Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need to prepare an income statement, the statement of retained earnings, and a balance sheet with the information in the photos Pete Jackson decides to

need to prepare an income statement, the statement of retained earnings, and a balance sheet with the information in the photos

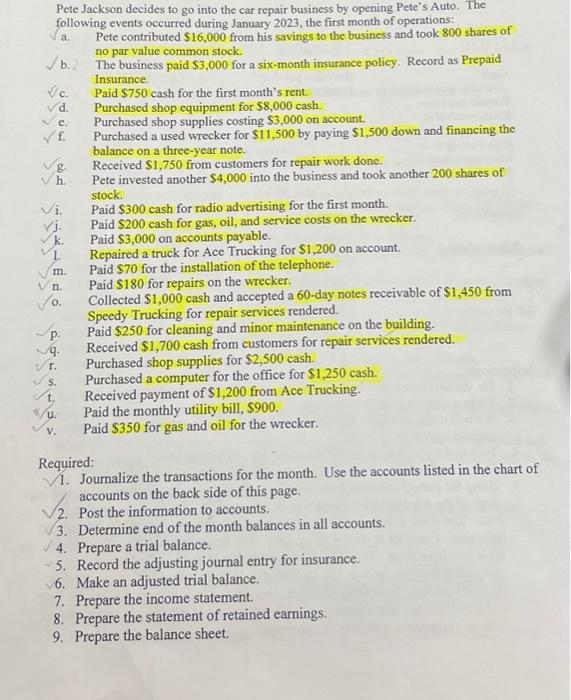

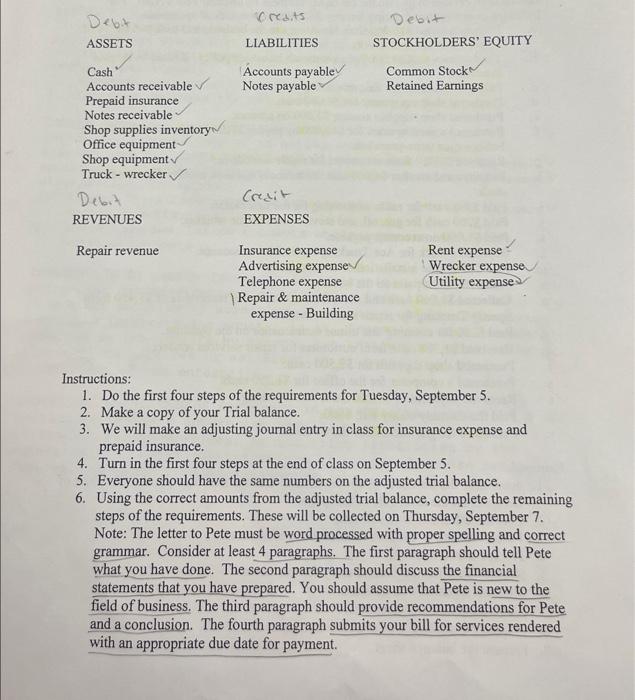

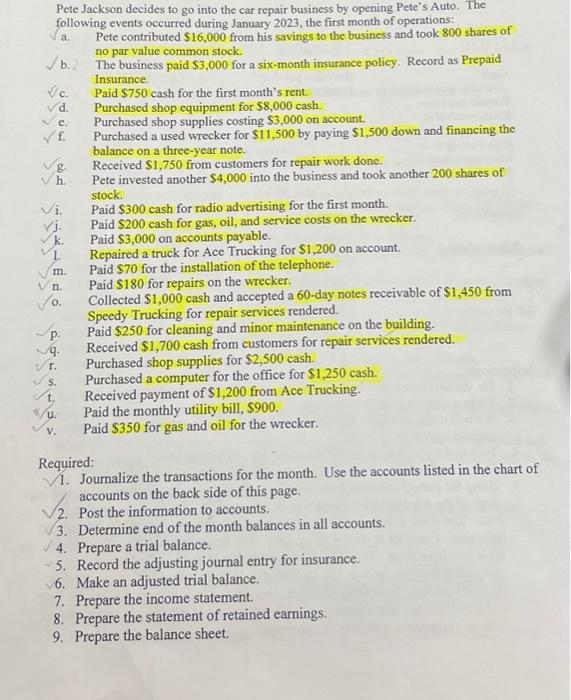

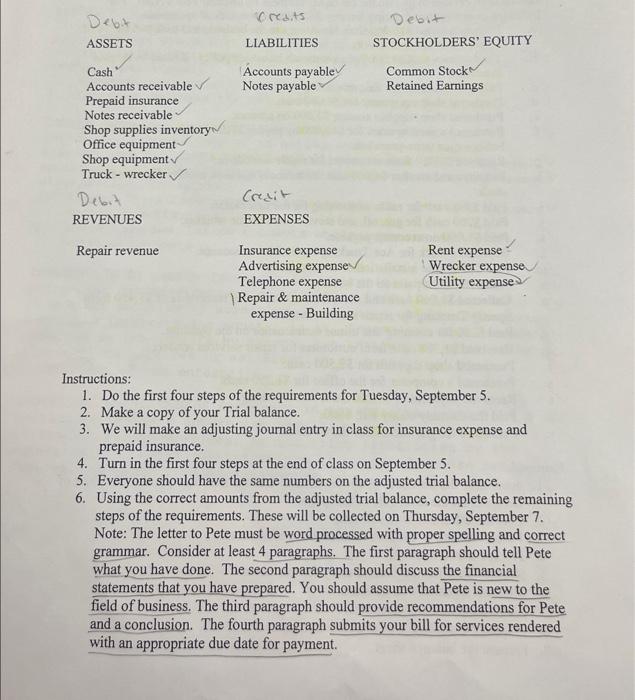

Pete Jackson decides to go into the car repair business by opening Pete's Auto. The following events occurred during January 2023, the first month of operations: a. Pete contributed $16,000 from his savings to the business and took 800 shares of no par value common stock. b. The business paid $3,000 for a six-month insurance policy. Record as Prepaid Insurance. c. Paid $750 cash for the first month's rent. d. Purchased shop equipment for $8,000 cash. e. Purchased shop supplies costing $3,000 on account. f. Purchased a used wrecker for $11,500 by paying $1,500 down and financing the balance on a three-year note. g. Received $1,750 from customers for repair work done. h. Pete invested another $4,000 into the business and took another 200 shares of stock. i. Paid $300 cash for radio advertising for the first month. Paid \$200 cash for gas, oil, and service costs on the wrecker. k. Paid $3,000 on accounts payable. 1. Repaired a truck for Ace Trucking for $1,200 on account. m. Paid \$70 for the installation of the telephone. n. Paid $180 for repairs on the wrecker. o. Collected $1,000 cash and accepted a 60 -day notes receivable of $1,450 from Speedy Trucking for repair services rendered. p. Paid $250 for cleaning and minor maintenance on the building. q. Received $1,700 cash from customers for repair services rendered. r. Purchased shop supplies for $2,500 cash. s. Purchased a computer for the office for $1,250cash. t. Received payment of $1,200 from Ace Trucking. u. Paid the monthly utility bill, $900. v. Paid $350 for gas and oil for the wrecker. Required: 1. Journalize the transactions for the month. Use the accounts listed in the chart of accounts on the back side of this page. 2. Post the information to accounts. 3. Determine end of the month balances in all accounts. 4. Prepare a trial balance. 5. Record the adjusting journal entry for insurance. 6. Make an adjusted trial balance. 7. Prepare the income statement. 8. Prepare the statement of retained earnings. 9. Prepare the balance sheet. Instructions: 1. Do the first four steps of the requirements for Tuesday, September 5 . 2. Make a copy of your Trial balance. 3. We will make an adjusting journal entry in class for insurance expense and prepaid insurance. 4. Turn in the first four steps at the end of class on September 5. 5. Everyone should have the same numbers on the adjusted trial balance. 6. Using the correct amounts from the adjusted trial balance, complete the remaining steps of the requirements. These will be collected on Thursday, September 7. Note: The letter to Pete must be word processed with proper spelling and correct grammar. Consider at least 4 paragraphs. The first paragraph should tell Pete what you have done. The second paragraph should discuss the financial statements that you have prepared. You should assume that Pete is new to the field of business. The third paragraph should provide recommendations for Pete and a conclusion. The fourth paragraph submits your bill for services rendered with an appropriate due date for payment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started