Answered step by step

Verified Expert Solution

Question

1 Approved Answer

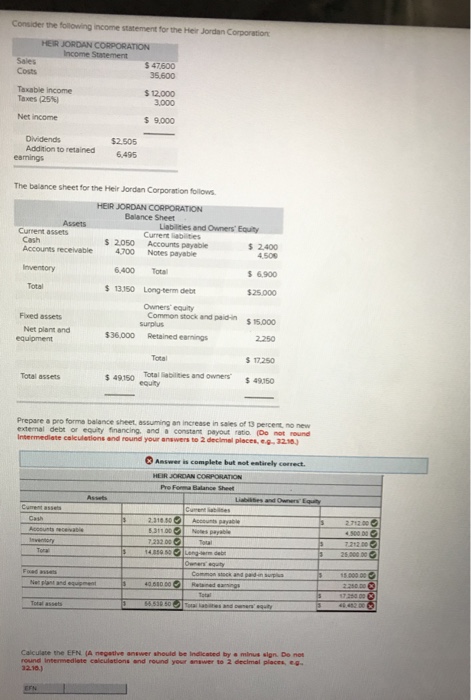

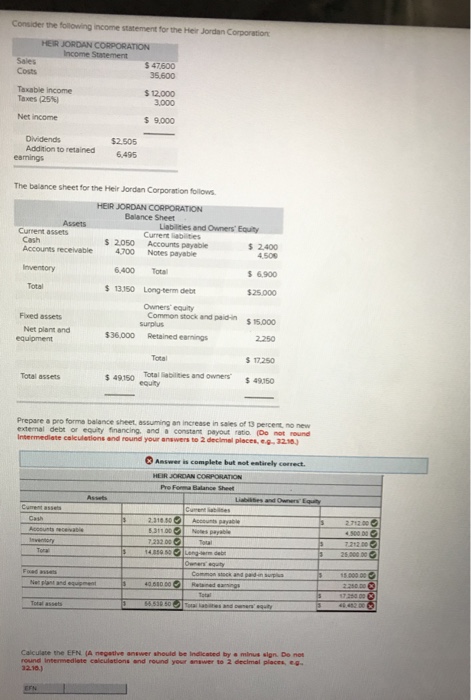

Need to know the correct answers for the incorrect numbers and how to get EFN? Consider the following income statement for the Her Jordan Corporation

Need to know the correct answers for the incorrect numbers and how to get EFN?

Consider the following income statement for the Her Jordan Corporation HEIR JORDAN C $ 47600 35.600 Taxable income Taxes (25%) $ 12.000 3.000 Net income $ 9.000 Addition to retained eamings $2.505 6.495 The balance sheet for the Heir Jordan Corporation folows HEIR JORDAN CORPORATION Balance Sheet Liabilities and Owners Equity Current assets Current liabiites s 2050 Accounts payable Cash Accounts receivable 4700 Notes payable 2400 4.500 6.900 $25.000 6.400 Tota Total 13150 Long-term de Owners equity Common stock and paidkn Fixed assets Net plant and 36.000 Retained earnings 2.250 Total s 17250 Total liabilities and owners equity Total assets 49150 Prepare a pro forme balance sheet assuming an increase in saies of 13 peicent no new external debt or equity financing, and a constant payout ratio (De not round Intermmediate celeuletions and round your answers to 2 decimel places, e.g- a216.J Answer is complete but not entirely correct. 31100 Nos le Calculate the EFN. (4 negetive answer should be Indicated by minus sign De net round intermediate calculations and round your answer to 2 decimal places, eg EFN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started