Answered step by step

Verified Expert Solution

Question

1 Approved Answer

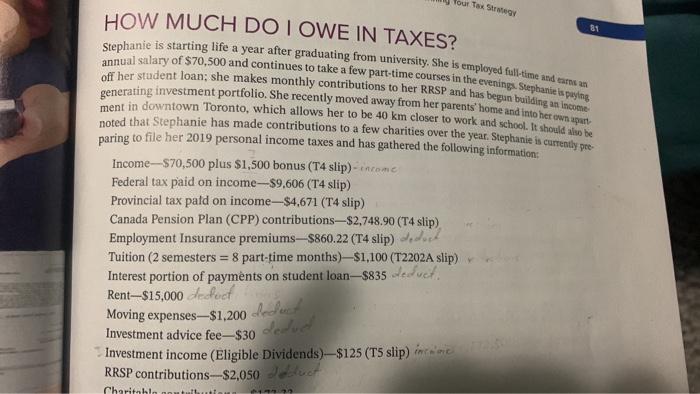

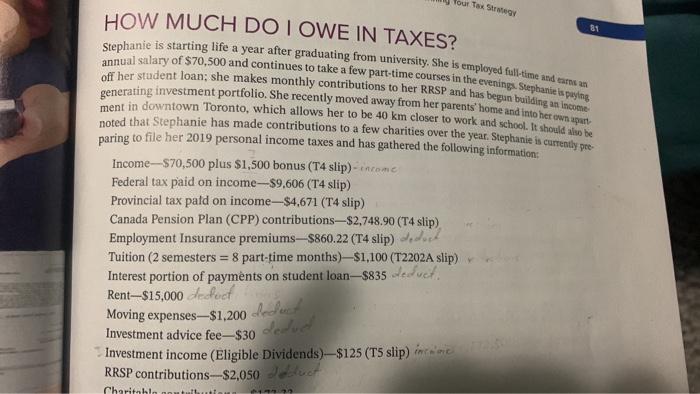

need to answer HOW MUCH DO I OWE IN TAXES? Stephanie is starting life a year after graduating from university. She is employed full-time and

need to answer

HOW MUCH DO I OWE IN TAXES? Stephanie is starting life a year after graduating from university. She is employed full-time and carnu an annual salary of $70,500 and continues to take a few part-time courses in the evenings Suephanie aspaylng off her student loan; she makes monthly contributions to her RRSP and has began building a inconser ment in downtown Toronto, which allows her to be 40km closer to work and school. It should alio be noted that Stephanie has made contributions to a few charities over the year. Stephanie is currently preparing to file her 2019 personal income taxes and has gathered the following information: Income $70,500 plus $1,500 bonus (T4 slip) = income Federal tax paid on income $9.606 (T4 slip) Provincial tax pald on income- $4,671 (T4 slip) Canada Pension Plan (CPP) contributions $2,748.90 (T4 slip) Employment Insurance premiums $860.22 (T4 slip) d. /.52 Tuition ( 2 semesters =8 part-time months) $1,100 (T2202A slip) Interest portion of paymnts on student loan $835 defvor. Rent $15,000 defoof Moving expenses $1,200 Investment advice fee $30 Investment income (Eligible Dividends) $125 (T5 slip) inscimic RRSP contributions $2,050 HOW MUCH DO I OWE IN TAXES? Stephanie is starting life a year after graduating from university. She is employed full-time and carnu an annual salary of $70,500 and continues to take a few part-time courses in the evenings Suephanie aspaylng off her student loan; she makes monthly contributions to her RRSP and has began building a inconser ment in downtown Toronto, which allows her to be 40km closer to work and school. It should alio be noted that Stephanie has made contributions to a few charities over the year. Stephanie is currently preparing to file her 2019 personal income taxes and has gathered the following information: Income $70,500 plus $1,500 bonus (T4 slip) = income Federal tax paid on income $9.606 (T4 slip) Provincial tax pald on income- $4,671 (T4 slip) Canada Pension Plan (CPP) contributions $2,748.90 (T4 slip) Employment Insurance premiums $860.22 (T4 slip) d. /.52 Tuition ( 2 semesters =8 part-time months) $1,100 (T2202A slip) Interest portion of paymnts on student loan $835 defvor. Rent $15,000 defoof Moving expenses $1,200 Investment advice fee $30 Investment income (Eligible Dividends) $125 (T5 slip) inscimic RRSP contributions $2,050

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started