Needed help with 4B and 4C?

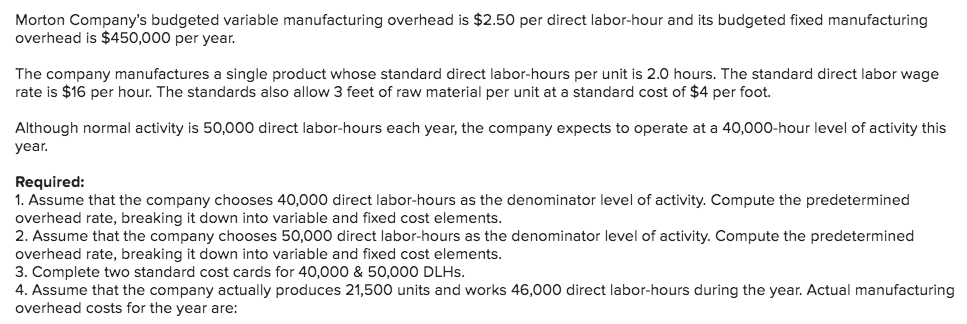

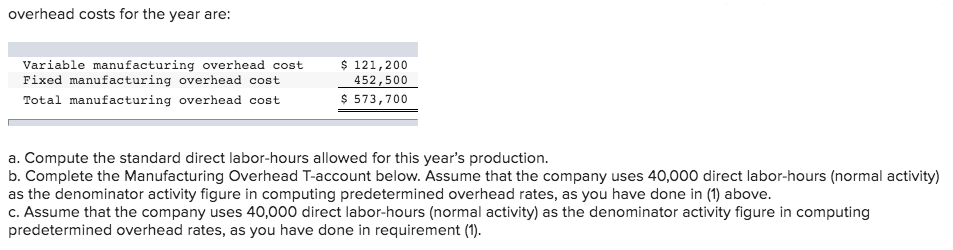

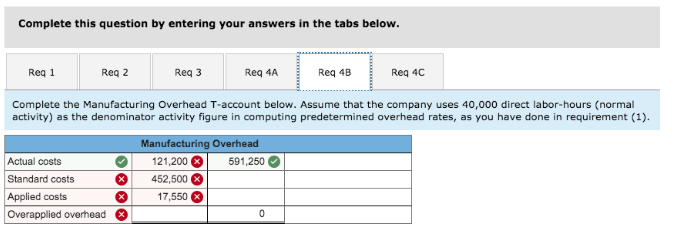

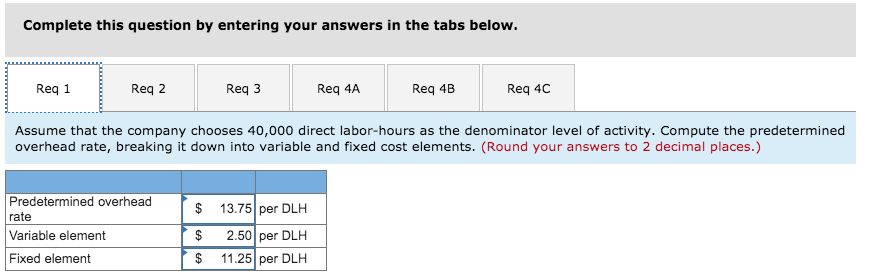

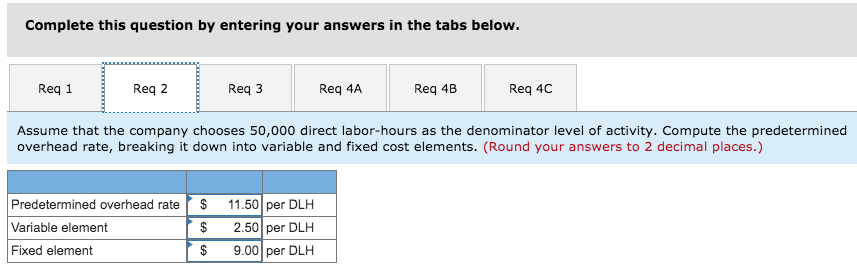

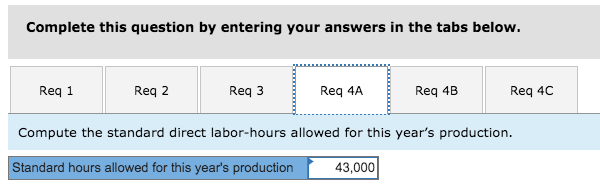

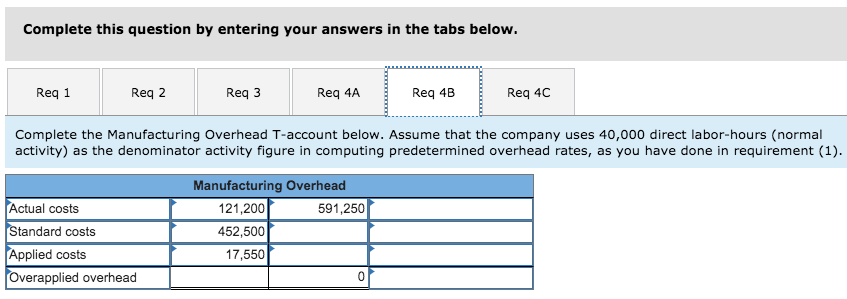

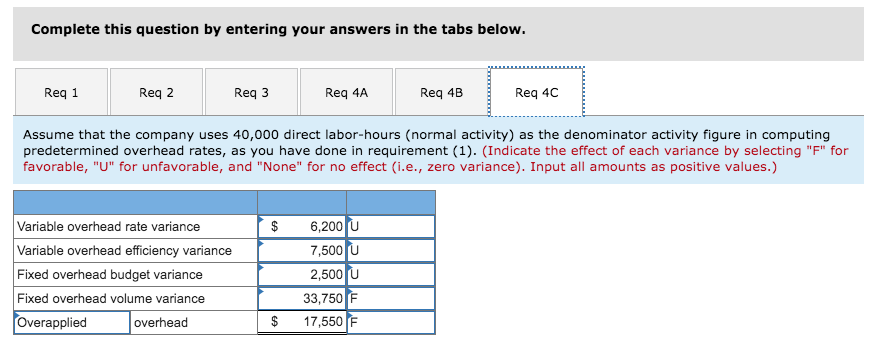

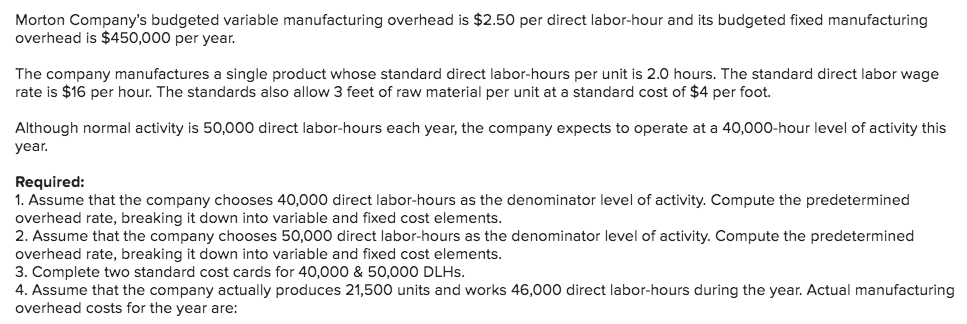

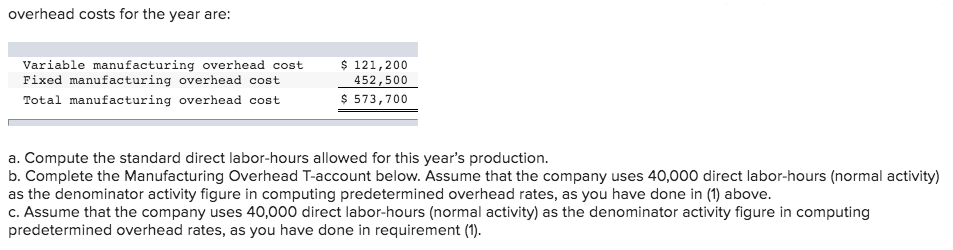

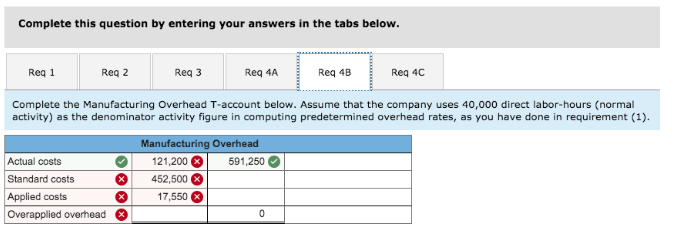

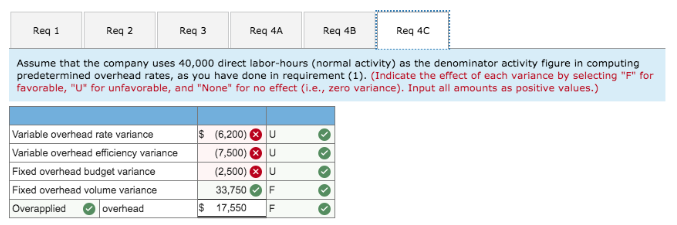

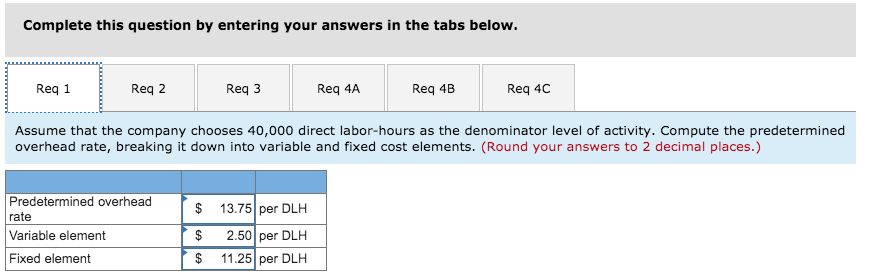

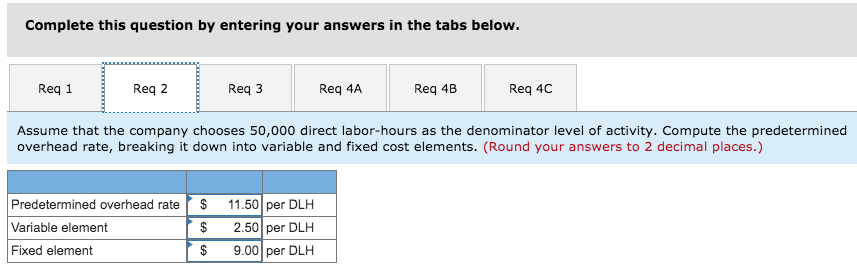

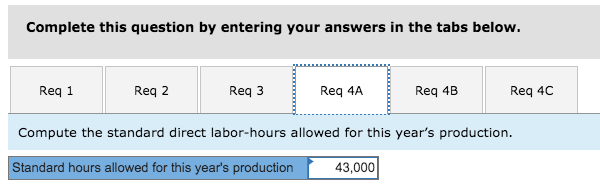

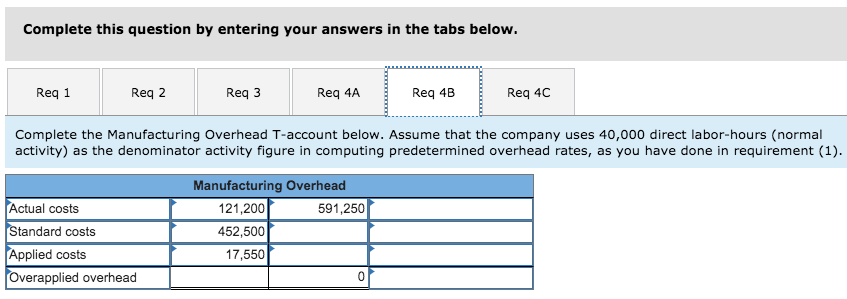

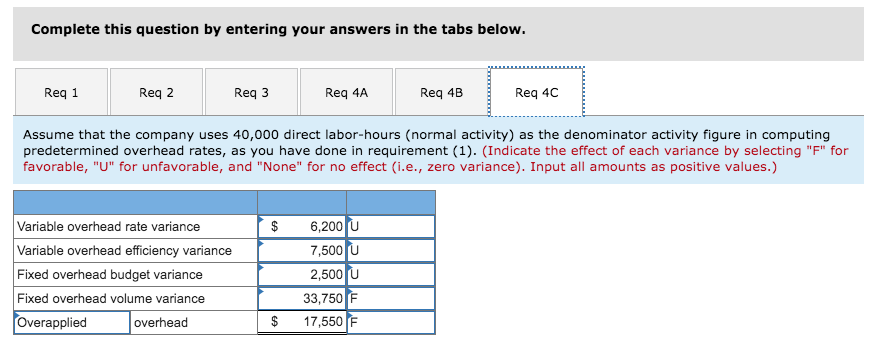

Morton Company's budgeted variable manufacturing overhead is $2.50 per direct labor-hour and its budgeted fixed manufacturing overhead is $450,000 per year. The company manufactures a single product whose standard direct labor-hours per unit is 2.0 hours. The standard direct labor wage rate is $16 per hour. The standards also allow 3 feet of raw material per unit at a standard cost of $4 per foot Although normal activity is 50,000 direct labor-hours each year, the company expects to operate at a 40,000-hour level of activity this year Required: 1. Assume that the company chooses 40,000 direct labor-hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements. 2. Assume that the company chooses 50,000 direct labor-hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements. 3. Complete two standard cost cards for 40,000 & 50,000 DLH. 4. Assume that the company actually produces 21,500 units and works 46,000 direct labor-hours during the year. Actual manufacturing overhead costs for the year are: overhead costs for the year are: $ 121,200 452,500 Variable manufacturing overhead cost Fixed manufacturing overhead cost 573,700 Total manufacturing overhead cost a. Compute the standard direct labor-hours allowed for this year's production. b. Complete the Manufacturing Overhead T-account below. Assume that the company uses 40,000 direct labor-hours (normal activity) as the denominator activity figure in computing predetermined overhead rates, as you have done in (1) above. c. Assume that the company uses 40,000 direct labor-hours (normal activity) as the denominator activity figure in computing predetermined overhead rates, as you have done in requirement (1) Complete this question by entering your answers in the tabs below. Req 2 Req 1 Req 3 Req 4A Req 4B Req 4C Complete the Manufacturing Overhead T-account below. Assume that the company uses 40,000 direct labor-hours (normal activity) as the denominator activity figure in computing predetermined overhead rates, as you have done in requirement (1). Manufacturing Overhead Actual costs 121,200 591,250 Standard costs 452,500 Applied costs 17,550 0 Overapplied overhead Req 4B Req 1 Req 2 Req 3 Req 4A Req 4C Assume that the company uses 40,000 direct labor-hours (normal activity) as the denominator activity figure in computing predetermined overhead rates, as you have done in requirement (1). (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) $ (6,200) U Variable overhead rate variance Variable overhead efficiency variance Fixed overhead budget variance (7,500) U (2,500) U Fixed overhead volume variance 33,750 $ 17,550 overhead Overapplied Complete this question by entering your answers in the tabs below. Req 4C Req 1 Req 2 Req 3 Req 4A Req 4B Assume that the company chooses 40,000 direct labor-hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements. (Round your answers to 2 decimal places.) Predetermined overhead 13.75 per DLH rate 2.50 per DLH Variable element $ 11.25 per DLH Fixed element Complete this question by entering your answers in the tabs below. Req 2 Req 3 Req 4B Req 1 Req 4A Req 4C Assume that the company chooses 50,000 direct labor-hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements. (Round your answers to 2 decimal places.) Predetermined overhead rate 11.50 per DLH $ Variable element 2.50 per DLH Fixed element 9.00 per DLH Complete this question by entering your answers in the tabs below. Req 1 Req 3 Req 4A Req 4B Req 4C Req 2 Complete two standard cost cards Complete two standard cost cards for 40,000 & 50,000 DLHS. (Round your answers to 2 decimal places.) Denominator Activity: 40,000 DLHS 50,000 DLHS Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total standard cost per unit 12.00 12.00 32.00 32.00 5.00 5.00 22.50 18.00 71.50 $ 67.00 Complete this question by entering your answers in the tabs below. Req 4C Req 1 Req 2 Req 3 Req 4A Req 4B Compute the standard direct labor-hours allowed for this year's production Standard hours allowed for this year's production 43,000 Complete this question by entering your answers in the tabs below. Req 3 Req 4A Req 4C Req 1 Req 2 Req 4B Complete the Manufacturing Overhead T-account below. Assume that the company uses 40,000 direct labor-hours (normal activity) as the denominator activity figure in computing predetermined overhead rates, as you have done in requirement (1). Manufacturing Overhead 121,200 452,500 591,250 Actual costs Standard costs Applied costs 17,550 Overapplied overhead 0 Complete this question by entering your answers in the tabs below. Req 4A Req 4B Req 1 Req 2 Req 3 Req 4C Assume that the company uses 40,000 direct labor-hours (normal activity) as the denominator activity figure in computing predetermined overhead rates, as you have done in requirement (1). (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Variable overhead rate variance Variable overhead efficiency variance Fixed overhead budget variance Fixed overhead volume variance Overapplied 6,200 U 7,500 U 2,500 U 33,750 F overhead 17,550 F