Question

NEED TO MAKE GENERAL JOURNAL ENTRIES FOR THE FOLLOWING USING THE CHART OF ACCOUNTS ABOVE: The following events occur in July 2014: July 1 You

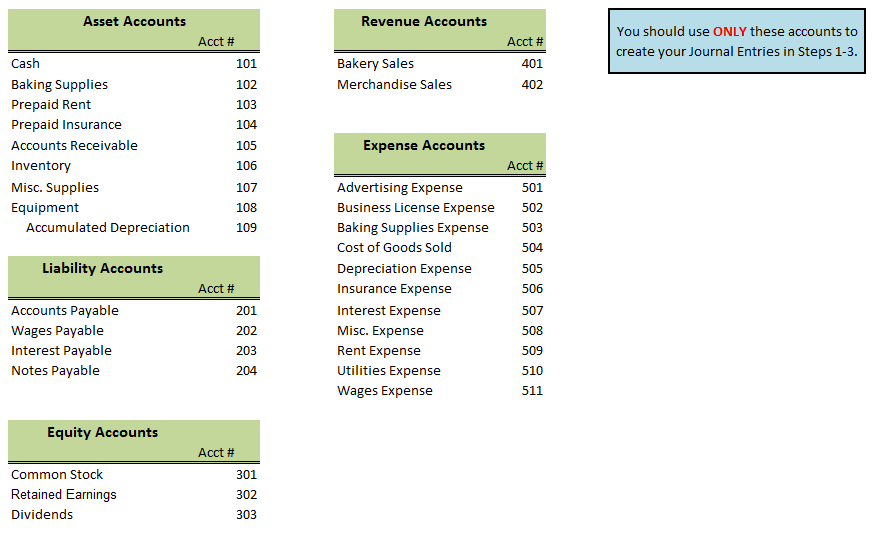

NEED TO MAKE GENERAL JOURNAL ENTRIES FOR THE FOLLOWING USING THE CHART OF ACCOUNTS ABOVE:

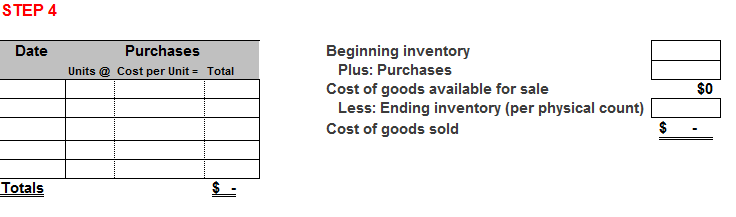

The following events occur in July 2014: July 1 You take $10,000 from your personal savings account and buy common stock in Janies Cupcakes, Inc.. July 1 Paid $4000 on a lease for bakery space. The lease is for 1 year, and requires first and last months rent up front. Lease period is effective July 1st 2016 through June 30th, 2017. July 1 You have baking equipment, including an oven and mixer, which you have been using for your home-based business for one year and will now start using in the bakery. The current book value of the equipment is $8,000, and you transfer the equipment into the business in exchange for additional common stock. The equipment has a 5-year useful life, and an original cost of $10,000. July 2 Your parents lend the company $10,000 cash, in exchange for a ten-year, 3% note payable. Interest is payable quarterly, and the principal is due at maturity. July 4 -Purchased $5000 in baking supplies from vendor, on account July 10 Paid $325 to the City Licensing office for a business license. July 14 Went to Costco and paid $750 for Miscellaneous Supplies, such as paper products, office supplies, etc. July 15 Hire counter staff at $12 per hour. Pay periods are the 1st through the 15th and 16th through the end of the month with paydays being 7-days after the end of each pay period. July 30- Received utility bill for July in amount of $185. Payment is due on August 25th July 31- Accrue 40 hours of wages earned by your employee for period of July 16th through 31st. . Total July bakery sales were $6,500. Of this amount, $1500 was on account for a local restaurant. Step 2: Complete the following transactions in the August section of the General Journal tab in your workbook August 1-Pay rent on bakery space $2000 August 1 Buy a 12-month insurance policy for $600. Payment in full was required at the policys inception. Policy effective dates August 1, 2016 through July 31st, 2017 August 3 Paid $250 for a website and social media advertising. August 7 - paid employee for period ending 7/31 August 8 - Receive payments from local restaurant towards accounts receivable in amount of $1000. August 15- Purchase additional baking supplies in amount of $4000 from vendor, on account. August 15 Accrue wages earned for employee from period of 1st through 15th of August. Employee worked 50 hours this pay period. August 20- paid $7500 toward baking supplies vendor payable August 22- paid employee for period ending 8/15 August 25 paid July utility bill August 31- received utility bill for August in amount of $235. Payment is due on September 25th. August 31- Accrue wages earned for employee for period of August 16th through August 31st . Employee worked 48 hours this pay period. August bakery sales total $12,500. Of this, half was on accounts. Step 3: Complete the following transactions in the September area of the General Journal tab in your workbook. September 1- paid rent September 3 - Purchased 25 T-shirts with Janes Cupcakes logo for resale. Each shirt was $9.00. Since you are just starting out with selling this type of merchandise, you decide to use the periodic method to track your inventory, and the FIFO method for Inventory measurement. In addition to recording the Journal entry for this purchase transaction, you should also begin to complete the Purchases chart and COGS computation in Step 4. September 5 - Receive $4000 from customers on Account September 7 -paid employee for period ending 8/31 September 11-purchase baking supplies in amount of $ 7,000 from vendor on account. September 13- Paid on supplies vendor account in amount of $5000 September 15- Accrue 52 hours of employee wages for period of September 1st through September 15th September 20-Purchase 25 more T-shirts for resale to customers. Each shirt cost $9.80 wholesale price. Remember to adjust your purchases record in Step 4. September 22 Pay employees September 25 - pay August utility bill September 30-Accrue 58 hours of employee wages for period of September 16th through September 30th Total September bakery sales $17,500. $7,000 of these sales on accounts receivable. Additionally, you determine that you sold 35 T-shirts for $15 each. All 25 T-shirts from the Sept 3rd purchase were sold, and an additional 10 T-shirts from the Sept 20th purchase were sold. The remaining shirts have a dollar value of $147. September 30 - Record the adjustment to inventory to determine the Cost of Goods Sold of sold T-shirts and make the accompanying Journal entry. September 30 Paid Dividends of $5000

Step 4: Post Inventory-related entries to the FIFO Inventory record. Transfer the Inventory purchases, sales and ending balances to the Inventory Record worksheet. Remember that when using the FIFO method, the oldest items are sold first, removing the cost of those items from inventory and transferring it to Cost of Goods Sold.

Asset Accounts Acct Cash 101 Baking Supplies 102 Prepaid Rent 103 Prepaid Insurance 104 Accounts Receivable 105 Inventory 106 Misc. Supplies 107 Equipment 108 Accumulated Depreciation 109 Liability Accounts Acct Accounts Payable 201 wages Payable 202 Interest payable 203 Notes Payable 204 Equity Accounts Acct Common Stock 301 Retained Earnings 302 Dividends 303 Revenue Accounts Acct Bakery Sales 401 Merchandise Sales 402 Expense Accounts Acct Advertising Expense 501 Business License Expense 502 Baking supplies Expense 503 Cost of Goods Sold 504 Depreciation Expense 505 Insurance Expense 506 Interest Expense 507 Misc. Expense Rent Expense Utilities Expense 510 511 Wages Expense You should use ONLY these accounts to create your Journal Entries in Steps 1-3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started