Answered step by step

Verified Expert Solution

Question

1 Approved Answer

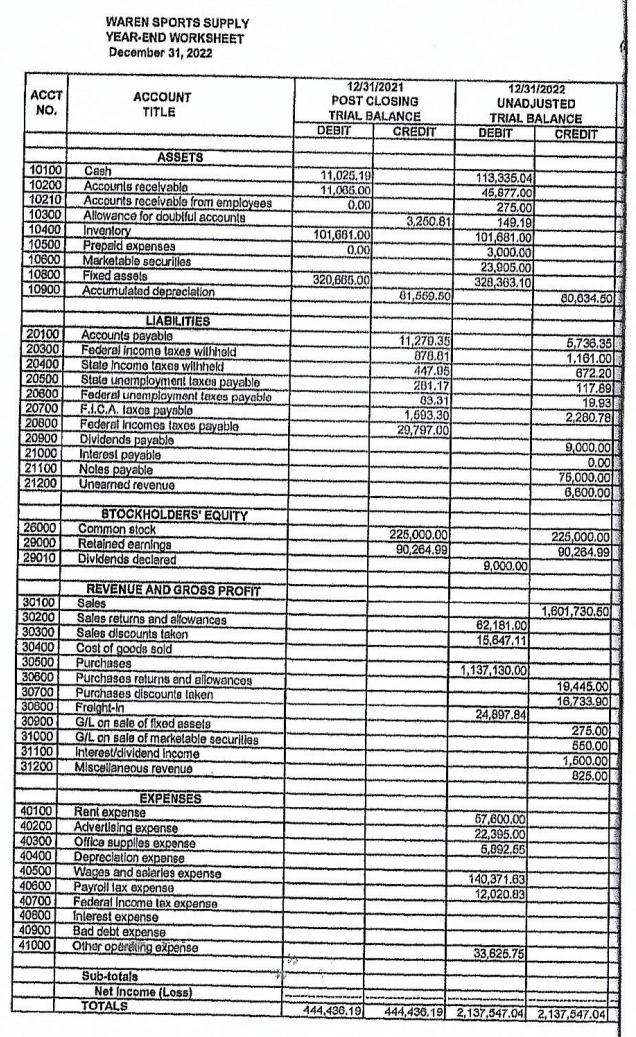

Need to know the adjusting entries, adjusted trial balance, income statement, and balance sheet. There should be adjusting entries for depreciation expense, interest expense, bad

Need to know the adjusting entries, adjusted trial balance, income statement, and balance sheet. There should be adjusting entries for depreciation expense, interest expense, bad debt expense, ending inventory, and federal income tax expense.

ACCT NO, 10100 10200 10210 10300 20100 20300 20400 20500 20600 20700 20800 20900 21000 10400 10500 10600 Marketable securities 10800 Fixed assels 10900 Accumulated depreciation 21100 21200 26000 29000 29010 30100 30200 30300 30400 30500 30600 30700 30800 30900 31000 31100 31200 40100 40200 40300 40400 WAREN SPORTS SUPPLY YEAR-END WORKSHEET December 31, 2022 40500 40600 40700 40800 40900 41000 ACCOUNT TITLE Cash Accounts receivable Accounts receivable from employees Allowance for doublful accounts Inventory Prepaid expenses ASSETS LIABILITIES Accounts payable Federal income taxes withhold State Income taxes withheld State unemployment laxes payable Federal unemployment taxes payable F.I.C.A. laxes payable Federal Incomes taxes payable Dividends payable Interest payable Notes payable Unearned revenue STOCKHOLDERS' EQUITY Common stock Retained earnings Dividends declared REVENUE AND GROSS PROFIT Sales Sales returns and allowances Sales discounts takon Cost of goods sold Purchases Purchases returns and allowances Purchases discounts taken Freight-in G/L on sale of fixed assets G/L on sale of marketable securities Interest/dividend Income Miscellaneous revenue EXPENSES Rent expense Advertising expense Office suppiles expense Depreciation expense Wages and salarles expense Payroll tax expense Federal Income tax expense Interest expense Bad debt expense Other operating expense Sub-totals TOTALS Net Income (Loss) 12/31/2021 POST CLOSING TRIAL BALANCE DEBIT 11.025.19 11,005.00 0,00 101,681.00 0,00 320,665.00 CREDIT 3,250.81 am 81,569.50 11,270.35 878.81 447.95 281.17 83.31 1,593.30 29,797.00 225,000.00 90,264.99 12/31/2022 UNADJUSTED TRIAL BALANCE DEBIT 113,335.041 45,877.00 275.00 149.19 101,681.00 3,000.00 23,905.00 328,363.10 9,000.00 62,181.00 15,647.11 1,137,130.00 24,897.84 57,600.00 22,395.00 5,892.65 140,371.63 12,020.83 33,625.75 CREDIT 80,034.50 5,736.35 1.161.00 672.20 117.89 19.93 2,280.78 9,000.00 0.00 75,000.00 6,800.00 225,000.00 90,264.99 1,601,730.50 19,445.00 16,733.90 275.00 550.00 1,500.00 825.00 *A*VERKA 444,436.19 444,436.19 2,137,547.04 2,137,547.04

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

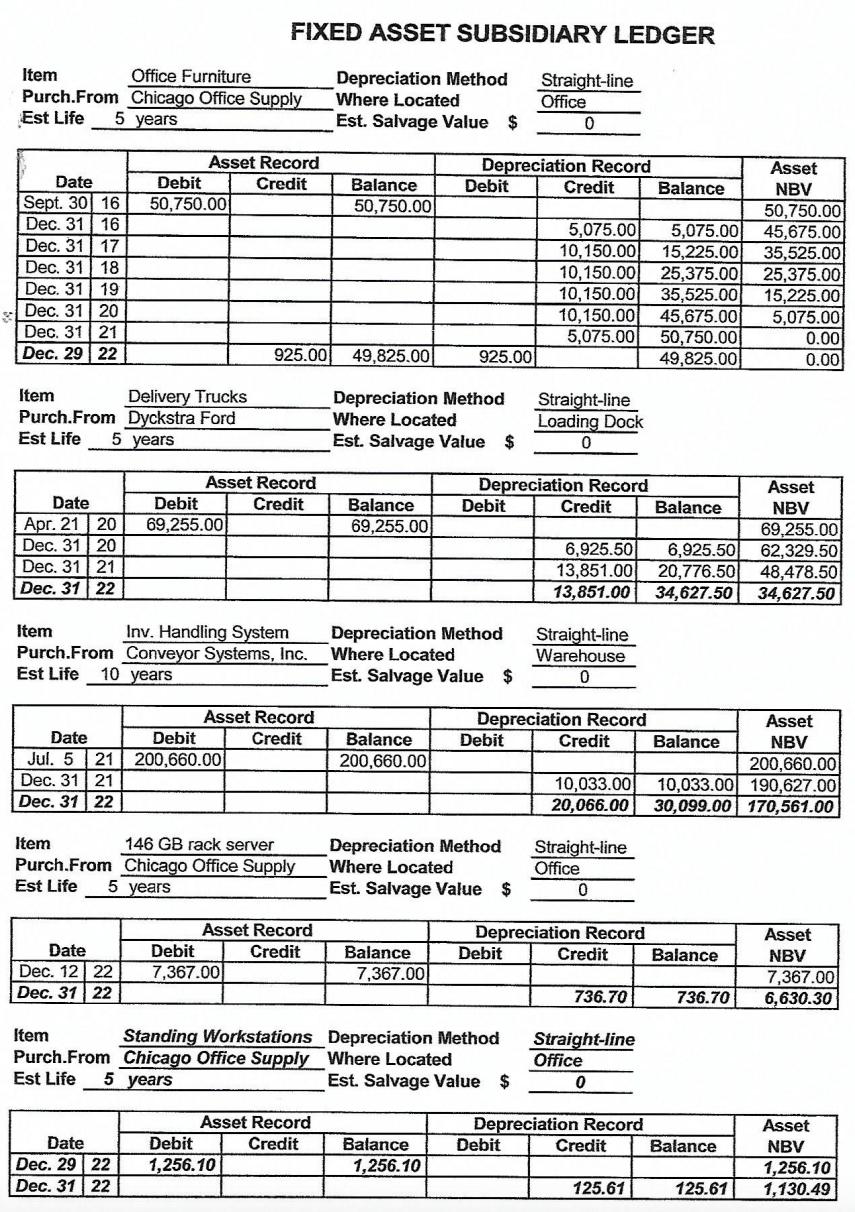

Adjusting Journal Entries Journal Entry Date Particulars Debit Credit Dec 31 2016 Deprecation Expenses Office Furniture 5075052 5075 To Accumulated De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started