Question

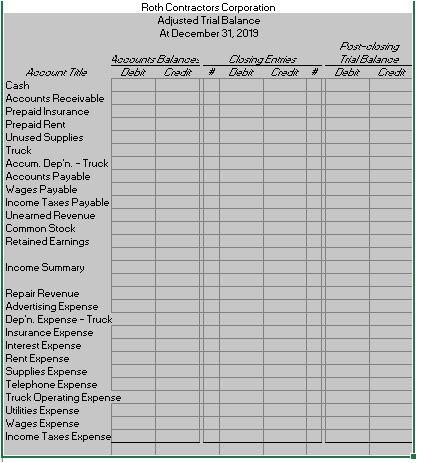

Need to do an adjusted trial balance for Roth Contractors but need to see all the columns reflected in adjusted trial balance: Transactions are: a)

Need to do an adjusted trial balance for Roth Contractors but need to see all the columns reflected in adjusted trial balance: Transactions are: a) issued common stock for cash $2000, b) paid cash for three months rent Dec 2019, Jan/Feb 2020 - $2400, c) Purchased used truck on credit (record as a/p) $13000, e) Paid for one year truck insurance policy eff Dec 1 $1600, f) Billed a customer for work completed to date $6000, g) Collected cash for work completed to date $4000, h) Paid advertising $700, interest $700, telephone $800, truck operating exp $600, wages $5000, i) collected part of the amount billed in f above $1000, j) billed customer for work completed to date $7000, k) signed a contract to be performed in January 2020 $5000, l) paid advertising $600, interest $600, truck operating exp $900, wages $2000, m) collected an adv on work to be done (record such advances as revenue at time received) $2000, n) received a bill for electricity $800, o) one month of prepaid ins has expired, p) December portion of the rent paid on Dec 1 expired, q) counted supplies and found this amount still on hand record as used exp $100, r) The amount collected in m is unearned at Dec 31 $2000, s) Three days of wages for Dec 29, 30, 31 unpaid will be paid in Jan $2900, t) One month of depreciation needs to be recorded $361, u) income taxes to be paid $100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started