Needed: Journal Entry and Statement of Partners Equity as shown below:

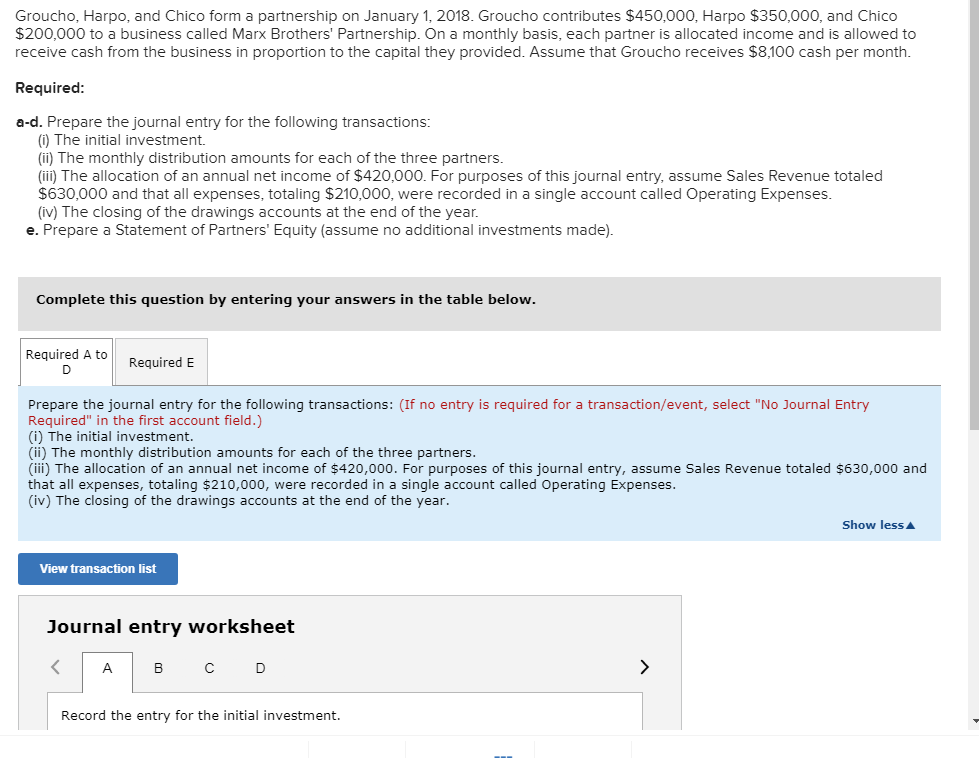

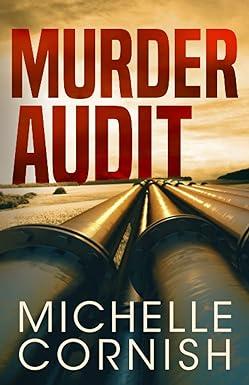

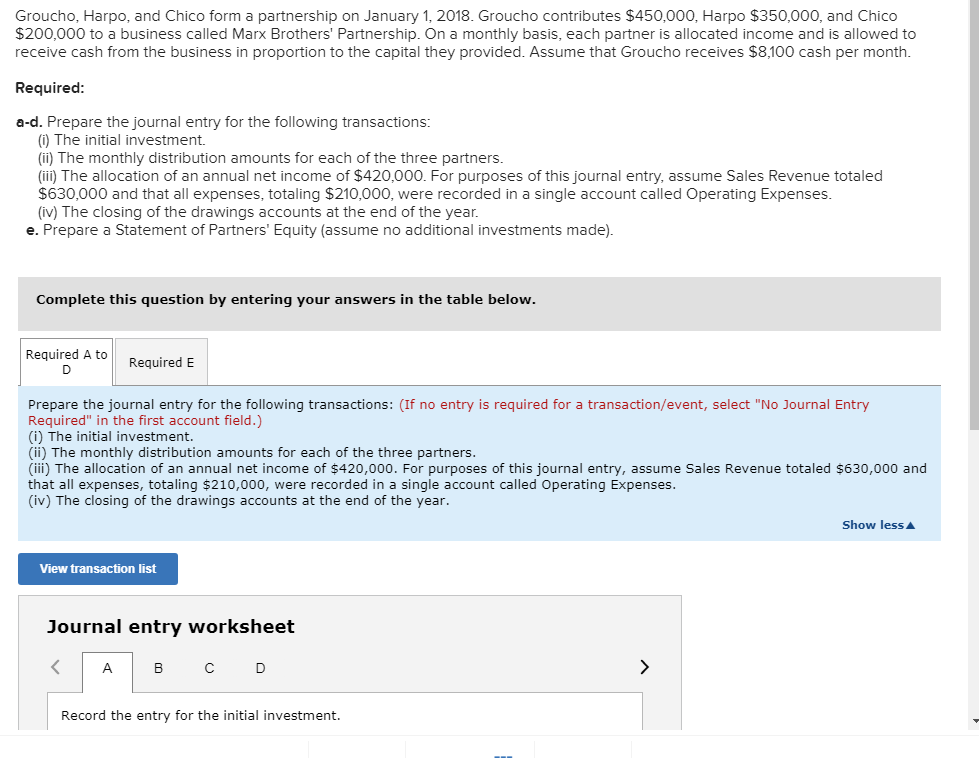

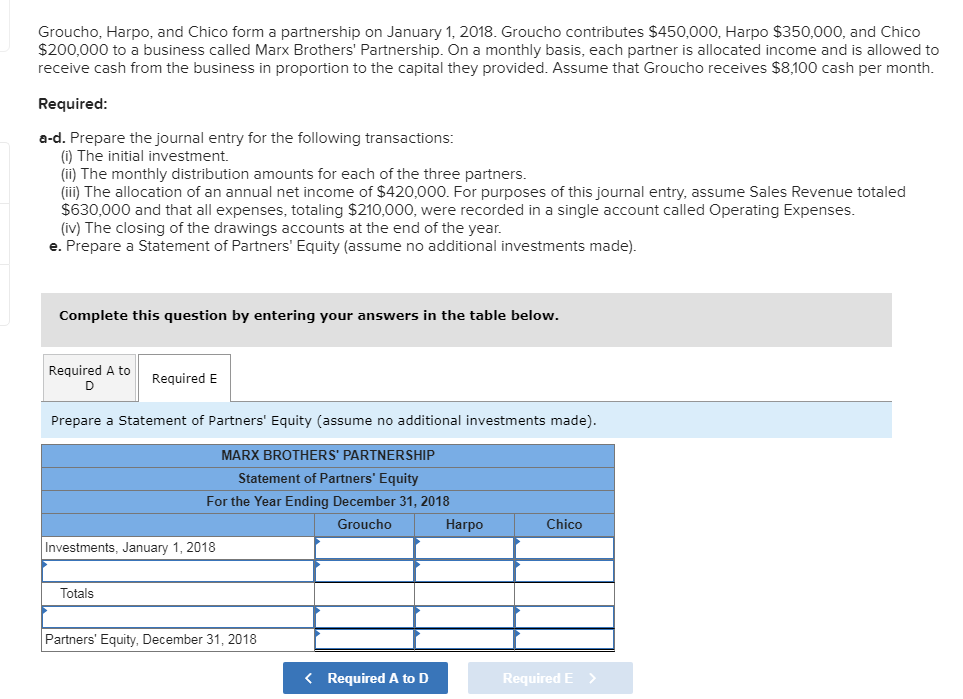

Groucho, Harpo, and Chico form a partnership on January 1, 2018. Groucho contributes $450,000, Harpo $350,000, and Chico $200,000 to a business called Marx Brothers' Partnership. On a monthly basis, each partner is allocated income and is allowed to receive cash from the business in proportion to the capital they provided. Assume that Groucho receives $8,100 cash per month Required a-d. Prepare the journal entry for the following transactions (i) The initial investment. (ii) The monthly distribution amounts for each of the three partners (ii) The allocation of an annual net income of $420,000. For purposes of this journal entry, assume Sales Revenue totaled $630,000 and that all expenses, totaling $210,000, were recorded in a single account called Operating Expenses (iv) The closing of the drawings accounts at the end of the year. e. Prepare a Statement of Partners' Equity (assume no additional investments made) Complete this question by entering your answers in the table below Required A toRequired Prepare the journal entry for the following transactions: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) (i) The initial investment. (ii) The monthly distribution amounts for each of the three partners (iii) The allocation of an annual net income of $420,000. For purposes of this journal entry, assume Sales Revenue totaled $630,000 and that all expenses, totaling $210,000, were recorded in a single account called Operating Expenses (iv) The closing of the drawings accounts at the end of the year. Show less View transaction list Journal entry worksheet Record the entry for the initial investment. Groucho, Harpo, and Chico form a partnership on January 1, 2018. Groucho contributes $450,000, Harpo $350,000, and Chico $200,000 to a business called Marx Brothers' Partnership. On a monthly basis, each partner is allocated income and is allowed to receive cash from the business in proportion to the capital they provided. Assume that Groucho receives $8,100 cash per month. Required a-d. Prepare the journal entry for the following transactions (i) The initial investment. (ii) The monthly distribution amounts for each of the three partners. (ii) The allocation of an annual net income of $420,000. For purposes of this journal entry, assume Sales Revenue totalec $630,000 and that all expenses, totaling $210,000, were recorded in a single account called Operating Expenses (iv) The closing of the drawings accounts at the end of the year. e. Prepare a Statement of Partners' Equity (assume no additional investments made) Complete this question by entering your answers in the table below Required A toRequired E Prepare a Statement of Partners' Equity (assume no additional investments made). MARX BROTHERS' PARTNERSHIP Statement of Partners' Equity For the Year Ending December 31, 2018 Chico Groucho Harpo Investments, January 1, 2018 Totals Partners' Equity, December 31, 2018 Required A to D Required E