Answered step by step

Verified Expert Solution

Question

1 Approved Answer

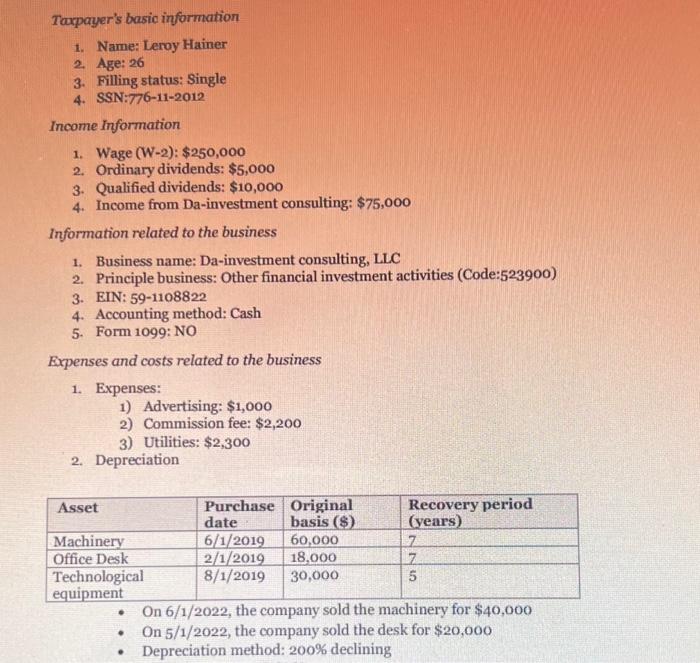

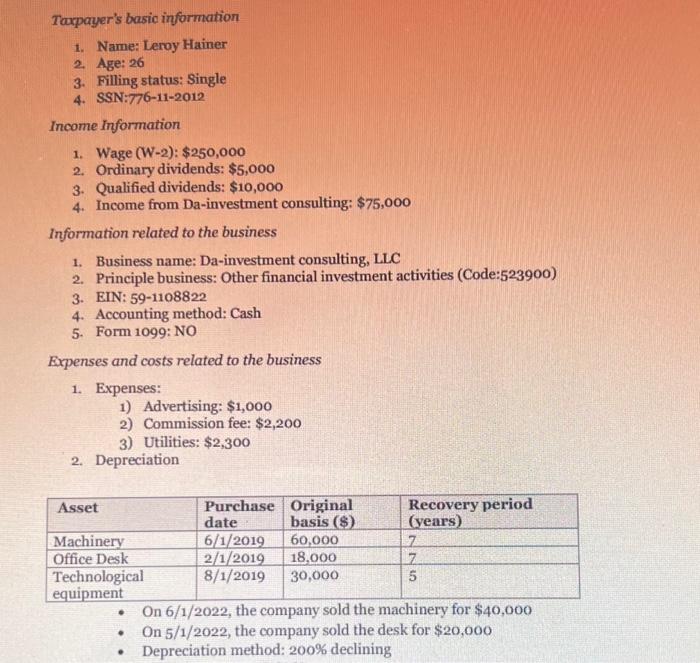

Need to fill out all of the tax return schedules with the information provided. Information related to the business 1. Business name: Da-investment consulting, LLC

Need to fill out all of the tax return schedules with the information provided.

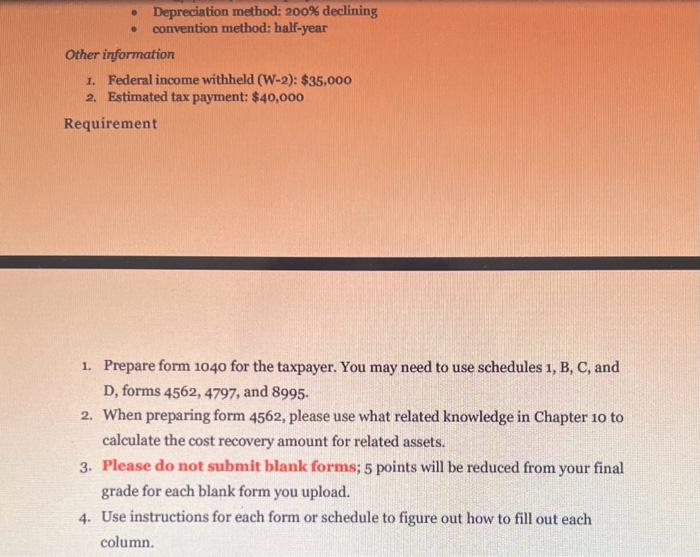

Information related to the business 1. Business name: Da-investment consulting, LLC 2. Principle business: Other financial investment activities (Code:523900) 3. EIN: 591108822 4. Accounting method: Cash 5. Form 1099: NO Expenses and costs related to the business 1. Expenses: 1) Advertising: $1,000 2) Commission fee: $2,200 3) Utilities: $2,300 2. Depreciation - On 6/1/2022, the company sold the machinery for $40,000 - On 5/1/2022, the company sold the desk for $20,000 - Depreciation method: 200\% declining - Depreciation method: 200% declining - convention method: half-year Other information 1. Federal income withheld (W-2): $35,000 2. Estimated tax payment: $40,000 Requirement 1. Prepare form 1040 for the taxpayer. You may need to use schedules 1,B,C, and D, forms 4562,4797 , and 8995. 2. When preparing form 4562 , please use what related knowledge in Chapter 10 to calculate the cost recovery amount for related assets. 3. Please do not submit blank forms; 5 points will be reduced from your final grade for each blank form you upload. 4. Use instructions for each form or schedule to figure out how to fill out each column. Information related to the business 1. Business name: Da-investment consulting, LLC 2. Principle business: Other financial investment activities (Code:523900) 3. EIN: 591108822 4. Accounting method: Cash 5. Form 1099: NO Expenses and costs related to the business 1. Expenses: 1) Advertising: $1,000 2) Commission fee: $2,200 3) Utilities: $2,300 2. Depreciation - On 6/1/2022, the company sold the machinery for $40,000 - On 5/1/2022, the company sold the desk for $20,000 - Depreciation method: 200\% declining - Depreciation method: 200% declining - convention method: half-year Other information 1. Federal income withheld (W-2): $35,000 2. Estimated tax payment: $40,000 Requirement 1. Prepare form 1040 for the taxpayer. You may need to use schedules 1,B,C, and D, forms 4562,4797 , and 8995. 2. When preparing form 4562 , please use what related knowledge in Chapter 10 to calculate the cost recovery amount for related assets. 3. Please do not submit blank forms; 5 points will be reduced from your final grade for each blank form you upload. 4. Use instructions for each form or schedule to figure out how to fill out each column

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started