Answered step by step

Verified Expert Solution

Question

1 Approved Answer

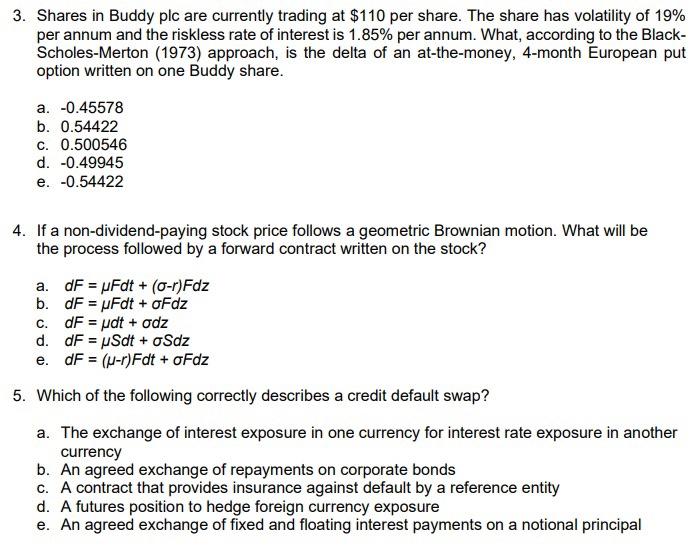

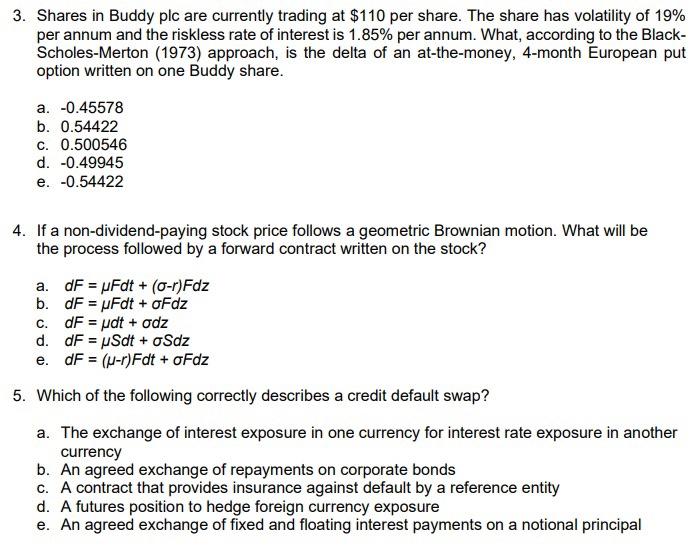

Need your workings and reasoning 3. Shares in Buddy plc are currently trading at $110 per share. The share has volatility of 19% per annum

Need your workings and reasoning

3. Shares in Buddy plc are currently trading at $110 per share. The share has volatility of 19% per annum and the riskless rate of interest is 1.85% per annum. What, according to the Black- Scholes-Merton (1973) approach, is the delta of an at-the-money, 4-month European put option written on one Buddy share. a. -0.45578 b. 0.54422 c. 0.500546 d. -0.49945 e. -0.54422 4. If a non-dividend-paying stock price follows a geometric Brownian motion. What will be the process followed by a forward contract written on the stock? a. dF = uFdt + (0-r)Fdz b. dF = uFdt + oFdz C. dF = udt + odz d. dF = Sdt + oSdz e. dF = (u-r)Fdt + oFdz 5. Which of the following correctly describes a credit default swap? a. The exchange of interest exposure in one currency for interest rate exposure in another currency b. An agreed exchange of repayments on corporate bonds C. A contract that provides insurance against default by a reference entity d. A futures position to hedge foreign currency exposure e. An agreed exchange of fixed and floating interest payments on a notional principal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started