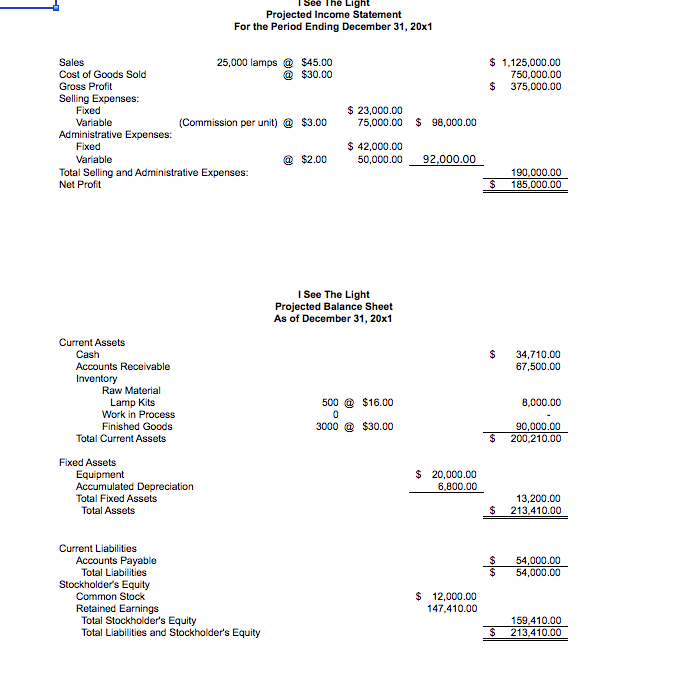

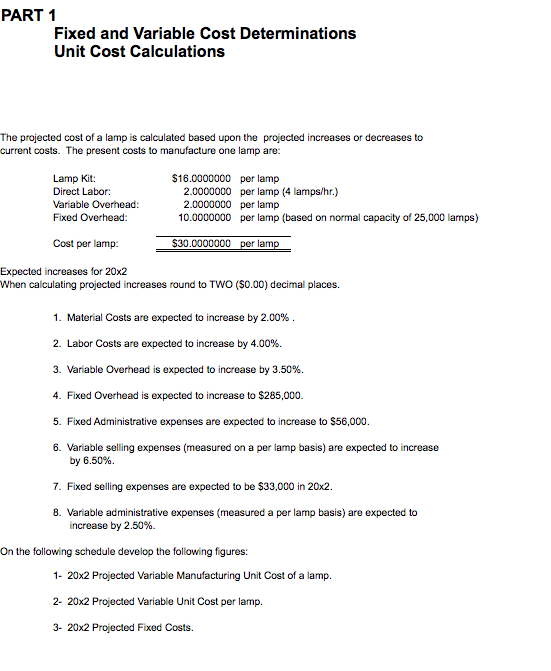

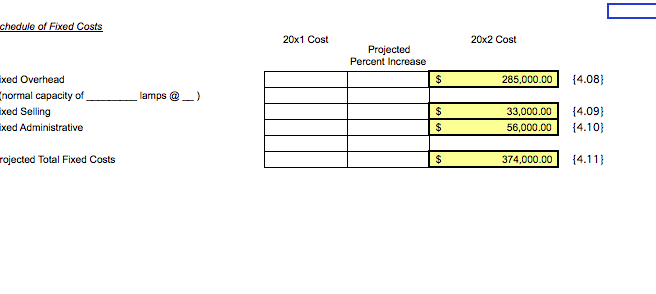

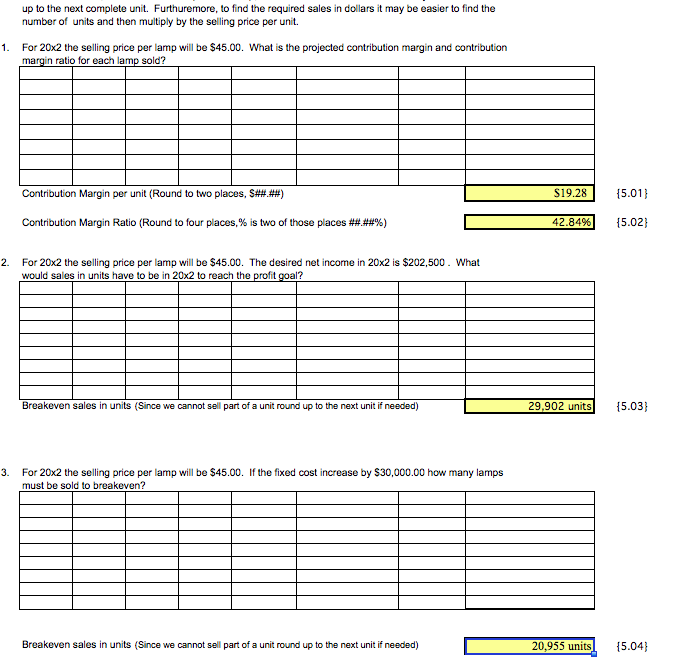

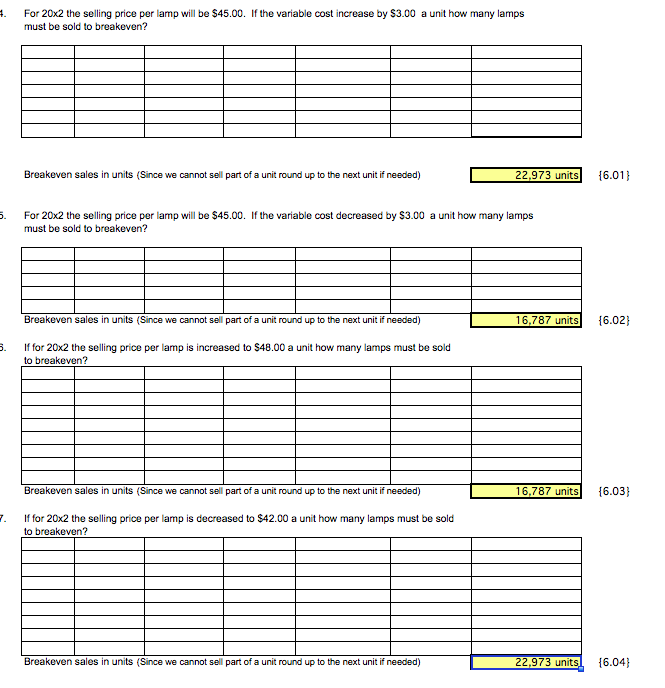

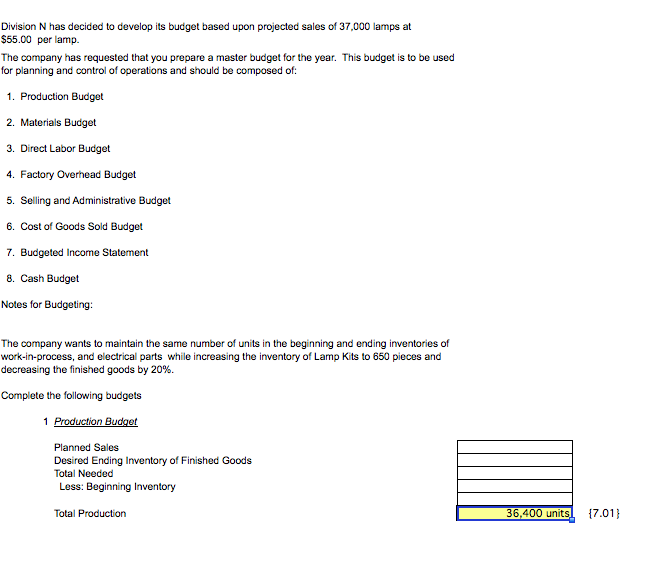

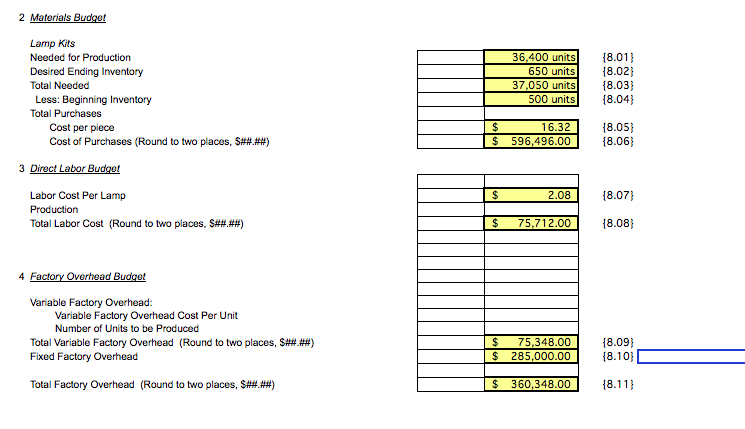

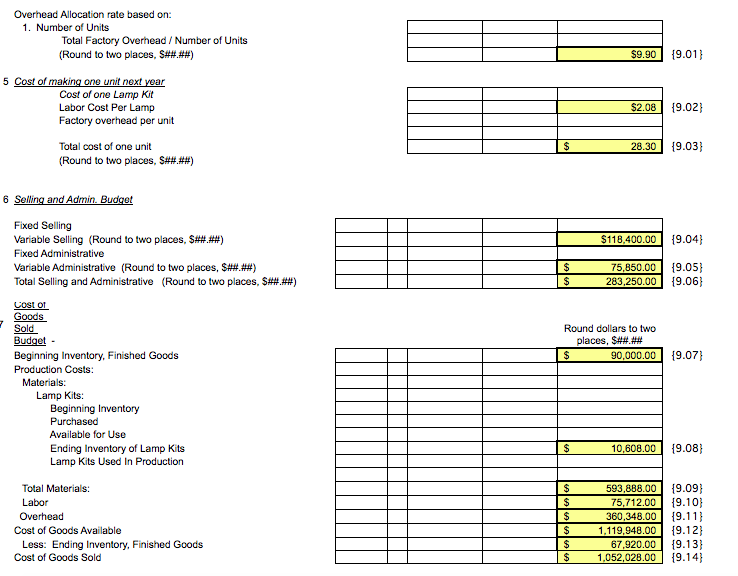

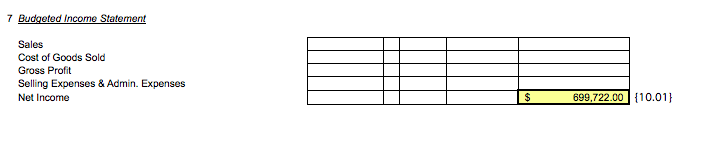

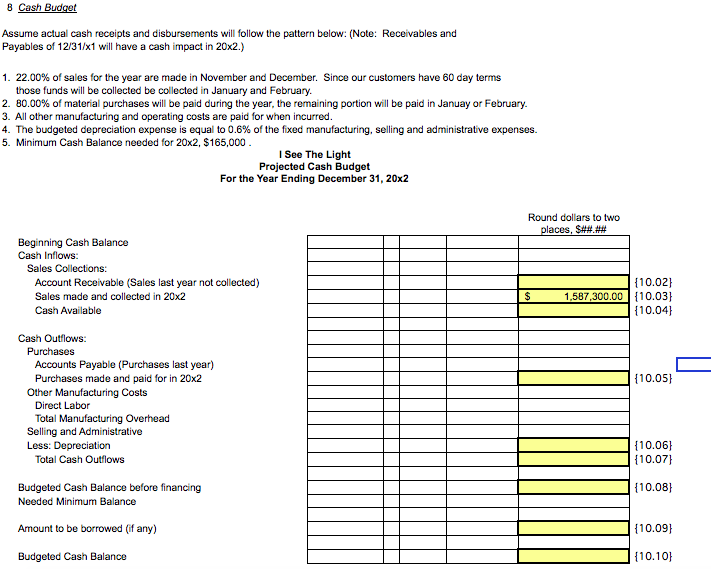

Need to answer 10.02, 10.04, 10.05- 10.1 (first pic shows the problem, rest of the pics are further info that may be needed) 8 Cash

Need to answer 10.02, 10.04, 10.05- 10.1 (first pic shows the problem, rest of the pics are further info that may be needed)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started