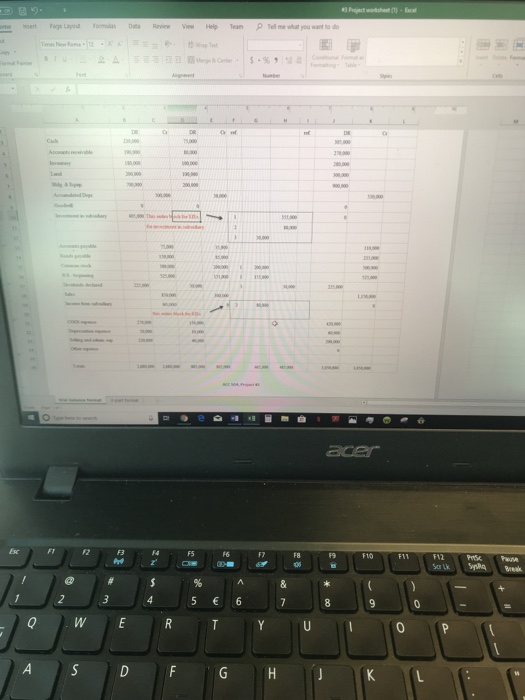

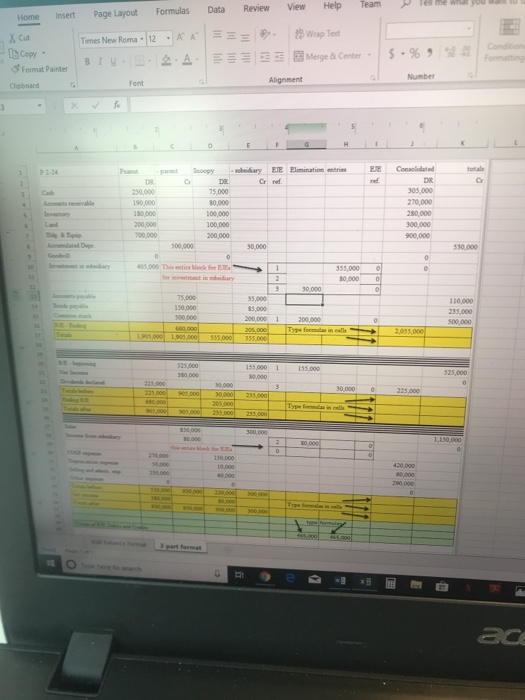

need to fill out excel sheets, check figures are

net income 332000

ending r/e 740000

tot. assets - 1740000

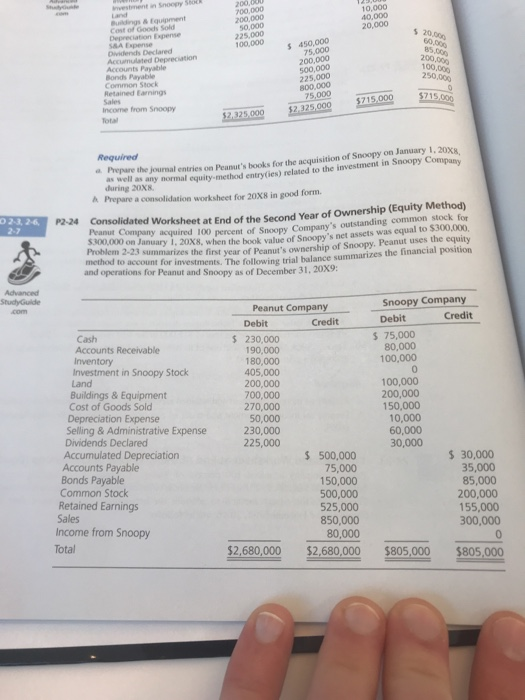

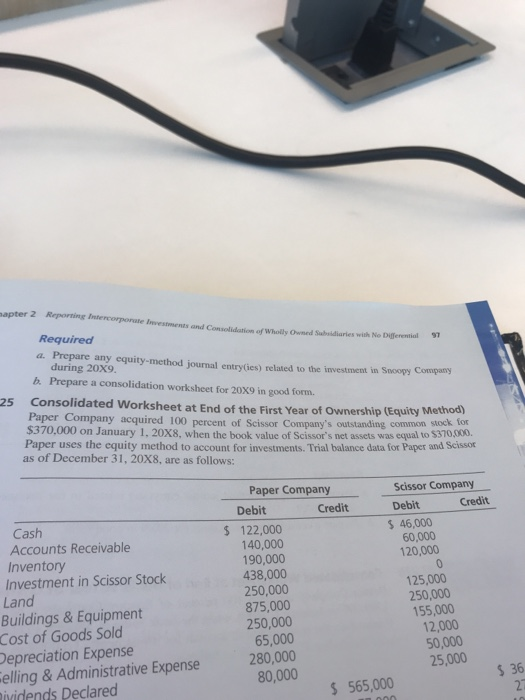

vestment in Snoopy Sho 00,000 200,000 10,000 40,000 20,000 Buildings&Equipment Cost of Goods Sold Depreciation Expense S&A Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock 50,000 225,000 100,000 s 450,000 75,000 200,000 500,000 225,000 800,000 75,000 Retained Earnings Income from Snoopy ta wen atheomal entries on Peunut's books for the acquisition of Saoopy on January 1. 20x during 20XK.qity-method entry(ies) related to the investment in Snoopy Company Required a. Prepare the entries Il as any normal h Prepare a consolidation worksheet for 20x8 in good form percent of Snoopy Company's outstanding common stock for 0x8, when the book value of Snoopy's net assets was equal to $300.000 sunmarizes the first year of Peanut's ownership of Snoopy. Peanut uses the equity to ccount for investments. The following trial balance summarizes the financial position Peanut Compaat End of the Second Year of Ownership (Equity Method acquired 100 $300,000 on J Problem 2-23 and operations for Peanut and Snoopy as of December 31. 20X9 StudyGulde Peanut Company Snoopy Company Debit Debit Credit Credit Cash Accounts Receivable $ 230,000 $ 75,000 80,000 100,000 Investment in Snoopy Stock 405,000 200,000 700,000 270,000 50,000 230,000 225,000 Land 0. 100,000 200,000 150,000 10,000 60,000 30,000 Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock S 500,000 75,000 $ 30,000 35,000 85,000 Sales 525,000 Income from Snoopy Total 155,000 300,000 80,000 $2,680,000 $2,680,000 $805,000 $805,000 nvestments and Consolidation of Wholly Owned Subnidiarles with No Digerential7 Required a. Prepare any equity-method journal entryies) related to the investment in Snoopy Companry during 20x9. b. Prepare a consolidation worksheet for 20X9 in good form. Consolidated Worksheet at End of the First Year of Ownership (Equity M Paper Company acquired 100 percent of Scissor Company's outstanding common $370,000 on January 1, 20X8, when the book value of Scissor's net assets was equal to $370,000 25 ethod) stock for Paper uses the equity method to account for investments. Trial balance data for Paper and Scissor as of December 31, 20X8, are as follows: Paper Company Debit Scissor Company Debit s 46,000 Credit Credit Cash Accounts Receivable Inventory Investment in Scissor Stock Land Buildings & Equipment Cost of Goods Sold epreciation Expense elling & Administrative Expense iidends Declared 5 122,000 140,000 190,000 438,000 250,000 875,000 250,000 65,000 60,000 120,000 125,000 250,000 155,000 12,000 50,000 25,000 280,000 80,000 S 36 $ 565,000 F8 F10 F11 Te Home Insert Page Layout Formulas Data Review View Help Teamp Cut Copy . Format Painter8I Font P2-34 DR 05,000 270,000 80,000 00,000 Cr DR 230,000 190,000 90,000 200,000 D8 75,000 80,000 Cr ref 100,000 530,000 05,000 Thieck f E 335,000 30,000 5,000 5,000 5,000 00,000 1 200,000 110,000 235,000 3 part format