Answered step by step

Verified Expert Solution

Question

1 Approved Answer

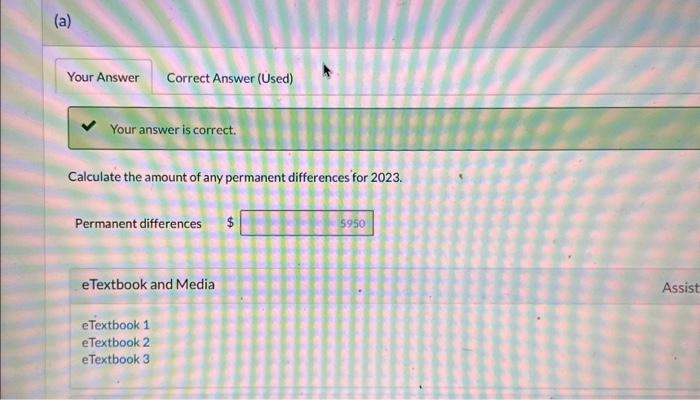

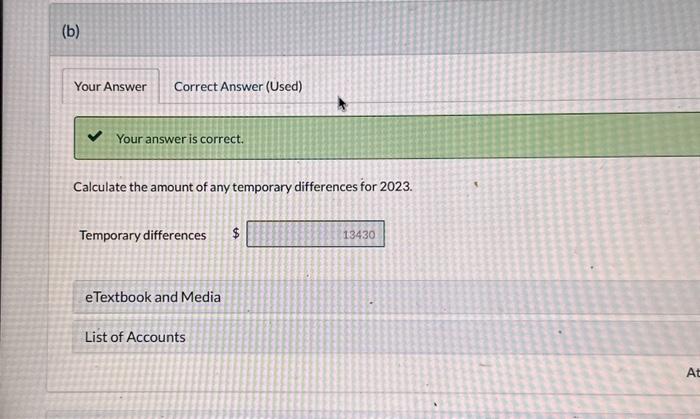

need to see method for the answer could you show how could i get those answer Your answer is correct. Calculate the amount of any

need to see method for the answer could you show how could i get those answer

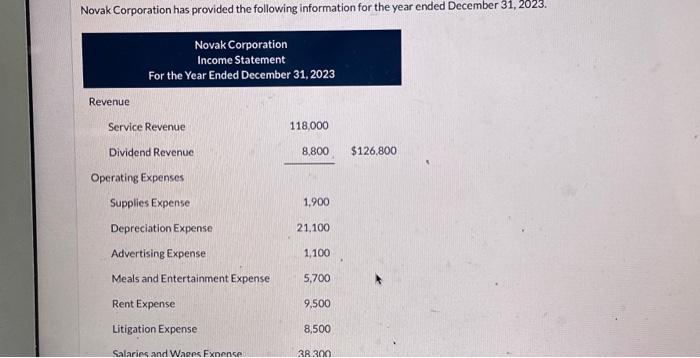

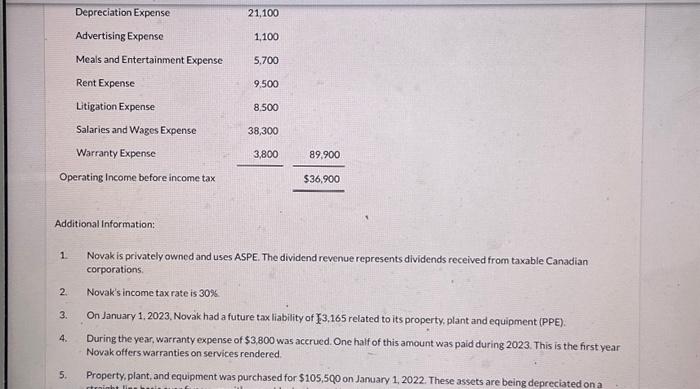

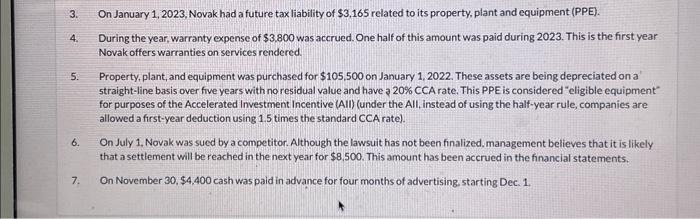

Your answer is correct. Calculate the amount of any permanent differences for 2023. Permanent differences eTextbook and Media 3. On January 1,2023, Novak had a future tax liability of $3,165 related to its property, plant and equipment (PPE). 4. During the year, warranty expense of $3,800 was accrued. One half of this amount was paid during 2023 . This is the first year Novak offers warranties on services rendered. 5. Property, plant, and equipment was purchased for $105,500 on January 1,2022. These assets are being depreciated on a straight-line basis over five years with no residual value and have 220% CCA rate. This PPE is considered "eligible equipment" for purposes of the Accelerated Investment Incentive (AII) (under the All, instead of using the half-year rule, companies are allowed a first-year deduction using 1.5 times the standard CCA rate). 6. On July 1, Novak was sued by a competitor. Although the lawsuit has not been finalized, management believes that it is likely that a settlement will be reached in the next year for $8,500. This amount has been accrued in the financial statements. 7. On November 30,$4,400 cash was paid in advance for four months of advertising, starting Dec. 1 . Novak Corporation has provided the following information for the year ended December 31, 2023. (b) Your answer is correct. Calculate the amount of any temporary differences for 2023. Temporary differences List of Accounts 1. Novak is privately owned and uses ASPE. The dividend revenue represents dividends received from taxable Canadian corporations. 2. Novak's income tax rate is 30% 3. On January 1, 2023, Novak had a future tax liability of {3,165 related to its property, plant and equipment (PPE). 4. During the year, warranty expense of $3,800 was accrued. One half of this amount was paid during 2023 . This is the first year Novak offers warranties on services rendered. 5. Property, plant, and equipment was purchased for $105,500 on Jamuary 1, 2022. These assets are being depreciated on a Your answer is correct. Calculate the amount of any permanent differences for 2023. Permanent differences eTextbook and Media 3. On January 1,2023, Novak had a future tax liability of $3,165 related to its property, plant and equipment (PPE). 4. During the year, warranty expense of $3,800 was accrued. One half of this amount was paid during 2023 . This is the first year Novak offers warranties on services rendered. 5. Property, plant, and equipment was purchased for $105,500 on January 1,2022. These assets are being depreciated on a straight-line basis over five years with no residual value and have 220% CCA rate. This PPE is considered "eligible equipment" for purposes of the Accelerated Investment Incentive (AII) (under the All, instead of using the half-year rule, companies are allowed a first-year deduction using 1.5 times the standard CCA rate). 6. On July 1, Novak was sued by a competitor. Although the lawsuit has not been finalized, management believes that it is likely that a settlement will be reached in the next year for $8,500. This amount has been accrued in the financial statements. 7. On November 30,$4,400 cash was paid in advance for four months of advertising, starting Dec. 1 . Novak Corporation has provided the following information for the year ended December 31, 2023. (b) Your answer is correct. Calculate the amount of any temporary differences for 2023. Temporary differences List of Accounts 1. Novak is privately owned and uses ASPE. The dividend revenue represents dividends received from taxable Canadian corporations. 2. Novak's income tax rate is 30% 3. On January 1, 2023, Novak had a future tax liability of {3,165 related to its property, plant and equipment (PPE). 4. During the year, warranty expense of $3,800 was accrued. One half of this amount was paid during 2023 . This is the first year Novak offers warranties on services rendered. 5. Property, plant, and equipment was purchased for $105,500 on Jamuary 1, 2022. These assets are being depreciated on a Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started