Question

Needed Adjustments 1. Prescotts fiscal year end is December 31. 2. 2021 annual depreciation expense of $300,000 needs to be recorded. 3. A final year-end

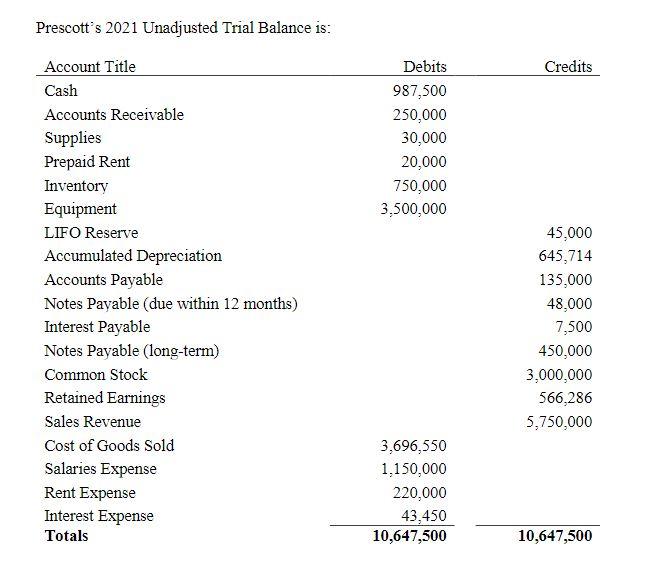

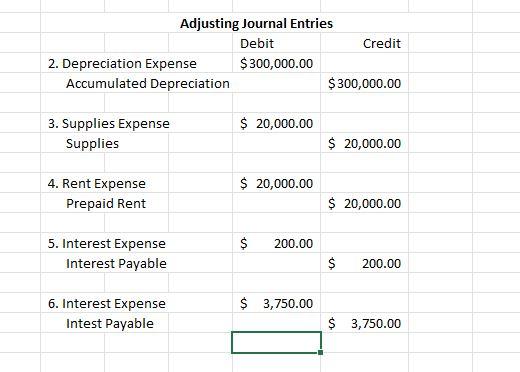

Needed Adjustments 1. Prescotts fiscal year end is December 31. 2. 2021 annual depreciation expense of $300,000 needs to be recorded. 3. A final year-end inventory count indicated that $10,000 in supplies were still on hand. 4. Prescotts annual rent is $240,000 which it prepays on January 1st each year. Decembers rent has not yet been recorded. 5. The current Note Payable of $48,000 has an annual interest rate of 5%. Prescott accrues interest on this note monthly (on the last day of the month) but pays the monthly interest 10 days later. Prescott has not yet accrued Decembers interest expense or payable. 6. The long-term Note Payable of $450,000 has an annual interest rate of 10%. Interest payments are due quarterly on the 15th day of January, April, July, and October. Prescott accrues interest monthly and has already recorded the appropriate interest expense and payable for October and November, but not for December. 7. Prescott tracks inventory internally using FIFO but prepares its financial statements based on LIFO. Prescott computes the 2021 ending inventory based on LIFO to be $690,000. Any required year-end adjustment has not yet been made. 8. Prescotts 2020 ending total assets and ending LIFO inventory were $4,200,000 and $670,000, respectively. 9. In Prescotts industry the average debt to equity ratio is 0.30 and the average timed interest earned ratio is 10. Your bank uses these industry averages when making credit decisions. 10. Prescotts income tax rate is 25%

Could you please provide the journal entries & work for 7-10 and check to make sure 1-6 are correct.

These are the journal entries that I have so far. Need help 7-10

Prescott's 2021 Unadjusted Trial Balance is: Credits Debits 987,500 250,000 30,000 20,000 750,000 3,500,000 Account Title Cash Accounts Receivable Supplies Prepaid Rent Inventory Equipment LIFO Reserve Accumulated Depreciation Accounts Payable Notes Payable (due within 12 months) Interest Payable Notes Payable (long-term) Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Salaries Expense Rent Expense Interest Expense Totals 45,000 645,714 135,000 48,000 7,500 450,000 3,000,000 566,286 5,750,000 3,696,550 1,150,000 220,000 43,450 10,647,500 10,647,500 Adjusting Journal Entries Debit Credit 2. Depreciation Expense $ 300,000.00 Accumulated Depreciation $300,000.00 $ 20,000.00 3. Supplies Expense Supplies $ 20,000.00 $ 20,000.00 4. Rent Expense Prepaid Rent $ 20,000.00 $ 200.00 5. Interest Expense Interest Payable $ 200.00 $ 3,750.00 6. Interest Expense Intest Payable $ 3,750.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started